Recent months have seen a series of powerful upgrades to our Match-Trader FIX infrastructure and HawkEye Risk Management System. These solutions are used internally by our liquidity providers, Match-Prime and FX-EDGE, enabling more efficient risk management, smarter liquidity routing, and enhanced support for brokers and prop firms.

In practice, it means Match-Prime and FX-EDGE now onboard clients faster, manage complex setups with less manual work, and deliver more consistent execution quality to brokers and prop trading firms.

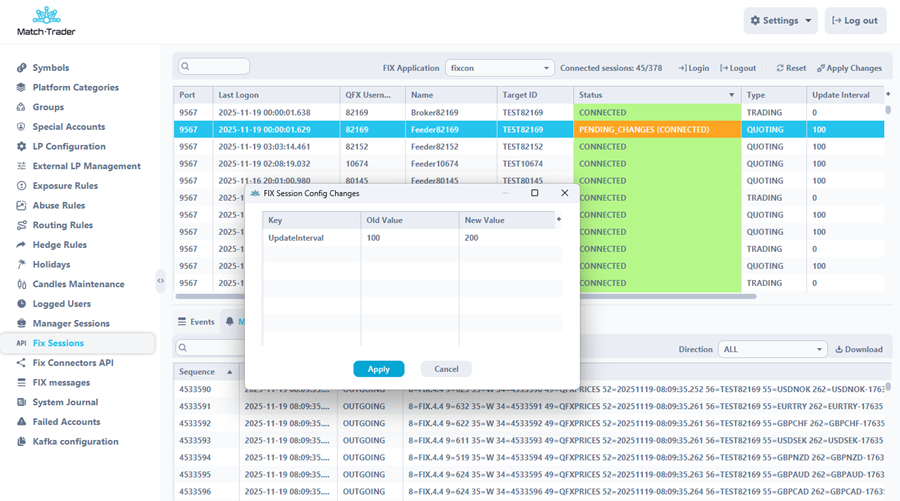

Faster Onboarding and Zero-Downtime Changes with Dynamic FIX Session Management

Our FIX Connectors support dynamic session management. Dealing teams at Match-Prime and FX-EDGE can add, modify, or remove FIX sessions without restarting services or interrupting live trading.

What this changes for our liquidity operations:

• No maintenance windows – new brokers or prop firms can connect and existing setups can be updated without planned downtime

• Faster go-live – new connections and configuration changes are deployed in minutes instead of days or weeks

• Fewer technical bottlenecks – all FIX sessions are managed directly in Match-Trader Admin with real-time status, a live FIX message view, and one-click restarts and configuration adjustments

• Full audit history – every change is logged for compliance and internal review

This allows our liquidity partners to react quickly to clients’ needs while keeping their infrastructure stable.

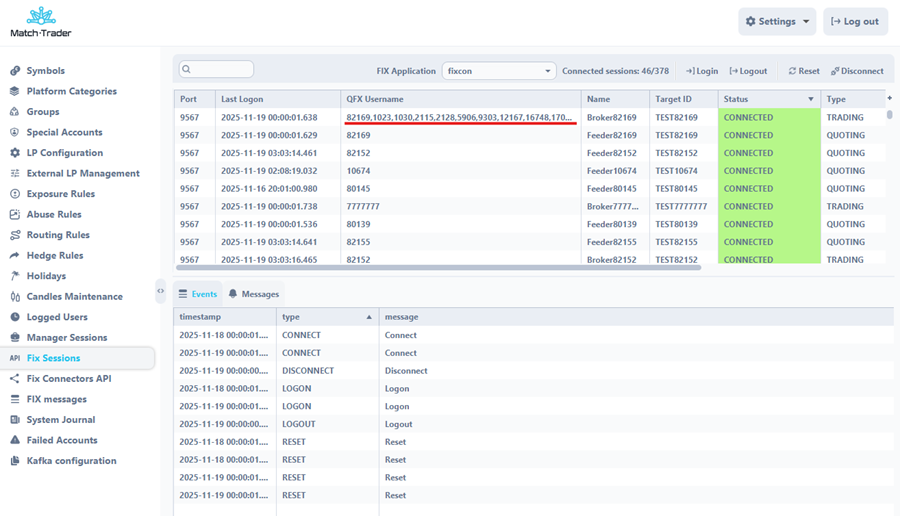

Simpler Architecture for Funded Accounts with Multi-Account FIX Sessions

We’ve extended support for FIX tag 1 (Account), enabling a single FIX session to serve multiple accounts throughout our liquidity systems.

How Match-Prime and FX-EDGE use it:

• Single connection for multiple accounts – trading activity from various funded or segregated accounts is aggregated and hedged via one FIX session

• 1:1 trade replication – each underlying client or funded trader can have a dedicated hedge account on our side, while our Prop Module in the CRM ensures full visibility

• Lower infrastructure overhead – no need to maintain hundreds of separate FIX sessions

• Seamless integration – full compatibility with all existing bridges and FIX setups used by brokers and prop firms

This allows our liquidity partners to scale their setups for funded and institutional clients without adding complexity.

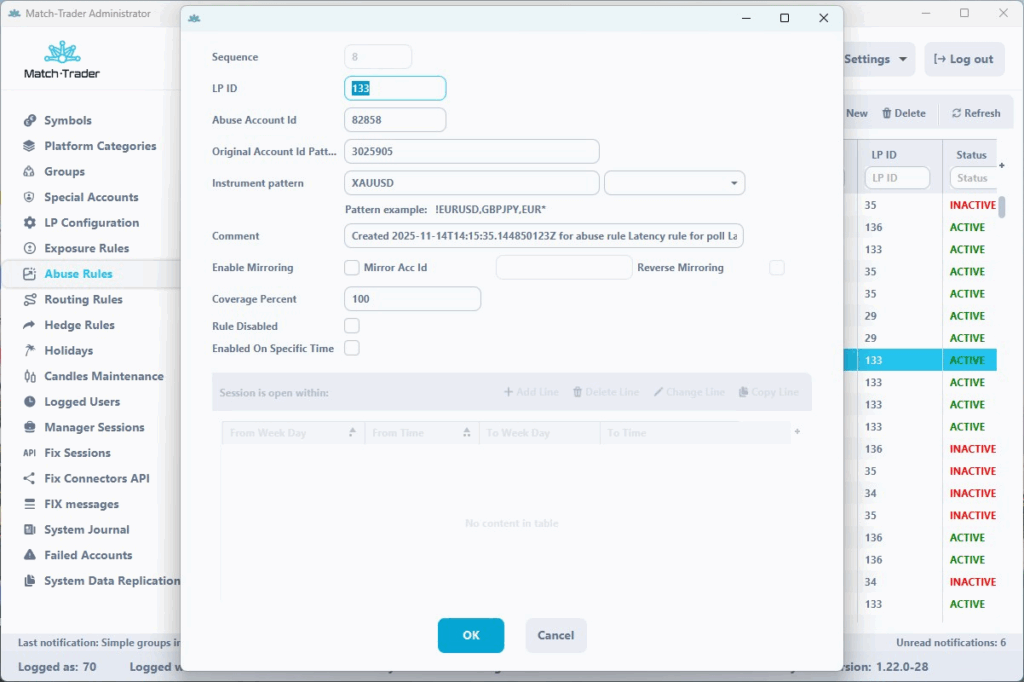

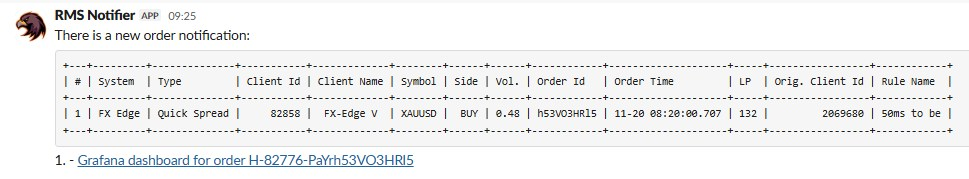

Account-Level Risk Routing with Abuse Rules

Our new Abuse Rules in Match-Trader Admin are used by Match-Prime and FX-EDGE to manage risk per individual client account instead of applying less favorable conditions to the entire client base.

What dealing and risk teams can do:

• Route specific accounts (identified via Original Account ID from MT4/MT5 and other platforms) to tailored liquidity pools

• Keep regular clients on optimal conditions, while problematic or abusive flow is handled separately

• Apply account-level decisions without changing global settings for all clients

Why it’s even stronger with HawkEye RMS:

When integrated with HawkEye, Abuse Rules can be triggered automatically when they detect suspicious activity, such as:

• Latency arbitrage

• Gold price manipulation

• Other toxic or exploitative strategies

Instead of manual intervention, the system automatically reroutes only the risky account, helping Match-Prime and FX-EDGE protect their books while preserving optimal trading conditions for legitimate clients.

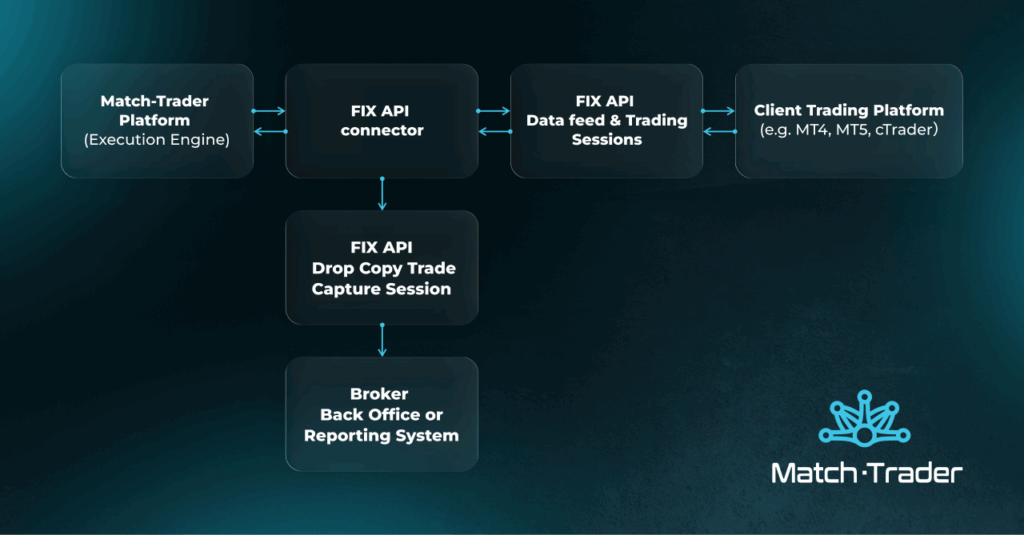

Real-Time Transparency with Drop Copy (Trade Capture Report)

Our FIX Connectors now support Drop Copy (Trade Capture Report) in full compliance with FIX 4.4. Match-Prime and FX-EDGE leverage this feature to enhance their internal reporting and monitoring.

How it supports brokers’ operations:

• Real-time trade reporting – every executed order generates a Trade Capture Report via a separate, dedicated FIX session

• Rich execution details – instrument, side, size, price, timestamp, and Original Account ID for clear traceability

• Separated from execution flow – reporting does not slow down or interfere with primary trading sessions

• Ready for internal and external reporting – capable of supporting in-house risk tools, clients’ back-office systems, and regulatory reporting

This gives our liquidity clients institutional-grade transparency across all trades executed for brokers and prop firms.

One Technology Stack Powering Match-Prime and FX-EDGE

All of these upgrades serve one goal: to provide Match-Prime and FX-EDGE with a tightly integrated, end-to-end trading stack based on Match-Trader – from the platform and FIX connectivity, through risk management, to liquidity delivery.

With this approach, our liquidity providers can:

• Onboard and configure brokers and prop firms faster

• Route orders and hedge exposure with more flexibility

• Detect and manage abusive flow at the account level

• Maintain clear, real-time reporting across all activity

Ultimately, these internal enhancements enable Match-Prime and FX-EDGE to support their clients more efficiently and deliver better execution quality to brokers and prop firms.

If you’re interested in exploring liquidity solutions built on Match-Trader’s infrastructure, contact us.