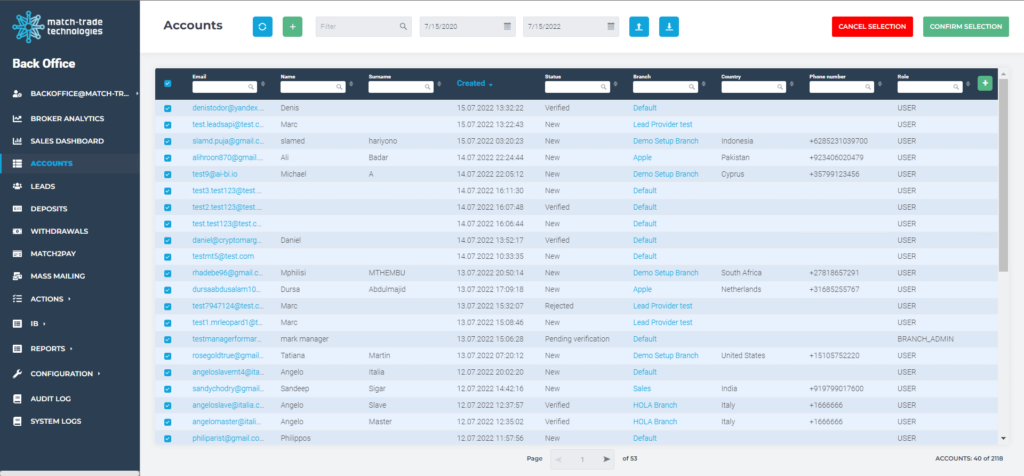

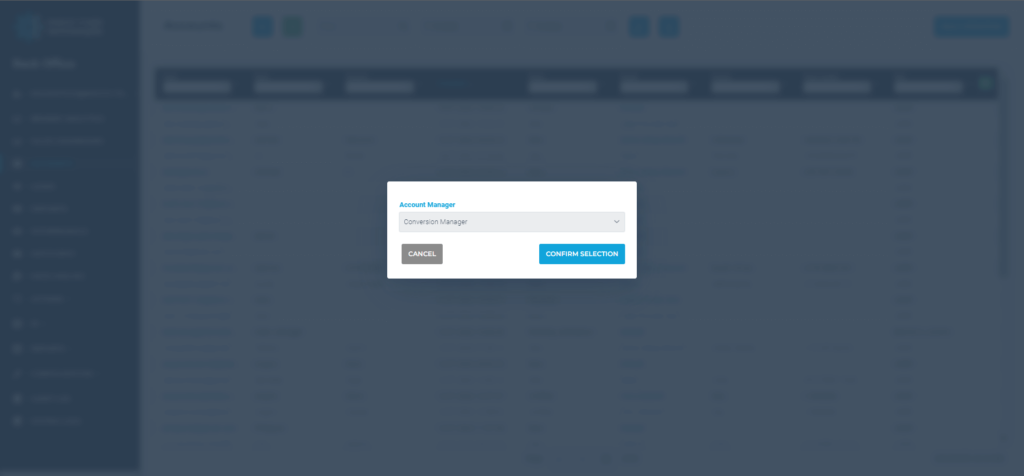

New Bulk assign Account Manager mode in our CRM

In our July release, we introduced yet another change in order to make working with our CRM for Brokers easier. We added the possibility of assigning all accounts/leads simultaneously. Users can do that by using the Bulk assign Account Manager. The new button called Select all takes into account the filters applied to the columns and selects all filtered accounts. When changing the filtering, the records set during the previous filtering are remembered. Moreover, users can add many different accounts from different filters and assign them to the same Account Manager with one click.

Reports embedded in Bridge Manager

Detailed hedging, singled trades profitability and closed trades report generation has been moved from Pentaho to Bridge Manager. It is available as export to CSV.

As a result, reports are built into our application. For the Brokers using it, that means they are faster and more accessible (no need to log into different apps). Bridge Manager is fully developed by Match-Trade’s expert team, so it is stable, and we can easily expand it with new reporting modules.

Possibility to set the order of payment gateways

In the Payment Gateways tab (in our CRM for Brokers), it is now possible to set the order of displaying payment gateways in Match-Trader and Client Office applications. Users can change it by dragging & dropping, clicking on the payment gateway and using the Move down or Move up buttons.

UTC time in the Match-Trader Manager

In Configuration (in the Match-Trader Manager), we added the Show time in UTC option, which changes all displayed dates, generating reports and filtering scope from device time to UTC.

Importing KYC documents to CRM

We added the possibility of importing KYC documents into our CRM.

This functionality is used to import customer KYC documents from another CRM. In the Actions-KYC tab, we added the Mass document import button. After clicking it, the Broker is redirected to the KYC import page.

As part of this function, it is also possible to mark all clients for whom KYC has been imported as verified. This may determine the possibility of withdrawals or creating trading accounts. Having this information on hand will support Brokers in their everyday work.

The supported file formats include PDF, PNG, JPEG, DOC, DOCX, HEIC, and IMG.

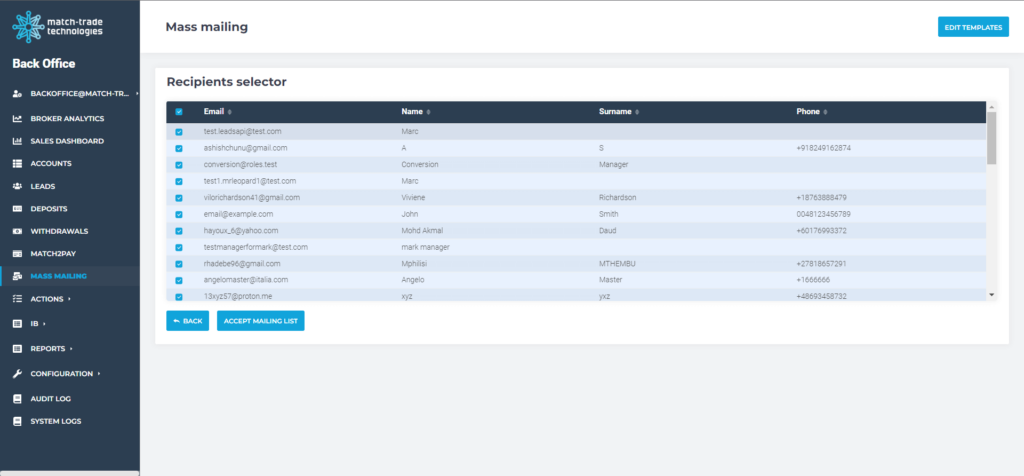

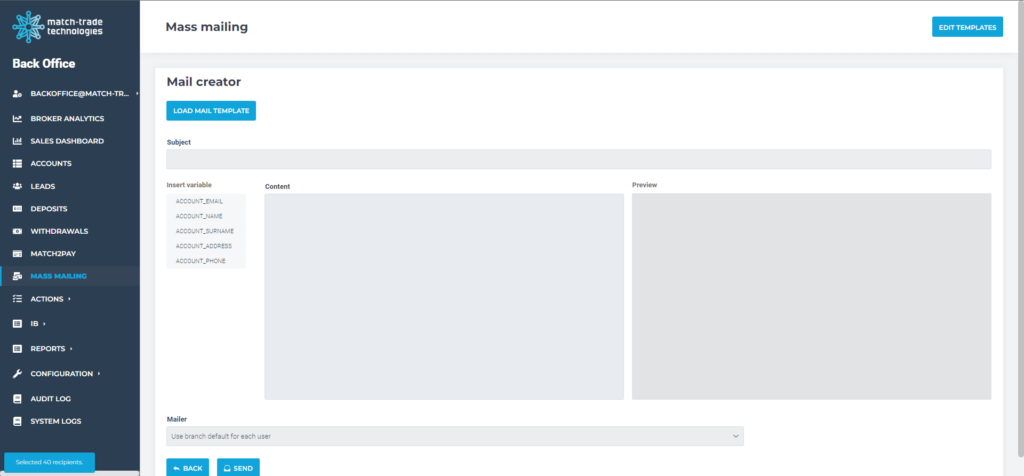

Expanding the mass mailing possibilities in our CRM

In July, we also developed the mass mailing options in our CRM for Brokers. The Mass Mailing button appeared in Accounts and Leads views. In mass mailing mode, Brokers can select multiple accounts to which the email will be sent. This makes mailing campaigns hassle-free and allows Brokers to reach even more clients.

What’s more, in the email editing view, the Broker can set the email address from which the message is sent (the address is taken from the branch or custom mailer, defined only for this particular mailing).

Virtualpay, Bridgerpay and Fasapay deposit integration

We added three new payment providers for brokers using our Match-Trader and Client Office applications.

Virtualpay is a credit card & mobile transactions payment provider supporting Visa, Mastercard, UnionPay, Discover, American Express, and JCB. Supported currencies for card payments are KES, USD, EUR, GBP and KES, TZS and UGX for mobile payments.

Bridgerpay is a payment provider that integrates other PSP providers. The choice of a currency depends on the selected integrated provider. For a list of Bridgerpay integrated PSPs, see https://bridgerpay.com/connections.

Fasapay is a payment provider operating in over 200 countries. It allows users to use many banks without needing a credit card.

Elevated crypto transactions processing

In the Match2Pay application, an option to check the most popular processing errors has been added to the cryptocurrency deposits and withdrawals. If the request fails, Brokers can click on Show request info and learn more about the problem in processing the request. That will allow them to spot the issue and fix it.

Improved leads management

In the Leads view, the Last contact field is visible and updated when the lead status changes. We have extended this functionality, and the date additionally changes after adding a note in the Timeline view of a given lead.

This is especially important if the lead’s status does not change, but Brokers still want to mark the date of the last contact. While managing a long list of leads, this feature is handy.

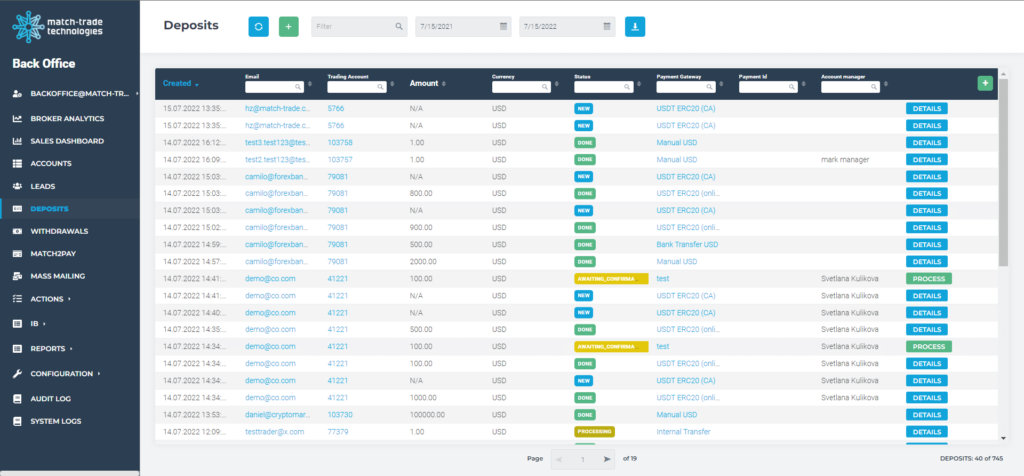

Account Manager column in the Deposits and Withdrawals tabs

In the Deposits and Withdrawals views, the Account Manager column has been added, in which users can see information about the manager assigned to a given account. This column can be exported along with the rest of the data.

Improving the Accounts, Leads, Deposits, and Withdrawals tabs in the CRM

Information about the number of records in a given view has been added to the Accounts, Leads, Deposits, and Withdrawals tabs. This is yet another small change that makes Brokers’ job more manageable.

More details available to import into our CRM

It is now possible to include information about the lead source while importing accounts and leads into the CRM. This improvement makes managing the lead base faster. It also allows Brokers to analyse their marketing efforts better. In today’s competitive environment, properly analysing brokerage activities is crucial to the company’s success.

Improved Roles Management in CRM

In the Roles Management tab, it is now possible to hide email addresses and telephone numbers. Until now, there was one option to hide both of them at once. Currently, there is a possibility to hide either the one or the other, or both, thanks to which the broker can better adjust the role to its business model.

Adding the possibility of exporting leads to a CSV file

In the Leads tab in our CRM for Brokers, an option to download records to CSV appeared. Filters set in the CRM also apply to the downloaded file.

This small change allows Brokers to download and analyse many lead-related factors easily. In other words, the new feature makes the entire sales process more accessible.