February’s release adds full MetaTrader 5 backend integration for Match-Trader Prop, alongside targeted improvements to onboarding, verification, challenge management, and core operational workflows. Phase-based fees and new add-ons open additional monetization options, while admin tooling updates reduce manual work and speed up configuration. Key updates include:

- Full MetaTrader 5 Integration for Prop Trading Backend – run and manage prop programs on MT5 with a unified backend

- Integration of Ondato as a New KYC Provider – choose between Ondato and SumSub directly in configuration settings

- Split Payment for Each Challenge Phase – configure a separate fee for each challenge phase

- Max Daily Profit Increase Add-On – provide higher daily profit limits for selected challenges

- Next Withdrawal Days Decrease Add-On – offer shorter withdrawal intervals for funded accounts

- Data Export in Import-Ready Format for Manager 2.0 – export data from Accounts, Positions, and Closed Trades in a Manager 2.0-compatible format

- Symbol Grouping: Customizable Groups and Advanced Filtering – let brokers configure symbol groups directly in Admin

- Network Reliability and Connectivity Status – improve the reliability of network connectivity across Match-Trader Admin, Manager, and WL Manager

- Account Rules Tab in Trading Account Details – view routing/hedge/abuse rules in one place with role-based access

- Exposure Rules: Counting Mode by Lots – configure exposure monitoring by lots or notional value

- “Accepted” Column Added to Terms and Conditions – record the exact date and time of agreement

- “Create Request Info” in Mobile Deposits and Withdrawals – bring request details to mobile for faster support

- Branch Column in IB Requests Table – get faster routing and review with branch-level visibility

Full MetaTrader 5 Integration for Prop Trading Backend

This release marks a major milestone for the Match-Trader Prop Trading platform: our proprietary backend is now fully integrated with MetaTrader 5 (MT5) through a dedicated connector and service architecture. Prop firms can directly connect their prop trading programs to MT5, unlocking multi-system support (MTR + MT5) and enabling a unified experience across both trading infrastructures.

The integration covers the entire prop trading lifecycle on MT5 accounts – including account creation and blocking, equity calculation, challenge and competition management, trading restrictions, and account breaching logic – while maintaining robust, real-time data flows and operational consistency. The Match-Trader frontend has also been enhanced to display MT5 prop accounts with live balance updates and detailed challenge status, ensuring a transparent and professional experience for both brokers and traders.

Benefits:

- Prop firms: Direct MT5 prop trading challenge launch and management taps into the platform’s massive global trader base, dramatically expanding addressable markets while offering traders their preferred execution environment.

- Administrators: Unified backend supports both MTR and MT5, with independent statistics, multi-currency capability, and seamless configuration for each trading system.

- Traders: Platform choice without compromise delivers a consistent, transparent experience with real-time account data, challenge tracking, and access to all key prop trading features – now available on MT5 accounts.

- Future growth: An extensible architecture lays the foundation for additional platform scaling and integrations, positioning the solution to meet evolving market demands and sustain competitive advantage.

Integration of Ondato as a New KYC Provider

Full support for Ondato as a Know Your Customer (KYC) provider is available across both the CRM and Match-Trader platforms. Brokers can now select between multiple KYC providers – Ondato and SumSub – directly within their configuration settings, offering greater flexibility and control over compliance processes. Enhanced onboarding and verification flows accommodate Ondato’s requirements, including a dedicated verification button and dynamic configuration options. These improvements streamline KYC management for brokers while ensuring a seamless verification experience for end users.

Benefits:

- Strategic optionality: Brokers’ choice between Ondato and SumSub as KYC providers allows for tailored compliance strategies aligned with specific business requirements.

- Reduced complexity: Simplified configuration and validation processes reduce operational overhead and technical complexity.

- Easy verification path: A more intuitive and transparent verification process provides traders with clear guidance and direct access to provider-specific flows.

- Business agility: Increased flexibility enables the adaptation of KYC processes to regulatory or business needs, removing technical barriers for prop firms and partners.

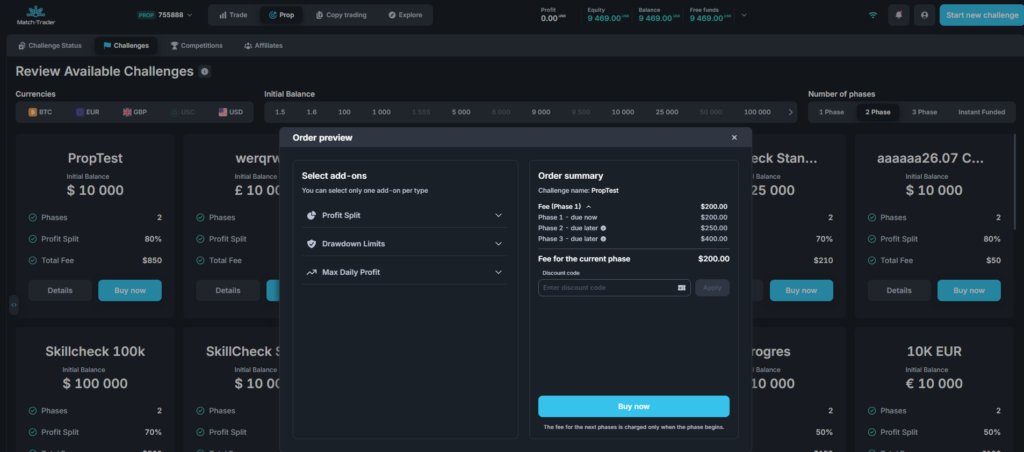

Split Payment for Each Challenge Phase

A flexible, phase-based payment model for prop trading challenges replaces the previous approach. Prop firms can now configure a separate fee for each challenge phase, enabling split payments and allowing traders to pay only for the phases they enter. This structure aligns with market trends and provides a more attractive and competitive offering. We’ve also enhanced the handling of discount codes, affiliate rewards, and add-ons, ensuring accurate calculations and a seamless user experience across all challenge phases.

Benefits:

- Trader acquisition: Prop firms can attract and retain more traders by offering flexible, phase-based payment options.

- Lower upfront cost: Traders reduce initial spend and pay only for the phases they complete.

- Payment accuracy: Affiliate partners and referrers receive rewards based on actual payments, improving clarity and motivation.

- Administrative control: Administrators gain finer control over challenge configuration and fee management.

- Market alignment: The platform remains competitive with industry standards, supporting business growth.

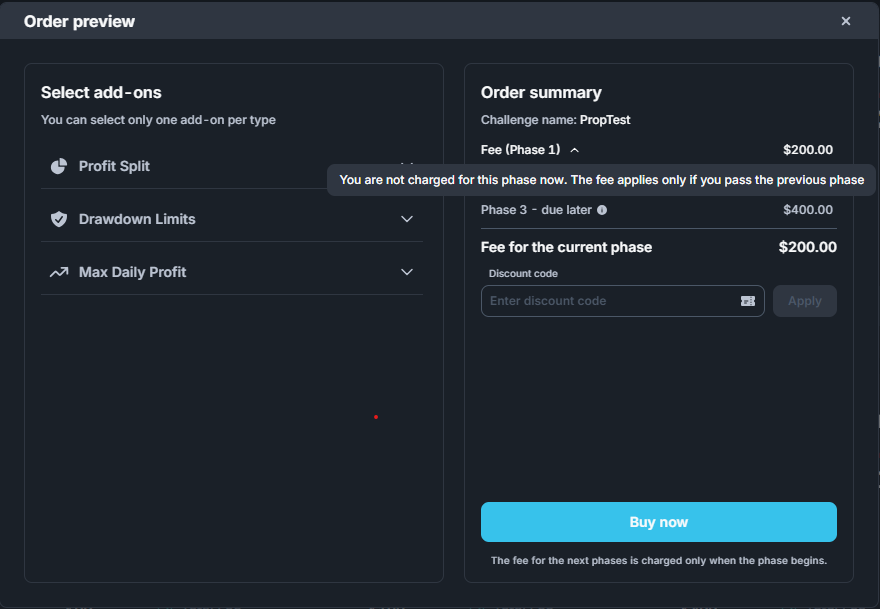

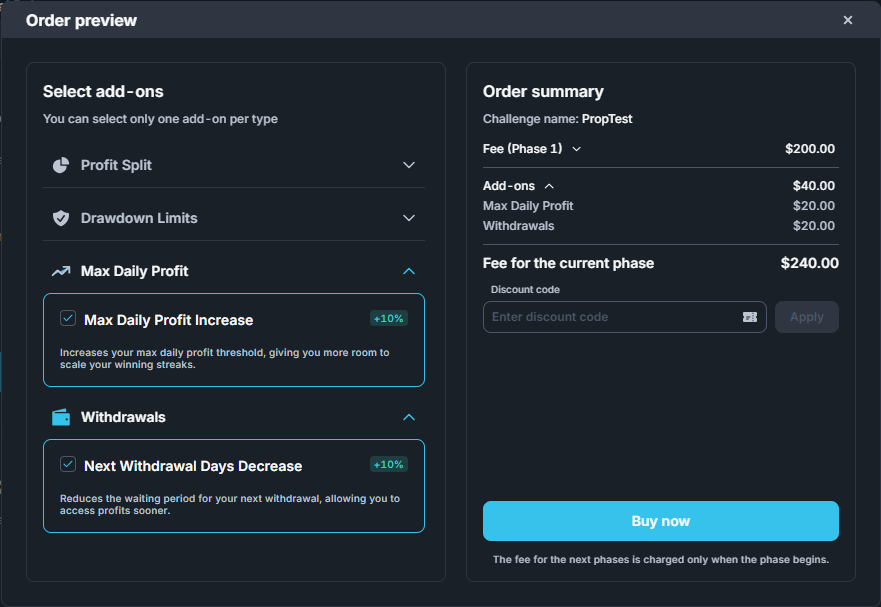

New Add-Ons

Max Daily Profit Increase Add-On

A dedicated add-on allows brokers to offer higher maximum daily profit limits for selected challenges. When enabled, traders can raise their daily threshold, giving them more room to pursue higher earnings and more flexible trading strategies. This feature is configurable per challenge and integrates with the existing add-on management flow.

Benefits:

- Competitive offering: Prop firms can differentiate their challenge portfolios by offering enhanced earning opportunities.

- Trader flexibility: Traders can increase their daily profit limits to support more ambitious trading strategies.

- Tailored configuration: Per-challenge settings support customized offerings for diverse client needs.

Next Withdrawal Days Decrease Add-On

We’ve introduced an add-on that reduces the waiting period between withdrawals for funded accounts. Prop firms can now offer traders the option to shorten the interval between withdrawal requests, enhancing flexibility and improving the attractiveness of funded challenges. The add-on is fully configurable, allowing withdrawal policies to be tailored to client preferences.

Benefits:

- Faster payouts: Traders can access their profits sooner, increasing satisfaction and engagement.

- Challenge differentiation: Prop firms can offer premium withdrawal options that distinguish their challenges from competitors.

- Settings control: Administrators can set withdrawal intervals and define add-on pricing as needed.

Data Export in Import-Ready Format for Accounts/Positions/Closed Trades in Manager 2.0

A new export capability delivers data from Accounts, Positions, and Closed Trades sections in a format directly compatible with Manager 2.0’s import functionality. Exported data requires no manual modification before re-import, creating a frictionless workflow between data extraction and system updates. This enhancement eliminates formatting errors and accelerates operational processes for administrators handling large datasets, and is particularly helpful during migrations, such as moving from white-label environments to a server-based setup. Export options are now available directly within each main section, streamlining data management and compliance activities.

Benefits:

- Improved accuracy: Seamless data transfer between export and import operations eliminates manual reformatting, significantly reducing processing time and minimizing human error.

- Data validation: Stronger data integrity and consistency during bulk operations ensure accuracy across large-scale account migrations and upgrades.

- Operational efficiency: Accelerated workflows support faster onboarding and updates for trading accounts and positions.

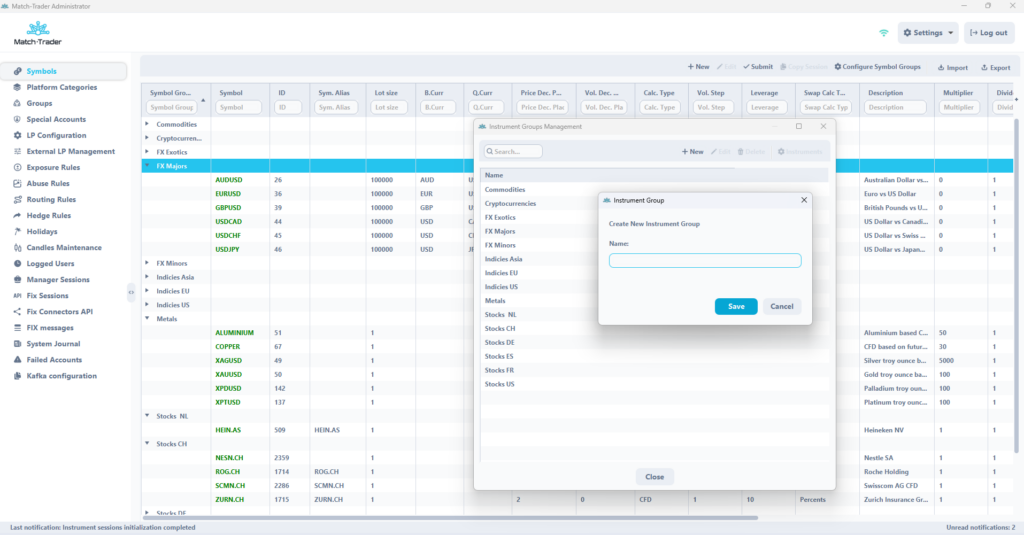

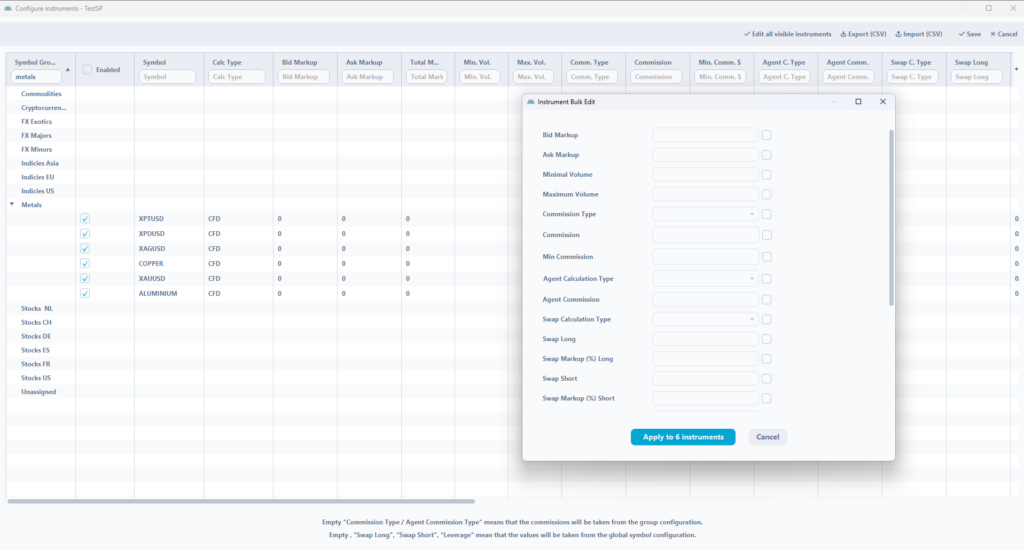

Symbol Grouping: Customizable Groups and Advanced Filtering

A comprehensive symbol grouping solution updates Match-Trader Admin, fundamentally transforming how trading symbols are organized, managed, and used. Brokers can now configure symbol groups themselves directly, reducing reliance on manual support and accelerating day-to-day operations. It’s possible to create, edit, and manage symbol structures, replacing the traditional flat list with an intuitive hierarchy that supports bulk operations and CSV-based import/export with group assignments.

Building on this foundation, advanced filtering and searching by symbol groups are now available across multiple platform areas, enabling targeted configuration and streamlined workflows in categories such as liquidity provider settings and price alerts. Automatic categorization keeps all symbols visible and accessible, while group-based organization translates directly into operational efficiencies and improved system oversight.

Benefits:

- Faster symbol management: Quick, logical instrument organization saves time and boosts operational efficiency for administrators.

- Structured data workflows: Group-level import/export assignments align data management with specific business structures.

- Scalable growth: Hierarchical grouping supports expansion as the number of instruments increases.

- Less manual work: Group-level filtering and targeted search reduce repetitive navigation and manual sorting.

Enhanced Network Reliability and Connectivity Transparency

We’ve significantly improved the reliability and transparency of network connectivity across Match-Trader Admin, Manager, and WL Manager applications. Automatic connection loss detection triggers background reconnection attempts while preserving active sessions, eliminating unnecessary logouts during brief network interruptions. When reconnection fails, clear messaging guides users to check their connection and log in again. Also, a dynamic Wi-Fi icon has been introduced to provide real-time visual feedback on connection quality and to display the current ping value. These safeguards keep users informed about their network status, allowing them to continue working with confidence, even in unstable conditions.

Benefits:

- Disruption minimized: Automated reconnection handling preserves workflow continuity and eliminates data loss from unexpected disconnections.

- User control: Users gain greater transparency and control over their network status, with instant visual feedback and clear notifications for connectivity issues.

- Platform reliability: Professional-grade network resilience reduces operational risk and reinforces confidence in trading operations.

Account Rules Tab: Routing/Hedge/Abuse Rules in Trading Account Details

A dedicated Account Rules tab within trading account profiles centralizes all routing, hedge, and abuse rules into a single, comprehensive view. Managers access complete rule inventories including type classifications, sequences, symbol patterns, liquidity provider assignments, and activation states – all supporting informed oversight and regulatory compliance. Role-based access controls restrict visibility to authorized users, ensuring the security of sensitive configuration data.

Benefits:

- Account oversight: Immediate insight into the complete rule stack affecting each trading account eliminates guesswork and allows managers to understand the exact order-routing behavior and risk controls.

- Troubleshooting efficiency: Enhanced rule visibility supports faster troubleshooting and more effective account management.

- Security and compliance: Permission-gated access ensures sensitive logic and strategies remain visible only to authorized users.

Exposure Rules: New Counting Mode by Lots (Prop Futures Support)

A new exposure calculation methodology based on open-position lot counts complements the existing notional value approach. Designed specifically for Futures trading, this feature addresses the complexity of managing mixed contract types. Administrators can now configure exposure rules that seamlessly aggregate (i.e., Standard and Mini contracts), enabling unified risk limits regardless of contract size. The update also includes UI enhancements for clarity and a smooth migration of existing rules.

Benefits:

- Optimization for Futures: Precise risk control is possible for portfolios containing a group of instruments with different contract sizes by normalizing exposure limits based on lot counts rather than notional value alone.

- Risk management flexibility: Dual calculation methodologies allow risk teams to choose the metric (lots vs. notional) that best fits the asset class.

- Operational continuity: Effortless migration ensures continuity and minimizes operational disruption.

“Accepted” Column Added to Terms and Conditions Subtab

The Terms and Conditions subtab now captures and displays precise acceptance timestamps for each provided consent. A new sortable “Accepted” column records the exact date and time of agreement, making it immediately available during client reviews. This enhancement strengthens audit capabilities and provides compliance teams with a verifiable consent chronology.

Benefits:

- Compliance operations: Immediate access to timestamped consent records streamlines regulatory reporting and due diligence processes with verifiable acceptance history.

- Client support: Brokers gain clear visibility into agreement status and timing, which accelerates issue resolution.

- Audit integrity: Detailed audit trails strengthen trust and accountability for all stakeholders.

Mobile: “Create Request Info” in Deposits and Withdrawals

The “Create Request Info” section now appears in mobile Deposits and Withdrawals interfaces, achieving feature parity with desktop environments. Mobile users can now access detailed request information directly from their devices, ensuring consistency and transparency across platforms. This update empowers brokers and support teams to manage financial requests with full context while on the go.

Benefits:

- Mobile responsiveness: Complete request visibility on mobile devices enables brokers and support staff to address inquiries immediately, eliminating delays caused by desktop dependency.

- Cross-platform consistency: Unified interfaces across desktop and mobile reduce training overhead, minimize user confusion, and streamline support.

- Resolution speed: Fuller context supports faster resolution of deposit and withdrawal inquiries.

“Branch” Column Added to IB Requests Table

A new “Branch” column in the IB Requests table provides brokers and administrators with immediate visibility into branch affiliations for each request. Clickable branch names offer direct access to detailed branch profiles, while alphabetical sorting enables efficient data organization. This enhancement improves operational efficiency and data navigation for teams managing IB requests.

Benefits:

- Request processing: Instant branch identification eliminates additional lookup steps, enabling brokers and administrators to route, prioritize, and process IB requests with full context.

- Navigation efficiency: Improved data navigation accelerates request processing and follow-up actions.

- Performance oversight: Higher visibility supports better branch-level performance tracking.