We are expanding our proprietary platform horizons by making the Match-Trader system available as a standalone backend technology. This move allows Brokers seeking a distinctive trading solution to craft their own custom front end while seamlessly integrating MTT‘s cutting-edge matching engine in the backend, ensuring top-tier performance.

In the dynamic landscape of the Forex industry, we have consistently tailored our services to meet the evolving needs of Brokers and traders. From the outset, Match-Trader has been renowned for its state-of-the-art backend. The other advantage was meticulously crafted front end, exemplifying the platform’s technical prowess and unwavering commitment to delivering a seamless trading experience.

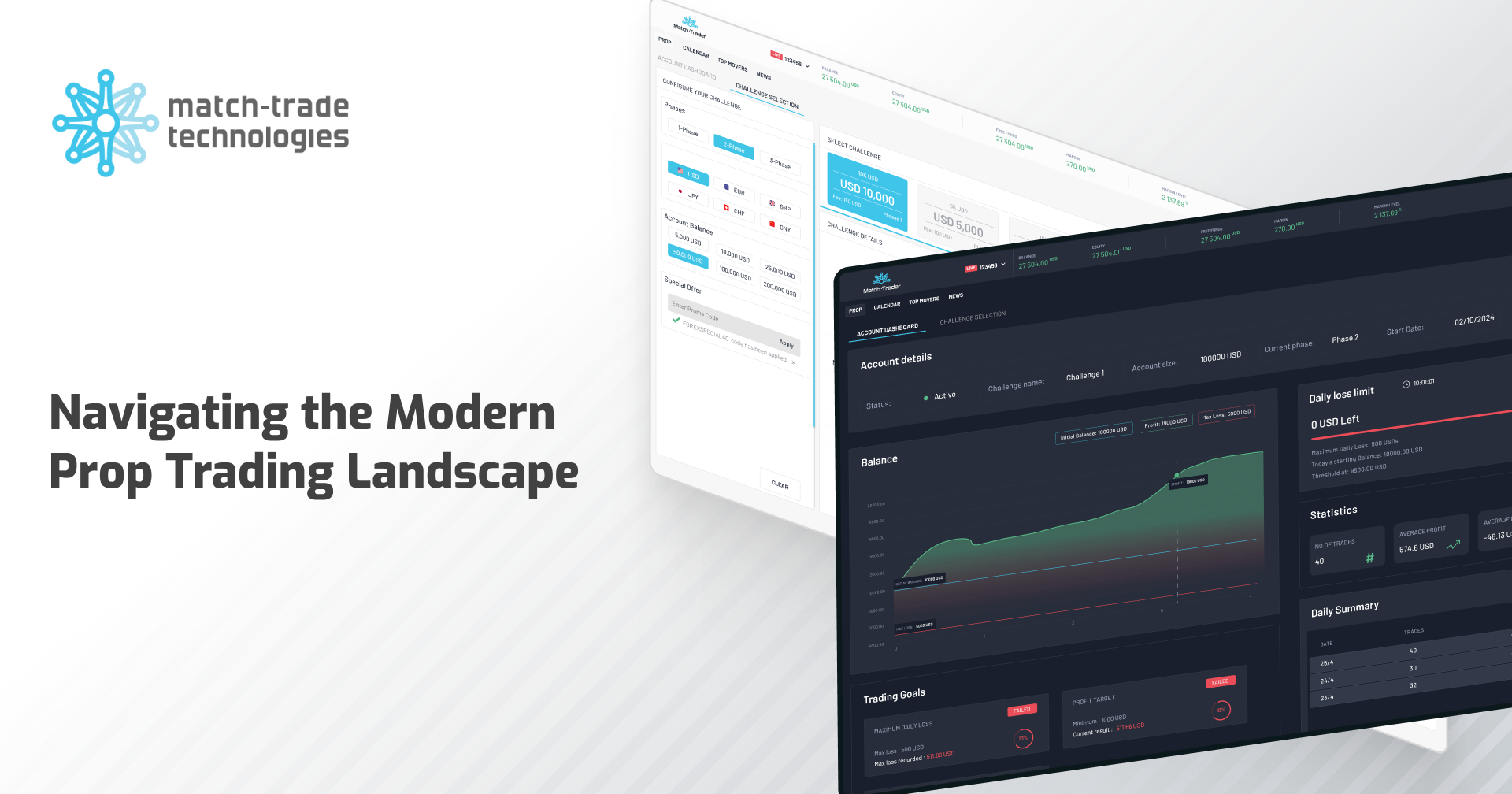

Get a competitive edge with your custom front end

However, given the current market saturation, Brokers increasingly seek customised solutions to differentiate their trading platforms in a crowded marketplace. Historically, only a handful of major brokers could afford the time and resources needed to develop their own platforms. The reason was that it demanded significant investment. Nonetheless, we anticipate this trend toward bespoke platforms will develop as Brokers search for competitive advantages and ways to boost their brand recognition.

Seeing this growing demand for unique trading platforms, we have strategically aligned ourselves with market trends by offering our back-end technology as a standalone solution. Any Broker interested in building their own platform can streamline the entire process. It can be done by connecting their custom-made front end to the robust matching engine powering the industry-respected Match-Trader platform.

Enhance your business efficiency with the Match-Trader back end

The decision to offer our backend technology independently aims to strengthen our position as the go-to partner for creating distinctive trading platforms built on established and reliable technology. One such custom solution built on the Match-Trader backend technology is the trading platform developed by Fintech360, featuring a front end designed by a team of respected forex industry experts.

We believe that clients who wish to use our trading system to construct their unique solutions by developing custom interfaces can significantly expand the platform’s market reach and user base. Whether it’s the broker’s in-house team or a third-party provider, developers can create specialised front ends tailored to specific niches or trading strategies, attracting new types of traders. Leveraging trusted backend technology from a reliable partner represents the most efficient and cost-effective way for brokers to build their own platforms, particularly when targeting specific investor groups with well-defined expectations.

Developing the front end is enough for a unique trading platform

This approach empowers brokers to tap into the expertise and infrastructure of established technology providers specialising in developing and maintaining robust backend systems, crucial for seamless trade execution, risk management, liquidity aggregation, and connectivity to various markets. By outsourcing the backend technology, brokers can significantly reduce development costs, accelerate time to market, and ensure reliability and scalability. With their resources, they can focus on delivering a unique, user-friendly front end tailored to their specific target audience. This strategy not only enhances the broker’s competitiveness but also eliminates the resource-intensive burden of backend system maintenance, leading to cost savings and increased operational efficiency.

Benefit from an API-based open trading environment

The Match-Trader platform has received numerous awards and industry recognition over the past years. Our ultra-fast matching engine boasts a proven track record of meeting market demands over the last eight years, demonstrating scalability to handle high-volume traffic without compromising latency. As the creators of the Match-Trader platform, we provide an open trading environment accessible via various APIs. Seamless integration can be achieved through REST API software architecture, supported by Websocket and gRPC protocols, offering flexibility and compatibility with web-based applications and services. Furthermore, brokers interested in creating their own front end can utilise the same structure as Match-Trader’s original interface, leveraging Platform API or easily exporting charts with indicators to external websites using Web Candle API.

We believe that by providing the Match-Trader system as a standalone back-end technology, we’ll expand the platform’s reach and help Brokers offer unique trading experiences based on their custom front ends.