Major upgrades to the Match-Trader platform have arrived with our May release, headlined by the new Affiliates module that empowers Prop Brokers to build effective referral programs. This feature lets users generate unique referral links and earn configurable commissions. Security takes centre stage with the implementation of IPv4 whitelist mechanism, while operational visibility reaches new heights through expanded Platform Logs with detailed system event tracking. The platform also offers enhanced flexibility in cashback calculations. Beyond these core improvements, the release delivers CRM integration with a leading mailing platform, strengthened MLIB structure protection and refined margin management through the introduction of the “Both Sides” model.

Affiliates Module

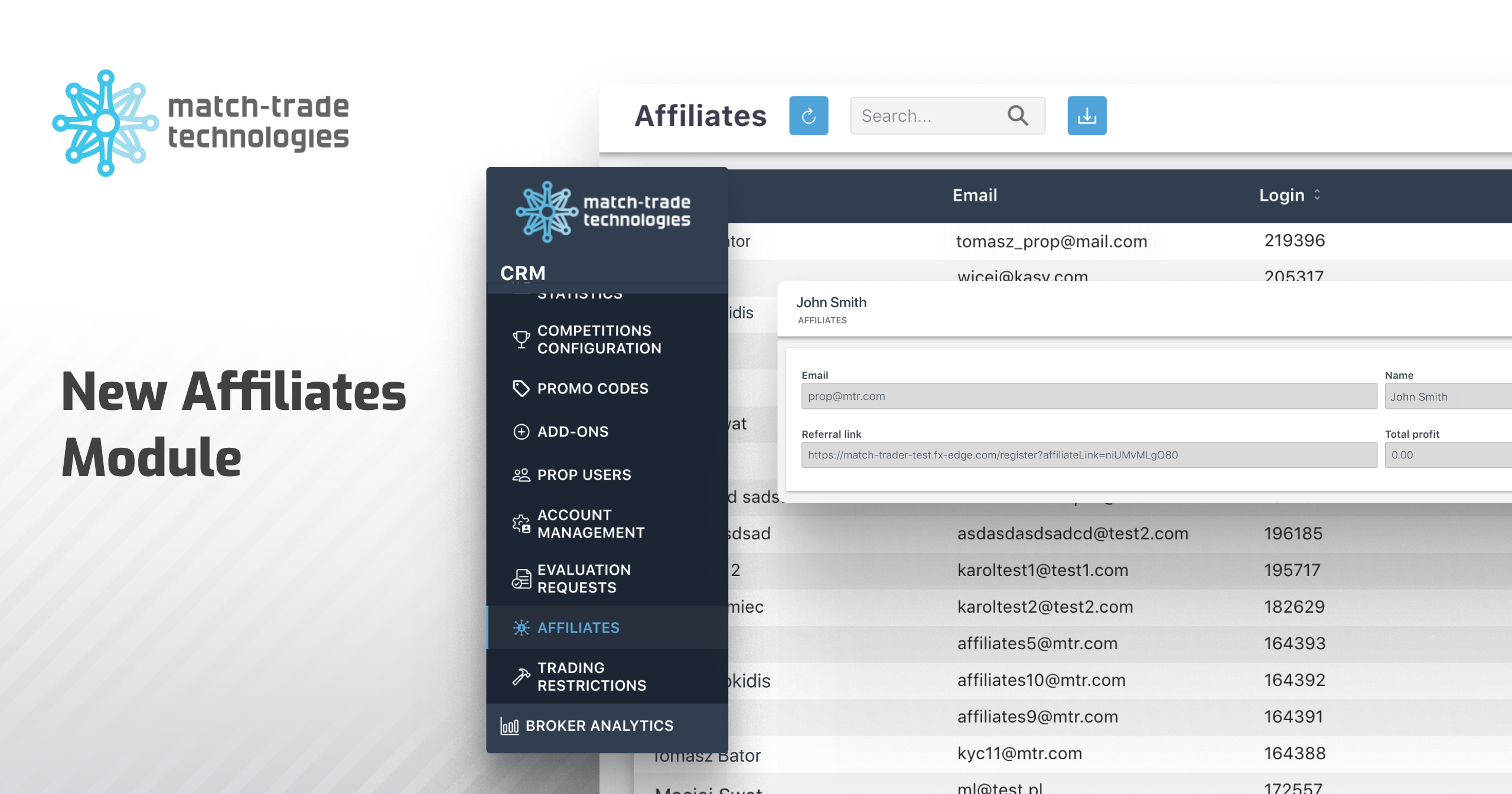

A new powerful Affiliates module has been added, enabling Prop Brokers to create partnership programs and reward users for driving traffic to the platform.

New features:

- Users can generate a unique referral link and share it to invite others

- When someone registers via a referral link, they are automatically linked to the referrer, enabling commission payouts

- Configurable cashback and discount settings:

- Possibility to set custom cashback amounts for referrers (e.g., a percentage of fees or commissions)

- Offering discounts to referred users

- Option to attach an “Agreement” document required to join the program

- A new “Affiliates” tab in the CRM shows all active affiliates, the number of users they referred and their earned profit

- Detailed affiliate view displays:

- Users registered with the referral link

- The commission each of them generated for the affiliate

Benefits:

- Boosted client acquisition through referral marketing

- Additional income stream for users, increasing their engagement

- Enhanced transparency and control over referrals and commissions

Instrument List Added to Cashback Calculation

In the Cashback configuration view (Configuration > Cashback), a new setting has been introduced: the “All Instruments” checkbox (checked by default). When this option is unchecked, a new field appears—“Comma-separated instrument list”—allowing you to specify the instruments for which Cashback will be calculated. Inputting a list of instruments (with wildcard use supported) is required to save the configuration. This mechanism is consistent with the setup used in IB > Commissions Setup.

Benefits:

Brokers now have greater control over rewarding traders for activity on specific instruments.

Customisation of the Platform Logs View

The existing “Platform Logs” tab in the CRM has been customised to include more information and log system events (responses from the trading system).

Among the newly logged events are:

- Opening, closing and editing positions

- Bulk closing of positions

- Creation, cancellation and modification of pending orders

- Withdrawal requests

- User logins and logouts

Depending on the event type, all entries contain detailed data such as volume, instrument, price, order side and set TP/SL levels. Errors are also logged—for example, when a position fails to open.

The new data will replace the previous one. From the release date forward, legacy data will no longer appear in current logs. However, old logs will remain available for up to 3 months before being fully replaced with the new format.

Benefits:

- Greater transparency and detail in recorded system events enables more effective monitoring of activities such as opening of positions, orders and withdrawals

- Logging both detailed data (e.g., volume, instrument, prices, TP/SL) and errors supports faster issue identification and resolution

IPv4 Whitelist Mechanism

We’ve introduced the option to limit CRM access to specific IPv4 addresses only, strengthening application security.

Key changes:

- New “IP Whitelist” tab in the Configuration section and a sub-tab in the CRM User account detail view

- Possibility to add individual IP addresses or ranges using wildcards (*)

- Settings dependent on user roles (CREATE, READ, UPDATE)

- Optional 2FA verification when adding/removing IP ranges

- Whitelist management per partner (activated on request)

Benefits:

By limiting CRM access by IPv4 address we significantly increased application security, at the same time preventing unauthorised access attempts.

API Key in Mailing

We’ve introduced the option to configure mailings through an API Key, enabling CRM integration with a leading mailing platform—SendGrid.

Benefits:

Brokers can leverage professional email delivery services, improving the efficiency and reliability of client communications.

Blocking Deletion for Accounts in the MLIB Structure

We’ve added a protection system to safeguard the MLIB structure integrity in the CRM. Moving forward:

- Deletion of IB/Sub IB users or trading accounts is blocked when they are part of a hierarchy above other accounts

- Role modifications for IB/Sub IB users are blocked when they are part of a hierarchy above other accounts

Deletion or role change attempts trigger informative error messages specifying which accounts must be removed from the structure first to proceed. This protection mechanism helps Brokers avoid inadvertent damaging of the IB structure.

Benefits:

- Introducing a mechanism that protects the integrity of the MLIB structure in the CRM prevents unintentional damage to the IB/Sub IB hierarchy, preserving system stability

- Blocking the deletion or role change of a parent account in the structure maintains data integrity and reduces operational error risks

Both Sides Margin

Group configuration now supports setting how margin is calculated on client accounts by selecting the Both Sides model. Following this approach, the margin for a given instrument is calculated as the sum of margins from all positions—both buy (BUY) and sell (SELL)—regardless of their opposing nature. This delivers improved transparency, flexibility and risk management in trading offerings.

Benefits:

- Next option for risk management by fully accounting for all positions in margin calculation

- Improved client transparency regarding margin requirements

Hiding Rules in Hedge Monitor Based on Group/Account Permissions

We’ve implemented a system to hide Hedge rules within the Hedge Monitor and Hedge Summary tabs if the user doesn’t have complete access to the groups or accounts assigned to a specific rule.

Rules become invisible when users can’t access:

- Groups assigned to the pattern in the Hedge rule

- Groups containing accounts linked to the Hedge rule

Cancelling Active Orders During a Closed Session

Now, it is possible to cancel active orders (limit, stop, SLTP) on Retail accounts even when the trading session is closed.

Benefits:

- Enabled management of active orders on Retail accounts even beyond standard trading hours

- Better control of active orders

- Possibility to address potential issues immediately

Editing Swap Settings on Symbols via CSV Import

The system allows bulk modification of swap settings (Swap L, Swap S, Swap Calc Type) directly in the Admin app via CSV file import.

The functionality enables quick and convenient updating of numerous symbols simultaneously, removing dependency on external tools and manual navigation through each symbol.

A button has been integrated into the symbol management tab to upload a CSV file containing changes.

Supported fields:

- Symbol

- Swap L

- Swap S

- Swap Calc Type (optional; supported values: “PIPS” or “PERCENTS”)

Exporting the current swap configuration to a CSV format is now supported.

Benefits:

- Optimising the swap update process for multiple symbols simultaneously without using external tools

- Accelerating the operations team’s work by simplifying data editing and validation