In our April update, we’re introducing a series of enhancements to our Match-Trader platform. Leading these updates is a new login feature, which provides a one-time URL for secure and efficient access to the trading account without the need for password resets. This update, central to enhancing user experience, complements other enhancements, including account registration via Discord, advanced analytical tools in our Forex CRM, and expanded payment options in our Match2Pay crypto payment processor.

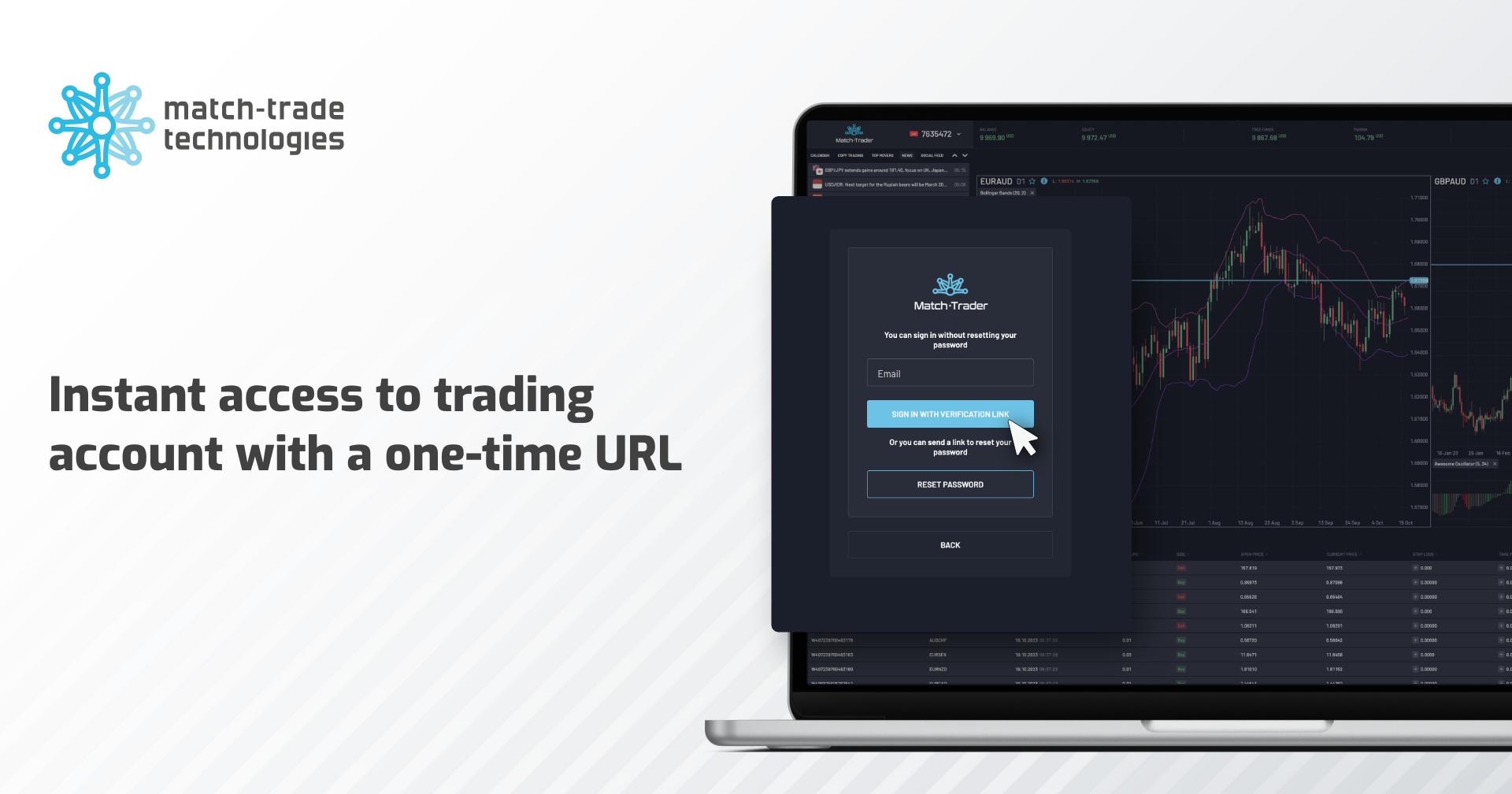

Instant access to trading account with a One-Time URL

Provide your clients with a secure and convenient login experience. Our new one-time URL feature allows traders to quickly access the Match-Trader platform and Client Office for traders if they’ve forgotten their password but do not wish to reset it. This feature is especially useful when users access the internet in public places or on new devices. By simply selecting the “Sign in with verification link” option, the system will automatically send a one-time login link to their email address. Clicking the link enables them to log in immediately without resetting their password. The link expires after 15 minutes, ensuring additional security and privacy.

Additionally, Brokers can personalize the content and style of the email messages through the CRM Operations settings to tailor them to their brand’s needs. This customization can include adding the company’s logo, adjusting the communication language, and incorporating key information that enhances customer trust.

Benefits for Brokers:

Implementing the one-time URL login feature is a significant advantage for Brokers, enabling them to increase customer loyalty by offering a secure access method to the platform. Clients can instantly access their accounts without having to reset a forgotten password. This functionality allows users to securely log into their trading accounts without the risk of leaving behind any password traces. This is particularly crucial in the Forex industry, where security and trust are essential for maintaining client relationships.

Log in to the Match-Trader using the Discord account

We are committed to continuously improving our registration and login mechanisms to ensure easy access to our services. This April, we’re broadening the range of login options available for traders in the Match-Trader trading platform and Client Office. Users can now conveniently register and log in using their Discord account, alongside previously supported registration via Google account.

Benefits for Brokers:

Discord is the leading communication tool within the Prop Trading community. By enabling Discord for sign-in, we facilitate a smoother and quicker onboarding process for new clients. This enhancement not only streamlines access for traders but also equips Prop Trading companies with a fast, effective client onboarding system, which is essential in this dynamic industry. This enhancement is designed specifically with the needs of Prop Brokers in mind, recognizing the importance of ease and efficiency in accessing trading platforms.

Adding Nominal and Point Value of 1 Lot within the Instrument Info

In addition to our recently introduced Nominal Value Calculation feature, we are ready to present a new update that significantly streamlines transaction management for traders. Now, the “Nominal Value of 1 Lot” and “Point Value of 1 Lot” are automatically converted into the currency of the user’s trading account. This data is displayed prominently within the “Instrument Info” tab of each instrument, ensuring easy access at all times. This enhancement eliminates the need for traders to manually calculate these values, enabling faster and more efficient market analysis and investment decision-making.

Benefits for Brokers:

Investors can now effortlessly view a planned transaction’s nominal and point values in their account currency without needing additional calculations. This solution not only saves time but also aids in making more informed investment decisions. As a result, our platform becomes even more intuitive and user-friendly, enhancing both the speed and accuracy of investment strategies.

Expanding payment options within the Match-Trader platform

This April, we implemented a significant enhancement to the payment method available on the Match-Trader and Client Office platforms for traders: “Custom Bank Transfer,” which now supports withdrawals in addition to deposits. This expansion of functionality was developed to further tailor the payment system to individual needs, regional specifications, and banks’ specific requirements regarding the transmission of necessary data for transfers.

Benefits for Brokers:

With the ability to customize the transaction fields, Brokers now have full control over adapting payment options to meet their operational and strategic requirements. The improved system allows for withdrawals through a broader range of payment gateways, increasing flexibility and convenience for both Brokers and their investors.

Displaying SL/TP as a percentage of account balance

We’ve updated the Match-Trader platform to include a new feature in the advanced view for opening positions and managing Pending Orders. Now, when traders set or edit Stop Loss (SL) and Take Profit (TP) levels, the platform displays these values as a percentage of the current account balance. This enhancement provides clear visibility into the proportion of their funds allocated for risk management, allowing traders to fine-tune their SL/TP settings in line with their trading strategies more efficiently.

Benefits for Brokers:

This update enhances the platform’s usability, enabling traders to control risks more quickly and effectively. By delivering more precise insights into risk allocation, brokers can offer a more intuitive trading experience. This not only improves trader satisfaction but also promotes safer and more strategic trading operations, making the platform more attractive to both new and experienced traders.

Enhanced notification management on the Match-Trader platform

This April, we’re also introducing a new notification grouping feature on the Match-Trader platform, designed specifically for traders who manage multiple notifications. This feature allows notifications to be grouped and paused until the user is ready to clear them, ensuring that no important information is missed and no critical alerts are overlooked. Additionally, traders can customize the duration that notifications remain visible (in seconds) and set a threshold for when notifications should be grouped.

Benefits for Brokers:

This update ensures that traders stay well-informed about significant activities on their accounts, such as news updates or market openings. The more organized and manageable notification system allows traders to respond swiftly and accurately to market conditions. This not only improves their trading efficiency but also enhances their overall platform experience, encouraging greater engagement and satisfaction among users.

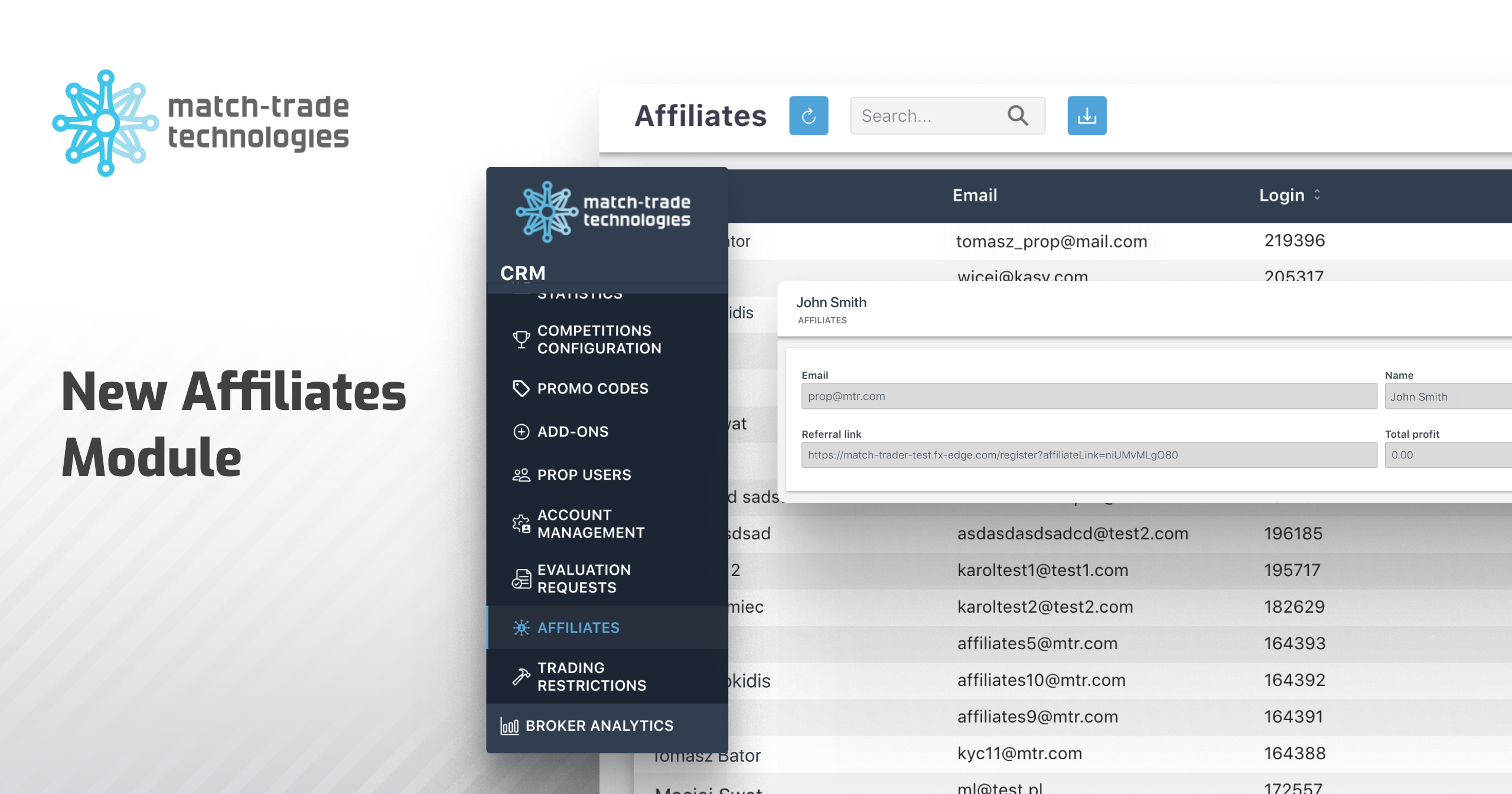

Enhancing analytical capabilities of our Forex CRM

We’ve upgraded the analytical functionalities of our Forex CRM, specifically within the IB > IB Accounts view. Now, Brokers can export data from the IB Accounts, Sub IB Accounts, and Clients IB Accounts tables directly to CSV files. This feature enhances the ability to manage and analyze data efficiently.

Benefits for Brokers:

Brokers gain improved analytical capabilities, allowing them to download essential data for further analysis. The ability to easily access and analyze extensive datasets provides a significant advantage in managing data and improving operational efficiency.

Enhanced data visibility in Forex CRM

We’ve updated our Forex CRM to include new columns in the Clients, Leads, Deposits, and Withdrawals views. The ‘Parent IB Account’ column now shows the IB/SubIB responsible for overseeing specific users. Additionally, we’ve introduced an ‘Affiliate’ column to identify the Lead Provider associated with each account.

Benefits for Brokers:

These updates provide brokers with deeper insights and improved data accessibility, allowing for enhanced business analysis. With these new columns, Brokers can more quickly locate clients and gain a comprehensive understanding of account activities and traffic generated. This streamlined access to detailed information helps Brokers optimize their operational strategies and marketing efforts, enhancing overall efficiency.

Enhanced Multi-Level IB System in Forex CRM

We’ve upgraded our Multi-Level IB System within our Forex CRM to offer greater flexibility and control over how commissions are calculated. In the IB > Commissions Setup section, we’ve introduced a new feature: a checkbox labelled “Calculate commission only for trades opened for a certain time.” When selected, this option displays a field for “Min. trade duration (seconds) to calculate commission,” where you can specify the duration in seconds. Commissions will be calculated only if a position is held open for at least the set duration. If the position is held for a shorter period, no commission will be applied.

Benefits for Brokers:

Brokers can now implement more precise control over how and when commissions are calculated. By setting a minimum trade duration, Brokers ensure that commissions are only paid on trades that meet their strategic criteria, reducing payouts on less significant.

Introducing the Holiday Configurator in the Match-Trader Administrator

The Match-Trader Administrator platform now features a Holiday Configurator, designed to streamline the management of non-trading days. This latest update introduces a dedicated “Holidays” section, providing the flexibility to suspend trading sessions for specific symbols on designated days. With this enhancement, Brokers can now effortlessly adjust session opening times for individual symbols, independent of recognized holidays or non-trading periods. Simply select the desired day and closure time under the “Holidays” tab to deactivate the session for selected symbols.

Benefits for Brokers:

This feature significantly simplifies the process of configuring session closures on specific days, particularly when a holiday is regionally observed. It also broadens the scope of managing active sessions for various instruments, offering Brokers a more versatile tool to tailor trading operations to their needs.

Streamlined account archiving in our Match-Trader Administrator

To enhance the management of inactive accounts, we’ve introduced the “must be blocked” and “should be locked” parameters to the account archiving functionality in the group configuration tab of our Match-Trader Administrator. These new features allow for more precise filtering of accounts based on their status.

Benefits for Brokers:

This update enables Brokers to better filter and manage accounts, ensuring that only truly inactive accounts are archived while active users remain unaffected. This reduces the risk of inadvertently disrupting active accounts and improves overall account management efficiency.

Match2Pay crypto payment processor now supports Solana Blockchain

We’ve expanded our list of supported cryptocurrencies and networks to include the Solana blockchain. Now, Match2Pay users can make deposits and withdrawals using Solana (SOL) cryptocurrency, as well as popular tokens such as USDT and USDC that operate on the Solana network. This extension of our cryptocurrency portfolio significantly enhances the payment options available on our platform.

Benefits for Brokers:

The introduction of Solana into Match2Pay’s supported technologies increases transactional flexibility. In response to the growing demand for diverse payment methods, this is a crucial tool for attracting new users and maintaining the loyalty of existing customers. Moreover, the integration of cryptocurrencies characterized by low transaction costs and high speed enables Brokers to minimize the costs associated with client withdrawals and to support transactions of smaller values.