This month, we’re thrilled to unveil a new series of enhancements tailored to elevate your brokerage operations. From boosting the analytics power of our Forex CRM to enhancing the usability of our solutions, our goal is to ensure you maintain a competitive edge in the Forex industry. Explore further to understand how our recent upgrades can bolster your business.

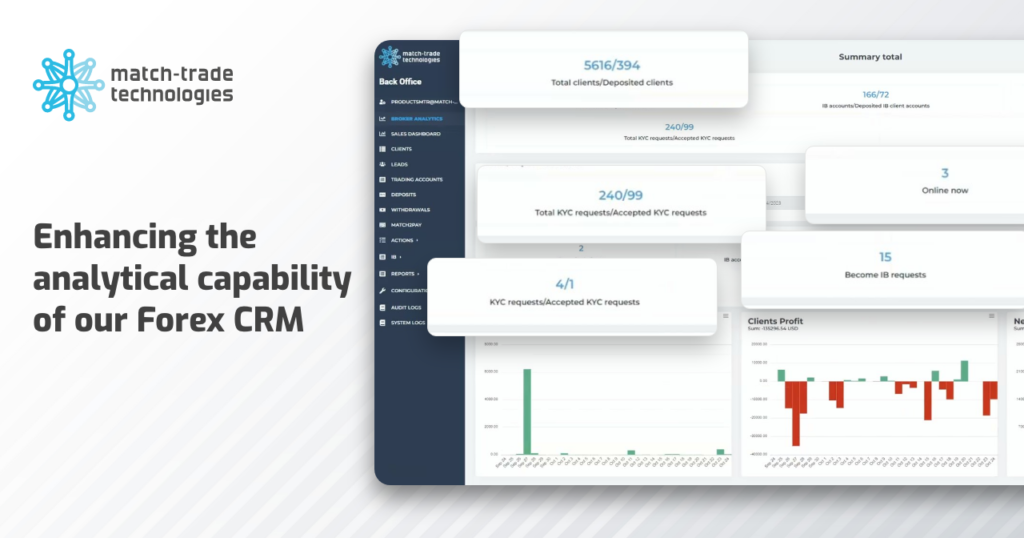

Enhancing the analytical capability of our Forex CRM

Unlock deeper insights into your Brokerage performance with our revamped CRM for Forex Brokers. Our “Broker Analytics” tab now boasts detailed fields and refined filters, enabling a deeper understanding of your business’s operation.

What’s new in the Broker Analytics tab:

- In the “Summary total” section, three new statistics have been introduced: “Total & Accepted KYC requests,” “Online now,” and “Become IB requests.”

- The “Business Trends” tab now features “KYC requests,” “Become IB requests,” and “Withdrawals requests.”

- We also added a filtering feature, allowing for the distinction between accounts based on Real/Demo offerings, those on A-Book/B-Book, and those without this classification in the group name.

Benefits for Brokers:

The improved Broker Analytics tab significantly elevates the analytical prowess of our Forex CRM. With its expanded fields and advanced filters, Brokers can now get in-depth insights into the core aspects of their business. By understanding metrics like KYC requests, real-time online users, and affiliation requests, Brokers are better positioned to strategize their marketing initiatives. Furthermore, Brokers can craft offers more in sync with specific client needs, thereby optimizing client acquisition and retention efforts.

Bulk Adjustment of TP/SL in the Match-Trader Platform

This October, we also rolled out an innovative feature within the Match-Trader platform that empowers users to adjust TP and SL for numerous positions and awaiting orders on specific instruments.

Benefits for Brokers:

By offering a streamlined TP/SL bulk modification tool, we enhance the agility of orders to reflect real-time market dynamics. This is particularly vital for traders who open multiple positions on a single instrument, ensuring they adapt swiftly to instrument price movements. Such efficient management encourages greater trader activity, potentially boosting overall platform trading volumes.

Optimizing payment icon management in our Forex CRM

We’re always striving to enhance the user experience for Brokers using our Forex CRM. Responding to market demands, we’ve introduced a new tab called “Payment Gateways Icons”. This feature provides a quick overview of active payment icons and streamlined management – enabling or disabling them all from one central location. Additionally, this tab allows for the addition of custom icons.

Benefits for Brokers:

Brokers can now independently manage and add new icons, streamlining their operations and saving time. They no longer need to contact customer support to add an icon; they can directly access and implement changes on the spot.

Improved Sales Dashboard view in our Forex CRM

Understanding the needs of our users and striving for continuous improvement, we’ve upgraded the Sales Dashboard interface of our Forex CRM. Brokers now have access to additional filters, allowing them to exclude demo accounts from the list displayed in the “Recent Events” section.

Benefits for Brokers:

By hiding events related to demo accounts, Brokers can focus on the most relevant information from real accounts, resulting in a less cluttered and more readable interface. Eliminating potential distractions reduces the risk of overlooking essential information or events.

Adding the Social Feed feature into the Analytics Tab per Instrument

This October, we continued our efforts to enhance the analytical capabilities of our Match-Trader platform. We added the “Social Feed” feature into the Analytics tab per instrument in the Symbol Info. Now, traders can view the three most recent positions opened by Money Managers for a specific instrument. Traders will be directed to a detailed Social Feed view by clicking on a chosen position.

Benefits for Brokers:

The new functionality not only empowers traders to refine their strategies through real-time data but also promotes increased trading activity. Access to up-to-date information allows for better decision-making and profit optimization for traders. Furthermore, offering such advanced features gives Brokers a competitive edge, setting them apart in a crowded market and attracting more traders.

Optimized TP/SL Settings in the Match-Trader platform

In October, we rolled out a significant enhancement to the Match-Trader platform, refining the way of setting the TP (Take Profit) and SL (Stop Loss). Now, with an intuitive interface, traders can easily define the exact price in USD value to activate their TP/SL. This innovative feature automatically determines the closest price level, aligning with a trader’s forecasted profit or loss. With improved precision and adaptability, placing new trades has never been more seamless.

Benefits for Brokers:

This enhancement increases user satisfaction due to streamlined trading experiences, giving Brokers a competitive edge in the market. The automatic price level calculations minimize human errors, leading to more efficient trade executions and potentially higher trading volumes. By implementing and promoting such enhancements, Brokers refine the user experience and position themselves as industry leaders attuned to their customers’ evolving needs.

Log in to the Match-Trader platform without a trading account

This October, we also worked on streamlining the onboarding process. We’ve revamped the “Edit Profile” section on the Match-Trader platform. It now boasts an advanced profile editor and the ability to upload KYC documents. A standout addition is the ability for users to log in to Match-Trader even if they don’t have an active trading account. This functionality is particularly beneficial for those awaiting account verification or approval from their Brokers.

Benefits for Brokers:

Understanding the challenges traders face when Brokers require verification before opening a trading account, we’ve enhanced the experience on the Match-Trader platform. We’ve simplified the verification process, allowing all necessary checks to be executed directly within the platform. This streamlined approach expedites account creation and allows users to explore the platform even if they don’t have an active trading account yet.

Change Password directly in the Match-Trader platform

As part of our ongoing improvements to the award-winning Match-Trader platform, we’ve introduced a new feature to enhance the security level. We’ve added a password change option within the “Security” tab in user settings. Notably, this feature was previously only accessible through the Client Office.

Benefits for Brokers:

Users can now more easily and quickly change their passwords directly in the Match-Trader platform. This means they no longer need to open a separate application, streamlining the entire process and making it more intuitive. Reducing the number of steps and platforms involved in the password change process minimizes potential vulnerabilities and risks. This not only bolsters the user’s trust but also emphasizes Broker’s commitment to safeguarding their data and privacy.

Verification code resend button in the Match-Trader platform

A recent enhancement to our Match-Trader platform aimed at improving User Experience and boosting security is the introduction of a feature that allows users to resend the verification code via the “Resend Code” button.

Benefits for Brokers:

Thanks to this feature, traders can easily resend the verification code if they’ve encountered issues receiving it or locating it in their email inbox. This eliminates the hassle of combing through emails, searching for the code, or addressing message delivery issues.

Optimization of the email templates in our Forex CRM

In the email templates associated with Operations, as well as throughout our Forex CRM mailing system, we’ve introduced the capability to use the {{MTR_ADDRESS}} variable. This improvement allows for the automatic inclusion of a specific Broker’s platform address in email communications.

Benefits for Brokers:

Embedding the direct Broker’s platform address in emails elevates personalization, leading to heightened recipient engagement. This tailored approach to communication fosters trust and boosts the professional image of the Broker, solidifying Trader-Broker relationships.

Enhanced transaction management in the Match2Pay crypto payment gateway

This October, we made significant improvements to our Match2Pay crypto payment gateway. Merchants can now easily track their Match2Pay settlement activities also in the “Transaction” tab beside “Balance” tab. We’ve renamed this from the previous “Crypto transactions”. For added convenience, we’ve also enabled these details to be exported as a CSV file. To view the details of these operations, simply select the “Show settlement transactions” button.

Benefits for Brokers:

This update allows Brokers to swiftly check any changes in their Match2Pay balance. The CSV export feature streamlines the process of creating in-depth balance operation reports. This ensures Brokers have a complete, clear snapshot of their balance activities, paving the way for sharper analyses and forecasts.

Optimizing column visibility in the Transactions tab

We’ve enhanced the User Interface of our Match2Pay crypto payment gateway. Now, not all columns are displayed by default in the Transactions tab. Users have the flexibility to customize their visibility, choosing from the available options on the list.

Benefits for Brokers:

With the ability to adjust column visibility, Brokers enjoy a more personalized and clear working environment. The flexibility of this feature allows for the elimination of unnecessary information, streamlining decision-making and enhancing the overall quality of interaction with the platform.