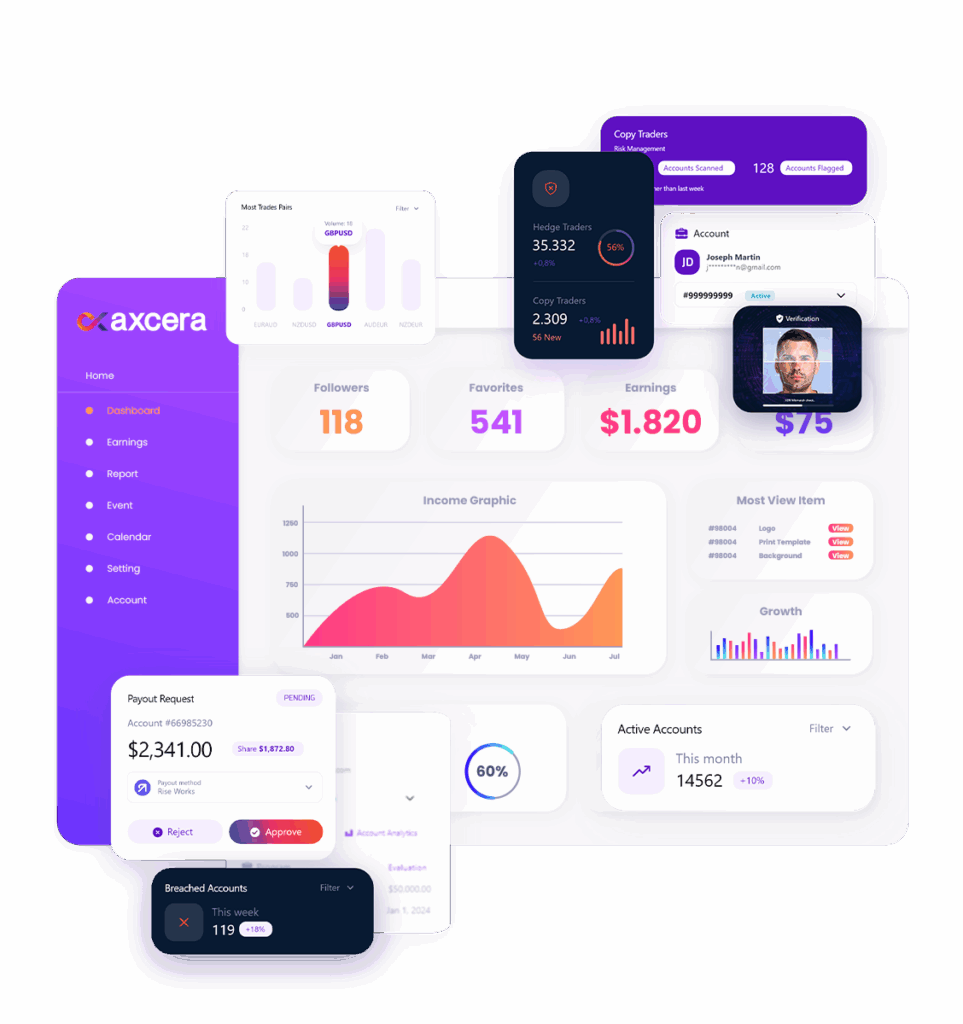

Axcera

Empowering Prop Firms Through Premium Technology

Axcera is a prop trading technology provider delivering advanced infrastructure, automation, and risk management solutions for proprietary trading firms worldwide. Built exclusively for the needs of prop firms, Axcera’s platform gives operators full control,no revenue sharing, no conflict of interest, and no compromises.

Whether your firm operates in CFDs, Forex, Futures, Crypto, or Equities, Axcera is the all-in-one solution. Instead of using separate systems for each asset class, firms can manage everything under one seamless infrastructure. This unified model removes complexity and silos, allowing firms to grow efficiently without duplicating platforms, tools, or teams.

This hybrid model offers a clear advantage. Firms can attract a broader range of traders, streamline operations, and scale faster, all without duplicating tools or teams. From onboarding and challenge creation to fraud detection, payouts, and trader analytics, Axcera covers the entire prop firm lifecycle with automation at its core.

With over 100 integrations and support for leading trading platforms, Axcera offers true flexibility and market reach.

Whether launching a new firm or scaling globally, leading prop firms choose Axcera to move faster, operate smarter, stay competitive, increase profits and lower operational overhead.

Core Capabilities:

Prop Trading CRM

Axcera’s CRM is purpose-built for prop firms. It allows firms to create and manage multiphase trading challenges, customize onboarding flows, and automate trader oversight. Everything is accessible from a powerful admin portal and a user-friendly trader dashboard.

Marketing Tools

Built-in coupon, affiliate, and referral tracking features empower firms to run and monitor promotions directly within the platform, while seamlessly integrating with external marketing tools for broader campaign management.

Automation & Compliance

Smart onboarding workflows streamline client verification, with integrations to tools like Sumsub and customizable KYC checkpoints. Automated processes cover email notifications, account creation, breach alerts, rule violation monitoring, and more, helping firms stay compliant while reducing manual workload.

Fraud Detection Modules

Advanced systems detect trader abuse across multiple dimensions: matching IPs, account cloning, payout loopholes and more. This helps prop firms protect capital and maintain payout efficiency. Automated fraud detection flags suspicious trading behavior such as copy trading, reverse hedging tactics, and other predefined exploit patterns.

Advanced Analytics & Reporting

Admins can access customizable dashboards showing trader activity, pass rates, revenue-to-payout ratios, risk exposure and many more, all in real time.

Third-Party Integrations

With over 100 integrations, Axcera works with the most popular trading platforms, payment providers, KYC vendors, marketing and affiliate tools, ensuring full ecosystem flexibility.

Firms that choose Axcera gain a performance advantage through greater efficiency, stronger compliance, and faster global scalability, without the burden of fragmented infrastructure.