This June, we’re excited to unveil innovative features and enhancements across our solutions for Forex Brokers. We’ve been hard at work, focusing on optimizing functionality, streamlining processes, and enhancing User Experience. These improvements, ranging from new features in our Copy Trading App to improved payment methods and advanced analytics in our Forex CRM, aim to provide Brokers with the necessary tools to drive their business to new heights. Keep reading to uncover all the updates.

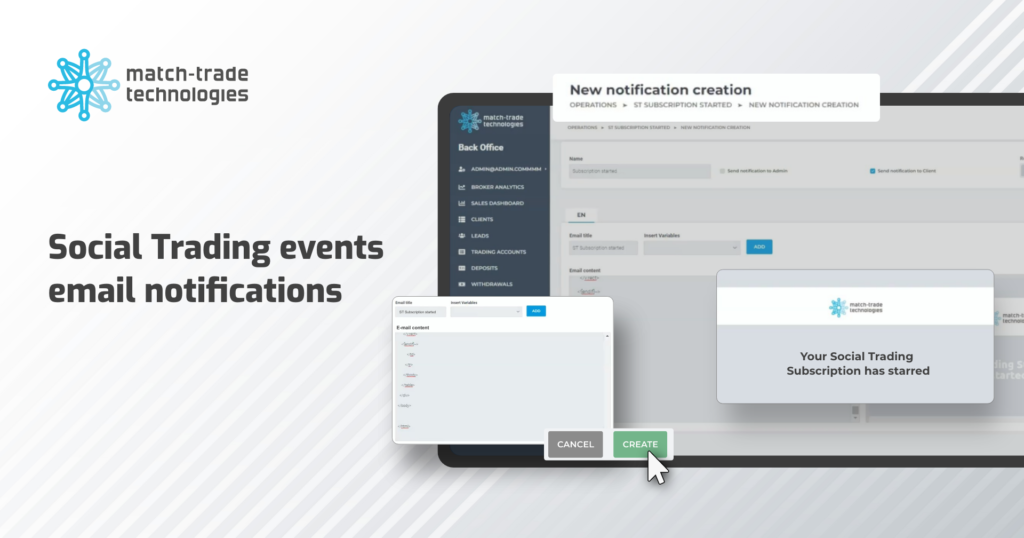

Social Trading events email notifications

In June, we focused our efforts on enhancing our Copy Trading App, which seamlessly integrated with the Match-Trader platform and Client Office for traders. Money Managers and their subscribers can now receive email notifications when starting and completing Social Trading subscriptions. These messages contain a summary of the number of subscribers, maximum losses, and subscription costs.

Benefits for Brokers:

This new feature significantly simplifies the analysis of Social Trading effectiveness. As now, Money Managers and their subscribers using our Copy Trading app will be better informed about their activity. This update will enable Brokers to attract more clients to the platform, making the Social Trading solution even more convenient both for experienced traders who want to increase their income by becoming Money Managers and beginners who choose to follow already successful investors.

Adding expiration time for Deposit Bonuses

A new functionality in our Forex CRM called “Funds expiration time in days” has been added to the Deposit Bonus configuration. This feature allows Brokers to automatically remove the credited amount from a trader’s account after a specific period. It applies to both the One Time Deposit and Every Deposit bonus types.

Benefits for Brokers:

Brokers can take advantage of increased flexibility and control over their Deposit Bonus policies. They can decide the exact terms of their bonuses, tailoring them to fit their business model while also reducing the risk of bonus abuse.

Advanced analysis of Account Managers’ performance within our Forex CRM

In order to enhance the analytics capabilities of our Forex CRM, we have aggregated all the key data related to the performance of Account Managers into one tab. In the Account Managers view of the Reports tab, we have updated the columns from “Deposit” to “Total Deposits,” from “Withdrawals” to “Total Withdrawals,” and from “Conversion Ratio” to “Ratio”. Furthermore, we have added new columns: Role, Clients, First Time Deposit, Daily Deposits, and Total Daily Deposits.

Benefits for Brokers:

This updated view provides in-depth insights into the performance of Account Managers. The precise statistical data is now available in one place, making the search for necessary information significantly simpler and faster. This aids in more accurately and comprehensively evaluating the performance of the Brokers’ team, allowing them to conclude the effectiveness of their interactions with clients. Brokers can significantly improve their sales strategy based on the results obtained.

Adding the “Proof of Transfer” feature for the “Redirect Payment” method

In June, we optimized the Redirect payment method for the Match-Trader platform, our Forex CRM, and Client Office for traders. We significantly accelerated the deposit verification process by allowing users to attach proof of their transfer to the payment. Consequently, Brokers can immediately book the funds based on the provided confirmation, no longer needing to wait for the payment to reflect in their accounts.

Benefits for Brokers:

This update will significantly speed up the deposit flow for traders using the “Redirect Payment” to make a deposit. This will help to eliminate situations where a trader cannot quickly start or continue trading due to delays in bank transfers. The seamless payment process enhances the overall satisfaction of the Broker’s clients and contributes to higher trading volumes on the platform.

Streamlined deposit process in the Match-Trader platform

To streamline the deposit flow for Match-Trader’s platform users, we optimized the payment method “Bank Transfer”. Traders can now effortlessly copy the essential deposit information using a copy button next to each field, eliminating manual entry and possible errors.

Benefits for Brokers:

The simplified deposit process allows users to start trading faster, increasing the volume of trading operations, which, in turn, positively impacts the Broker’s profits. Moreover, it reduces potential errors when entering payment information, enhancing the overall platform’s convenience.

Open positions visible in the Social Trading Leaderboard of the Match-Trader platform

In June, we made further enhancements to our Copy Trading App. Now, traders can access the open positions copied to their trading accounts from the Money Manager in the Social Trading Leaderboard of the Match-Trader platform. Previously, this information was only available through the corresponding leaderboard in the Client Office. With this update, traders can analyze detailed statistics of the Money Manager’s open positions directly within the Match-Trader platform, eliminating the need to switch between applications.

Benefits for Brokers:

Switching between various applications and platforms can be inconvenient for traders and may impact their productivity. Now, all data regarding open positions in Social Trading are available on a single platform. This allows traders to analyze the strategies of the Money Manager more quickly, as well as track the markets where the Money Manager operates.

Monitoring historical ticks in the Bridge Manager

In April, our development team significantly improved Bridge Manager, extending its Data Management capabilities. Now, Brokers can review historical ticks directly in Bridge Manager. Every recorded tick includes all markups established by Broker, allowing for precise instrument price determination at any given moment.

Benefits for Brokers:

One of the main advantages of this new feature is the ability to easily check the prices Brokers received from the Bridge at specific periods in the past. This is especially useful when handling client complaints related to instrument price inconsistencies. These improvements aim to help Brokers provide a higher level of service to their traders and increase the transparency of operations.

Simplified symbol configuration in the Bridge Manager

As part of our ongoing effort to improve the User Experience of our tools, we have added changes to the Bridge Manager app. As a result, users can now effortlessly and quickly edit the names of already configured instruments in the Broker/LP Symbols tab. Thus, Brokers no longer need to delete and recreate a trading instrument to modify its name.

Benefits for Brokers:

This new feature is particularly advantageous when dealing with symbols with multiple parameters, which previously required reconfiguration to change the instrument name. It enables Brokers to save valuable time, improve work efficiency, and reduce the possibility of errors that could occur during the recreation of an instrument. This functionality provides Brokers with greater flexibility in managing their trading instruments.