Mobile trading takes over Forex industry

It is well known that forex trading requires from investors not only skills but above all discipline and the ability to control emotions. Until recently, trading required to spend several hours in front of a computer each week to keep a decent level of trading performance. Fitting Forex trading around a busy schedule can be challenging, therefore more and more investors are looking for solutions that will allow them to perform trades “on the go”.

Trading Forex from a smartphone has really taken off in the last few years. Match-Trade Technologies, a technology provider for Forex Brokers responsible for launching Match-Trader, a new trading platform has recently analysed the traffic on its clients’ trading platforms. The analysis revealed that over 75% of trades are executed on mobile platforms.

This shows that mobile trading gave forex traders great freedom by increasing their control over investing their funds. Thanks to smartphones investors can trade from anywhere they want at any time.

Brokers need to adapt to forex mobile trading

According to recent reports, the number of active smartphone users in the world increased by 8% in the last year reaching the point of 3,6 billion. Which means that in just 12 months, there were 270 million new actively used smartphones around the world. But what does it mean for Forex Brokers?

The growing number of clients using smartphones calls for a change in the brokers’ approach to trading apps. Today, it is no longer enough to offer such a possibility because customers expect the highest standards of usability from mobile applications. Most popular trading platform providers offer mobile versions of their platforms, but they are generic platforms without broker brand and name inside. It doesn’t bring too much value for the brokers if they cannot promote their brand on mobile devices.

It’s no secret that investors in the forex industry benefit from the volatility of markets. To make the most of every opportunity they need, they need constant control over investments and quick access to information. There is no better way to monitor this market volatility than using a smartphone that is always at hand. Universal Internet access allows traders to check prices in real-time and place orders and monitor trades literally anywhere they are.

Accessibility is the key to successful mobile trading

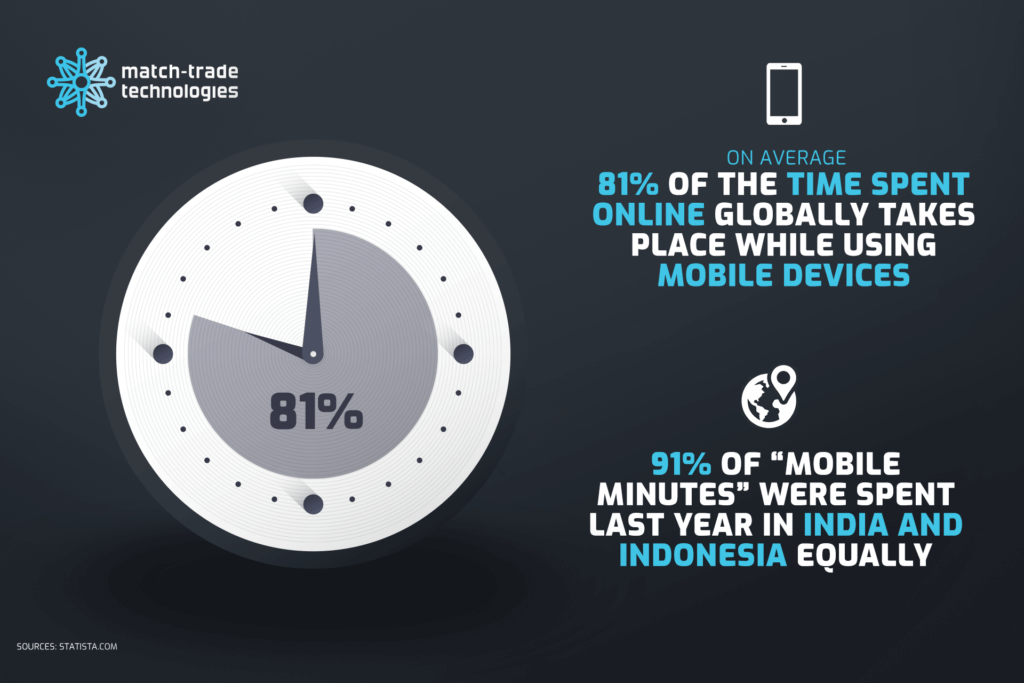

According to statista.com, almost 52% of web page views worldwide are performed on mobile devices (excluding tablets). And this percentage reaches up to 62% of webpage views via mobile generated in Asia. Moreover, on average 81% of the time spent online globally take place while using mobile devices with 91% of “mobile minutes” spent last year in India and Indonesia equally.

Internal research performed by one of the global brokers showed that there was an increase in mobile usage of their trading platform during the ‘commuting hours’ which indicates that people are checking in on the markets and their accounts while going to and coming from work.

PWA – modern technology designed for mobile trading

The average specifications of devices in developing countries differ from the specifications in more developed markets such as the USA and China. Therefore, a universal approach to application development is a must. For this reason, developers are increasingly using PWA (Progressive web app) technology to build applications. Thanks to this modern technology, the trading platform such as Match-Trader, does not require creating separate applications for mobile and desktop devices. And since it is, in fact, a single all-in-one application, all of the user’s settings and activities are synchronized and visible regardless of the device used to enter a trading account. Moreover, such a platform (app) is launched straight from an icon on the home screen of a chosen device and it doesn’t take any storage. This solution is especially convenient for users of less advanced smartphones requiring “lite versions” of apps thus it provides the very best performance.

One of the most important features of PWA technology is the ability to create apps with client own branding, without any dependencies on Google or Apple store. The branded app can be delivered to the broker within one day and all updates will happen automatically across all devices and systems. The client will enjoy always the same trading experience while using the web, desktop or mobile app whether his device runs on Android or iOS.

The forex mobile trading won’t stop growing

Although at the moment it looks like the global sales of smartphones have reached saturation and the activity of their users maintains a high though stable level, analysts predict another large increase in smartphone users with the advent of 5G technology, which will probably give a big boost for forex mobile trading and may cause greater migration of traders to mobile devices. It looks like we might have reached the point where a major factor of a client choosing one broker over another will be the mobile trading platform. Although many brokers have loyal customers, the very nature of the forex market will encourage traders to swap brokers to get better services and rates.

Therefore, every Forex Broker who wants to stay in the game must provide their clients with solutions that will allow them not only effectively execute trades on mobile devices but will also allow for efficient account management on the trading platform. For people who are just planning to start their own forex brokerage, it is obvious that the key aspect of choosing technology in the meaning of a trading platform will be finding an all-in-one trading system designed for mobile trading.