In this March update, we are concentrating on the ongoing enhancement of our Match-Trader platform along with other solutions for Forex and Prop Brokers. A key addition is the Nominal Value Calculation functionality, which significantly eases the process of making investment choices for Match-Trader users. This enhancement, together with further advancements like a user-friendly drag-and-drop feature for TP & SL management, is our way of addressing the distinct requirements of the trading community. Discover how our recent updates can elevate the performance of your brokerage activities.

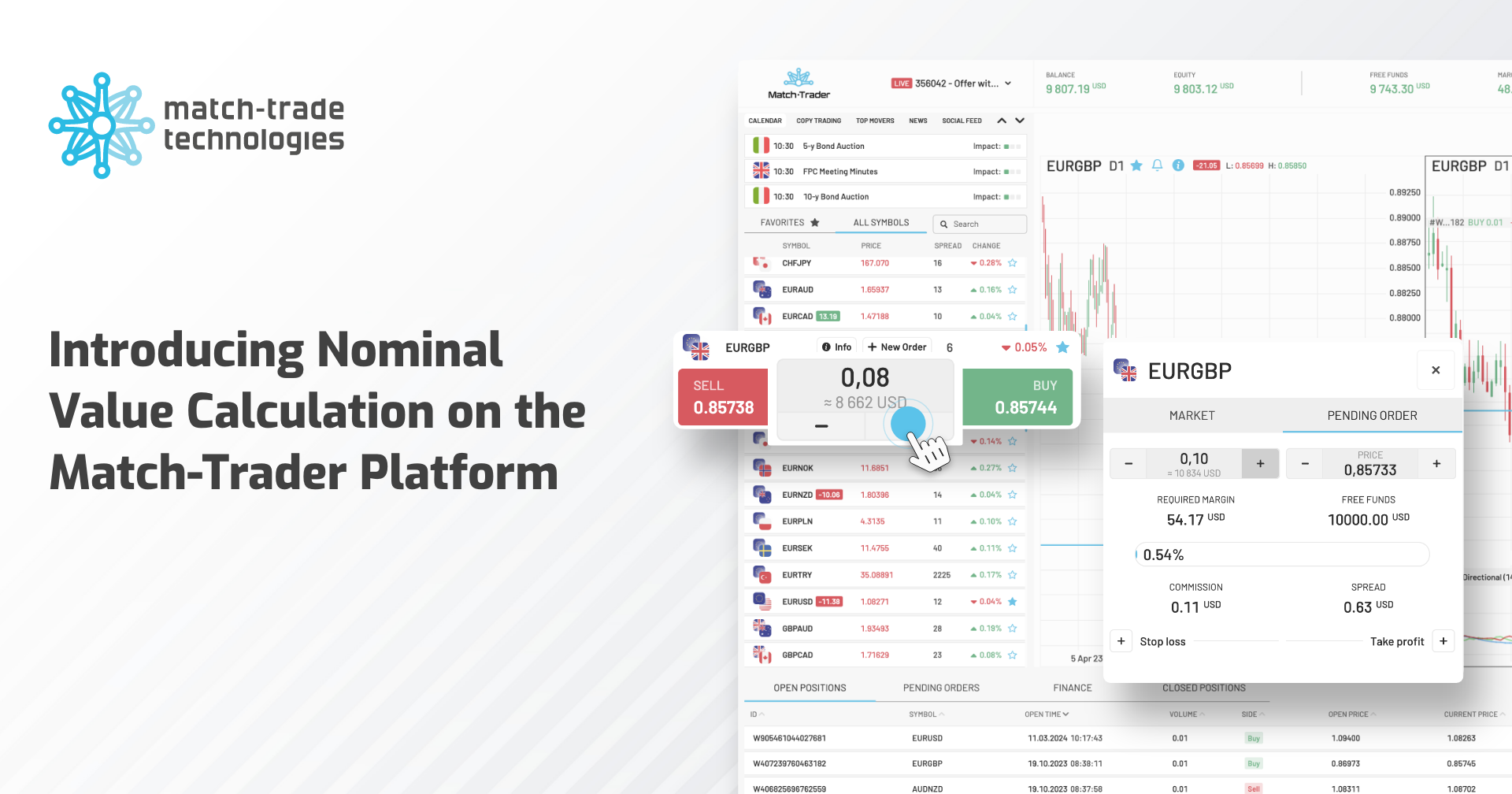

Introducing Nominal Value Calculation on the Match-Trader Platform

Based on valuable feedback from our users, we are continuously striving to improve our trading platform, Match-Trader. With a focus on providing even better service and convenience, we have introduced a new feature—displaying the nominal value when entering the volume of a transaction. Now, before opening a position or placing a pending order, users can easily see the nominal volume value expressed in the currency of their account. This innovation is available both when opening positions directly from Marketwatch and while placing Pending Orders.

Benefits for Brokers:

A key benefit of this update is a significant enhancement in the platform’s usability. Investors can now, effortlessly and without additional calculations, view the nominal value of a planned transaction. This solution not only saves time but also contributes to making more informed investment decisions. As a result, our platform becomes even more intuitive and user-friendly, facilitating both the speed and accuracy of investment strategies.

Simple TP, SL and Pending order Adjustment with Match-Trader’s Drag-and-Drop Feature

At Match-Trader, we’re constantly refining our platform to align with our users’ needs. Our newest update brings a drag-and-drop feature that simplifies managing Take Profit (TP), Stop Loss (SL), and Pending Orders right on the chart.

Intuitive Chart Editing for TP and SL:

After investors define their Take Profit and Stop Loss settings for a position, they will see corresponding lines on the chart indicating these levels. Adjusting these settings is as easy as clicking on the relevant line, dragging it to your desired level, and releasing it to set your new TP or SL position. This seamless interaction not only streamlines the adjustment process but also provides an apparent visual reference against the chart’s historical data, enabling more informed decision-making.

Simplified Pending Order Setup:

Setting a Pending Order has never been easier. By clicking the ‘New Order’ button next to the Symbol Information and navigating to the Pending Order tab, a corresponding line appears on the chart. Traders can simply drag this line to the desired level to easily set and adjust the execution price based on market movements.

This enhancement is accessible on both the desktop and mobile versions of the Match-Trader platform. Whether at home or on the move, investors can manage TP, SL, and Pending Orders with unmatched ease and accuracy.

Benefits for Brokers:

The simplicity and intuitive design of the drag-and-drop feature significantly improves the trading experience, making the platform more appealing. A user-friendly environment attracts more clients and increases retention, as traders prefer platforms where their needs are understood and met with innovative solutions.

Enhanced access to Broker’s Support for Traders

In March, we streamlined the way traders connect with their Broker’s support team by unveiling a new feature: the “Contact Form URL” within the Broker Details of our Forex CRM. Now, Brokers can offer their clients an even easier and faster way to report issues or get in touch. Simply by placing a URL to their contact form, an email address, or a phone number in the newly added field, Brokers enable their clients using the Match-Trader platform and Client Office for traders to access a direct “Contact Support” option. This option directly redirects them to the specified contact page, launches the email client for sending emails, or enables immediate phone calls—depending on the broker’s preference.

Benefits for Brokers:

The streamlined process for connecting traders with their Broker’s support team significantly shortens the time it takes for traders to report issues or seek assistance. This efficiency enhances the overall trading experience, leading to higher trader satisfaction. The new functionality also offers flexibility in adapting the contact method according to the client’s preferences and needs.

This feature is compatible with the ticketing systems that handle reports via email and allows Brokers to integrate this new functionality seamlessly into their existing support framework. This adaptability means Brokers can enhance their support capabilities without significantly changing their current systems.

Enhancing User Experience within the Sales Dashboard of our Forex CRM

We’re elevating the user experience of our solutions for Forex Brokers. In the “Last event” table within the Sales Dashboard of our Forex CRM, we’ve introduced a feature that allows users to highlight specific events by adding them to their favourites. The events that can be highlighted include:

- Take Profit

- Lead Assignment

- Stop Loss

- Stop Out

- Failed Deposit

- Successful Deposit

- Margin Call

- Withdrawal to Confirm

This highlighting feature is shared among all CRM users of a given Broker, ensuring a collaborative environment.

Benefits for Brokers:

The highlighting feature significantly diminishes the risk of missing out on vital events, particularly when they are numerous. It empowers Brokers and their teams to handle client management more efficiently and to react swiftly to crucial incidents. This tool prioritizes essential events, enabling Brokers to concentrate on tasks needing urgent action, thereby streamlining workflow and enhancing client relations. Furthermore, the shared highlighting functionality promotes teamwork by ensuring that every CRM user in the brokerage is updated about key events.

Enhanced IB Commission Setup in our Forex CRM

We’ve enhanced the Commission Setup configuration within our Forex CRM to support wildcard characters * and !, enriching our Multi-Level IB system. This update introduces a flexible way to specify instrument configurations, allowing for broader and more precise control over commission calculations.

With the addition of the * wildcard, our system can now identify all instruments matching a given pattern. For example:

- EURUSD* will match any instrument that begins with EURUSD, including variations like EURUSD.1 or the basic EURUSD itself.

- EUR* captures any instrument starting with EUR, covering pairs such as EURUSD, EURCHF, or EURUSD.1.

- *US* will find any instrument containing US, accommodating symbols like EURUSD or US100.

Furthermore, we’ve integrated the ! symbol to function as a negation operator, effectively excluding specified symbols from the configuration.

Benefits for Brokers:

This enhancement allows for the efficient inclusion or exclusion of a broad range of instruments based on specific patterns, ensuring accurate commission calculations. Brokers can now effortlessly manage and adapt commission structures to suit an extensive array of trading instruments, significantly simplifying the management of similar or variant-named instruments. This streamlined approach to commission customization enhances operational efficiency and provides the means to cater to diverse client needs precisely.

Introducing Daily Snapshots in the Match-Trader Streaming Manager

The latest update to the Match-Trader Streaming Manager includes a “Daily Snapshots” tab within the detailed account view aimed at improving client account management. This feature presents daily account summaries at the close of each day, with a filtering option for the last 30 days. It provides essential data, including:

- Date

- Balance

- Equity

- Credit

- Margin

- Margin level

- Free margin

- Open Profit

- Closed Profit

- Number of Closed Trades

- Deposits

- Withdraws

- Commissions

- Swaps

This feature allows for effortless monitoring of balance, equity, used margin, and other critical client data changes.

Benefits for Brokers:

The Daily Snapshots tab allows Brokers to effortlessly analyze their clients’ performance, providing access to daily summaries over the last month. This serves as a valuable tool for observing changes in trading account balances and forms a solid foundation for data analysis and anomaly detection, enhancing overall account management efficiency.

Elevating Risk Management capabilities of our Match-Trader Administrator

This March, we’re elevating the risk management capabilities of our solution for Forex Brokers. With our latest update, we introduce a crucial piece of information regarding exposure levels: the new “Current/Free Exposure” column within the Exposure Rules tab. This means that Match-Trader Administrator users with Admin access will now have a clearer view of the risks involved in adhering to specific Exposure Rules.

Benefits for Brokers:

Brokers can now have a clearer, real-time view of their current exposure levels. With detailed information on current and free exposure, Brokers can make more informed decisions regarding their exposure strategy. They can assess whether to take on more exposure, reduce current levels, or adjust their strategies to align with their current market conditions and compliance requirements.

Optimized account filtering in the Match-Trader Manager

This March, we’re also introducing enhanced filtering within the Match-Trader Manager, enabling Brokers to swiftly locate client accounts by entering a phone number. This advancement allows Match-Trader Manager users to efficiently identify trading accounts associated with a specific phone number, streamlining client management and ensuring prompt responses to their inquiries and needs.

Benefits for Brokers:

This update broadens the search capabilities within Match-Trader Manager, allowing for the quick identification of trading accounts with minimal information. Brokers can now enjoy a more efficient search process, facilitating better and faster client service.