In February, we’re rolling out a series of updates across our offerings for Forex Brokers, underscoring our dedication to ongoing improvement. Central to our enhancements is a new functionality within the Match-Trader platform that allows for effortless trading account removals. This innovative feature permits investors to request account deletions without directly reaching out to their Broker. Furthermore, we have upgraded our CRM systems by integrating new payment methods specific to certain countries, enhancing the adaptability and customization for our customers. Keep reading to learn more.

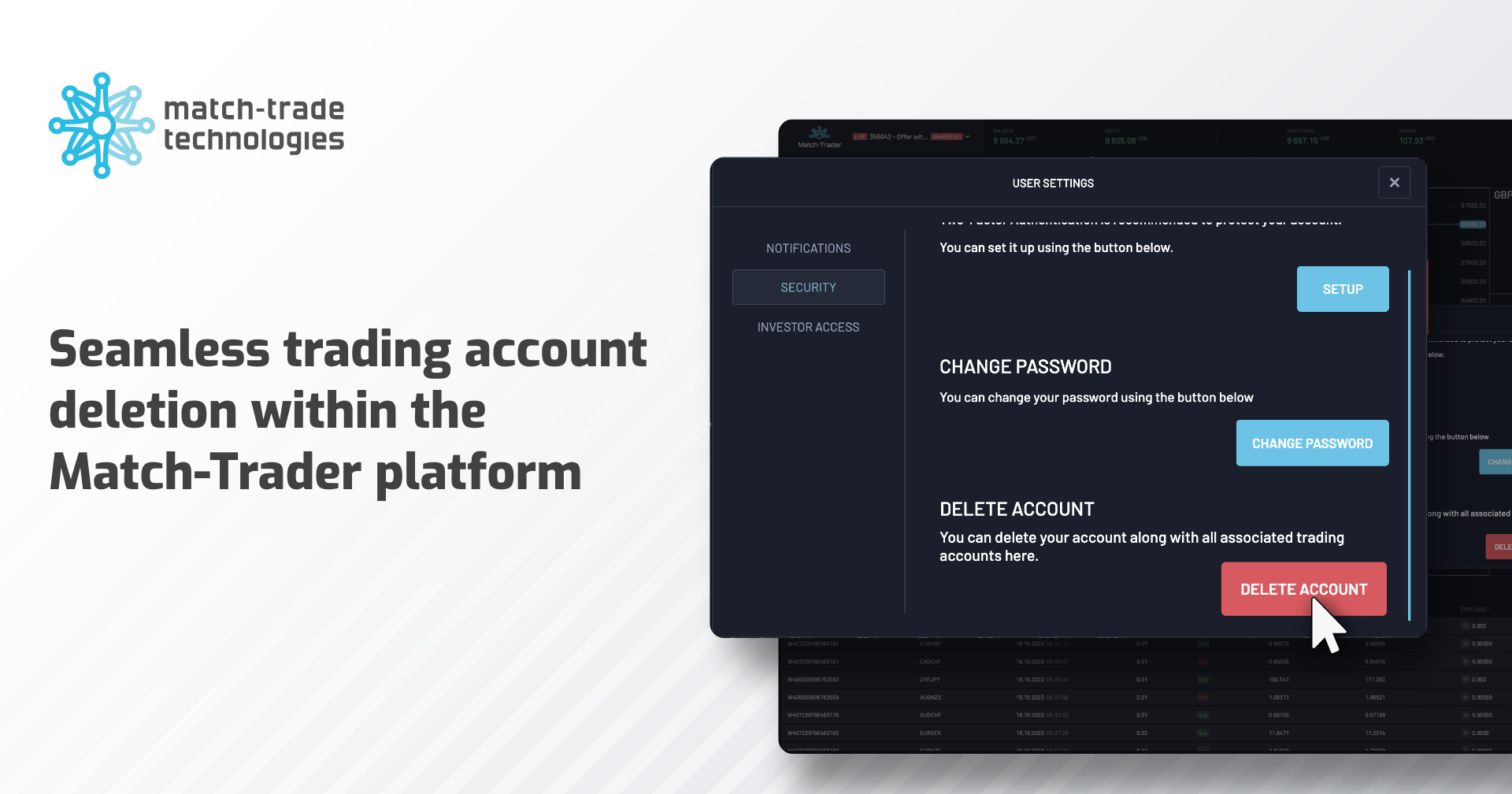

Seamless trading account deletion within the Match-Trader platform

In the “Security” tab (available in User Settings) of the Match-Trader platform, we’ve introduced a “Delete Account” feature. With it, users can now effortlessly delete their main account and all associated trading accounts without the need to contact their Broker. We offer Brokers flexibility in managing this process, allowing them to choose between automatic or manual verification and approval of the account deletion process.

Furthermore, we have enhanced our CRM solution with an “Actions > Account Deletion” feature, enabling Brokers to review all account deletion requests. This section provides information on the status of each request. It offers options for approval or rejection, which is especially useful in situations requiring verification of unsettled funds or open client positions.

Benefits for Brokers:

The ability for traders to delete their accounts independently eliminates the need for Broker’s intervention in this process. Automating this process can significantly speed up administrative actions and increase operational efficiency. Choosing between automatic or manual verification and deletion processes also allows for better adaptation to internal security procedures. Thanks to the new feature in our Forex CRM system, Brokers have direct access to data concerning account deletions. This improvement enables a better understanding of the reasons behind client resignations and the development of strategies aimed at increasing their retention. Introducing a more straightforward account deletion process also responds to increasingly stringent regulatory requirements regarding the protection of personal data.

Enhanced tailoring of brokerage services with country-specific payment options

In our Forex CRM system, we’ve enhanced the payment gateway configuration with a new “Supported countries” field. This feature allows Brokers to specify which countries will have access to a particular payment gateway. If no country is selected, the gateway remains accessible to all clients within the branch, maintaining the default setting. However, if a user’s profile does not list a country but the gateway is set to specific countries, access will be restricted until the user updates their profile.

Benefits for Brokers:

Brokers gain significant flexibility in customizing their service offerings with our new feature. This customization goes beyond branch locations, allowing for adjustments based on the trader’s home country. This adaptability is crucial for Brokers operating across diverse regions, where legal and currency variations can limit the availability of certain payment methods. By enabling country-specific payment gateways, Brokers ensure that their financial transactions are relevant and compliant with local regulations. This approach provides a more personalized and efficient service to their global clientele.

Enhancing User Experience in our Forex CRM

This February, we’ve introduced enhancements to our Forex CRM to improve the overall User Experience. In the Clients, Leads, Deposits, and Withdrawals tabs, we introduced an option that allows users to select the number of records displayed per page. Previously, the default was set to 40 records, but now users can choose from 40, 100, 200 or even 500 records per page.

Benefits for Brokers:

This improvement not only makes it easier to view more data without the need to navigate through pages but also enables the use of Bulk Operations for a large number of accounts simultaneously. This feature is particularly useful for sending notifications and emails to clients, streamlining communication and operational efficiency.

Integrating Litecoin Blockchain into our Match2Pay crypto payment gateway

This February, we’re expanding our cryptocurrency portfolio of Match2Pay crypto payment gateway, now including Litecoin. This enhancement delivers unparalleled flexibility and efficiency in crypto payments. It significantly broadens the spectrum of options available to merchants and their clientele.

Litecoin is a peer-to-peer cryptocurrency created to provide fast, secure, and low-cost payments by leveraging the unique properties of blockchain technology. It distinguishes itself with a decreased block generation time, offering quicker transaction confirmation times compared to other digital currencies. Litecoin’s efficiency and scalability make it an ideal candidate for integration into payment systems, aiming to facilitate seamless and cost-effective transactions.

Benefits for Brokers:

The addition of Litecoin to our Match2Pay crypto payment gateway significantly increases the range of cryptocurrencies that merchants can offer, becoming a pivotal factor in broadening customer bases. This expansion allows Brokers to cater to broader client preferences, ensuring they stay at the forefront in an increasingly competitive Forex market. By incorporating cryptocurrencies like Litecoin, known for their low transaction fees and rapid processing times, we are enabling Brokers to minimize withdrawal costs for their clients. This initiative not only enhances user satisfaction but also promotes the adoption of crypto payments due to its cost-effectiveness and efficiency.

Enhancing the ‘Accounts’ Tab in the Match-Trader Manager

We’ve enhanced the “Accounts” tab in our Match-Trade Manager by introducing the Gross Balance, Margin, and Free Margin columns – previously available only in the client view. Now, accessing these essential details is as simple as clicking the “+” symbol next to the column list, allowing for their quick and easy integration into your dashboard.

Benefits for Brokers:

With the new functionality in Match-Trade Manager, Brokers gain direct access to current Gross Balance, Margin, and Free Margin data without the need to switch to the client view. This means they can now monitor key financial indicators for multiple accounts more efficiently and effectively, significantly improving risk management. Our enhancement offers Brokers a competitive edge in responding swiftly to changes, which is invaluable in the dynamic Forex market.

Introducing the ‘Symbol Alias’ Column in Match-Trader Manager

We’re committed to continually enhancing the User Experience for Forex Brokers using our solutions. In our latest update to Match-Trader Manager, we’ve added a new ‘Symbol Alias’ column across several tabs: Positions, Active Orders, Orders, Closed Trades, Trades Summary, Positions Summary, and LP Routing Summary within the Streaming Manager. We designed this additional column to enrich both the overview and detailed account views. You can easily add it to your display by clicking the “+” icon on the column list, even though it is hidden by default.

Benefits for Brokers:

Gain immediate access to critical information by directly monitoring the ‘Symbol Alias’. This eliminates the need to navigate through additional views or use the Match-Trader Administrator. This update makes transaction management more transparent and convenient, streamlining Brokers’ operations and enhancing decision-making efficiency.

Enhancing readability in the Match-Trader Manager and EOD/EOM Reports

We’ve improved how client names are displayed within both the Match-Trader Manager and EOD/EOM reports. We now present client names in the intuitive ‘First Name Last Name’ format, replacing the ‘Last Name, First Name’ structure.

Benefits for Brokers:

This update significantly enhances the readability of clients’ full names, making information clearer and more accessible. By streamlining the presentation of client details, Brokers can enjoy a more straightforward, efficient way to review and manage client information.

Optimizing the ‘Trading’ Tab Interface in the Match-Trade Manager

This February, we’ve refined the ‘Trading’ tab in our Match-Trade Manager to streamline the order entry process by removing unnecessary fields. Now, we display only the fields relevant to the selected order type. For example, the “activation price” field is hidden for Limit orders, showcasing only the “limit price.” In contrast, the “limit price” field is hidden for Stop orders, displaying the “activation price” instead. Furthermore, the activation options for an order vary depending on its type. For instance, the ‘Good till cancel’ option isn’t available for market orders, but Brokers can use it for Limit, Stop, and SLTP orders.

Benefits for Brokers:

This enhancement significantly improves the User Experience when placing the transactions within the Match-Trader Manager by offering a more optimized and type-specific display of fields. Brokers can now enjoy a cleaner interface that reduces clutter and focuses attention on the necessary parameters for each order type. This update facilitates quicker and more accurate order execution.

Enhanced Maximum Exposure control in the Match-Trader Administrator

In February, we are expanding risk management capabilities for Match-Trader Servers, aiming to enhance control and operational efficiency for our Brokers. Our latest update focuses on improving the flexibility of managing Maximum Exposure settings via the Match-Trader Administrator. Previously, adjusting exposure was limited to symbols within specific groups. Now, we introduce the ability to merge accounts, groups, and symbols into unique groups, each with a settable unified Maximum Exposure. We are complementing this advancement with a new tab in the Administrator application, called “Exposure Rules”. This addition allows for the assignment of tailored rules to selected accounts, groups, and symbols, streamlining the management process.

Benefits for Brokers:

The introduction of Exposure Rules significantly speeds up the Maximum Exposure setup process thanks to a quick and intuitive configuration journey. Brokers gain flexibility in tailoring settings to meet specific operational needs with the newfound ability to set Maximum Exposure on a per-account and per-group basis. This improvement enhances risk management and operational efficiency.