Integrated technology delivering advanced risk management, automation, compliance,

analytics, and generative AI modelling for proprietary trading firms.

Empowering Prop Firms with Intelligent Risk Automation

Is your risk management ready to scale with your ambitions?

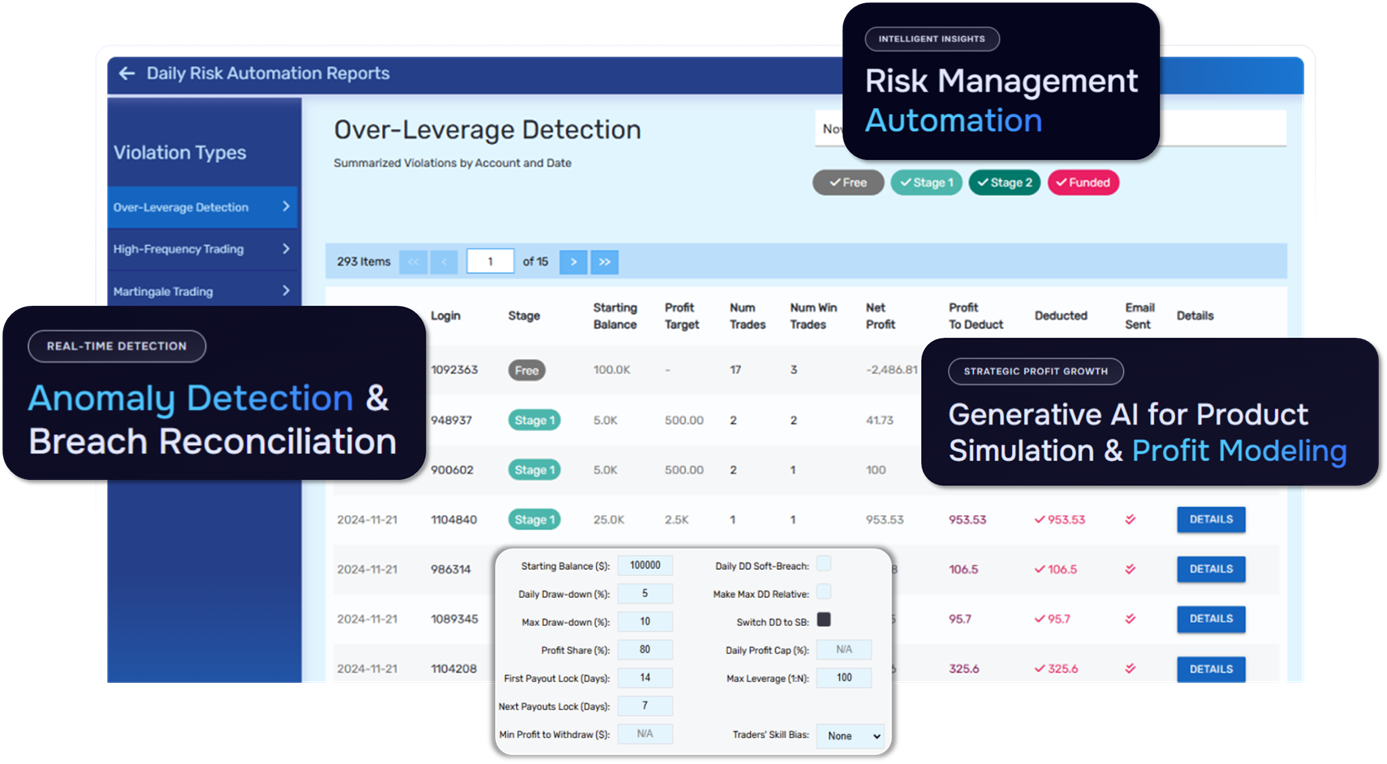

Arizet’s cutting-edge automation platform streamlines risk management, proactively detects anomalies, and maximizes profitability specifically for proprietary trading firms. Leveraging proprietary algorithms, Arizet automates violation tracking, adjusts illegitimate profits, seamlessly manages trader communications, and eliminates manual workflows—allowing firms to focus on scaling rather than administrative tasks.

With comprehensive monitoring of strategies such as HFT, martingale, copy trading, and grid trading, Arizet ensures a secure and compliant trading environment. Real-time anomaly detection, automated breach reconciliation, and seamless integration with Matchtrader and other leading platforms provide continuous oversight and consistent confidence in your safeguards.

Trusted by leading prop firms, Arizet combines precise risk management, automated trader oversight, and robust analytics to protect profits, minimize risk, and drive sustainable growth. Dedicated customer support ensures a reliable, ongoing partnership.

Automated Risk Enforcement

Automatically deduct illegitimate profits from trading violations, offering flexibility for manual adjustments and providing comprehensive daily reporting and account-specific insights.

Advanced Strategy & Behavior Monitoring

Proactively detect and manage high-risk trading behaviors including martingale strategies, HFT, max lot breaches, copy trading, grid strategies, and custom news-trading rules.

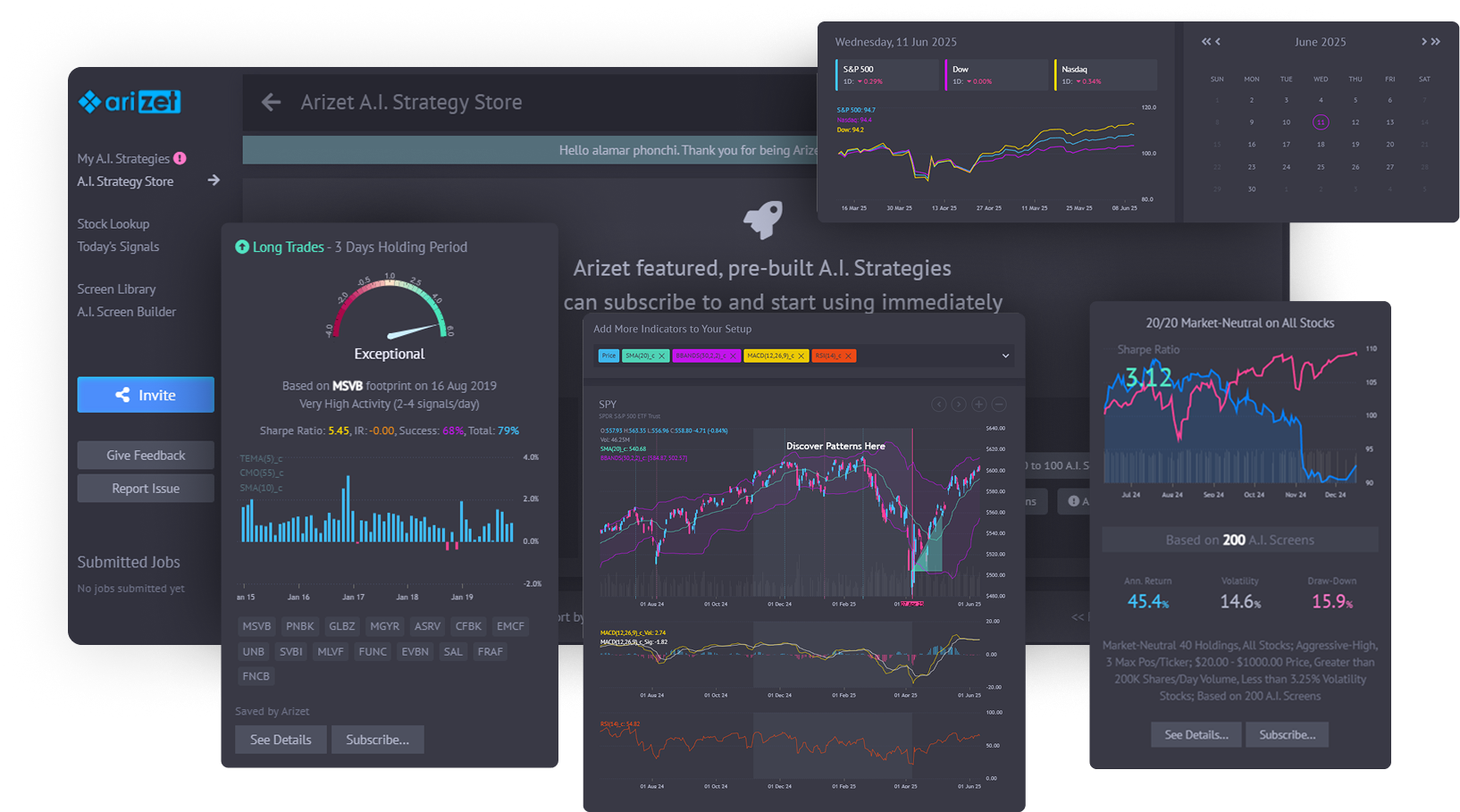

Customizable Rule & Scenario Modelling

Tailor technology-supported risk rules specific to your firm’s goals and leverage generative AI to simulate new products and profit scenarios before rollout.

Audit Logging & Activity Journaling

Complete documentation of every action for transparent internal reviews, audits, and compliance.

Automated Trader Communication

Instantly inform traders through automated, customizable email updates about violations, deductions, and account changes, ensuring transparency and minimizing administrative burden.

Real-World Impact (Case Study)

In a typical $100,000 challenge scenario, Arizet significantly improved firm profitability by reducing the payout-to-revenue ratio by 10 percentage points—from 42% to 32%—through intelligent profit deductions on rule violations. This directly increased margins and reduced operational risks.

Unified risk management. Strategic advantage. Engineered for prop trading excellence.

Firms choosing Arizet experience unmatched risk precision, streamlined workflows, and a robust foundation for sustained profitability and growth. Request your free personalized risk assessment today and unlock your firm’s full potential.