Use Cases

Platform tailored

to Prop Trading.

In-house Prop Trading solution for forex and futures, tailored to

challenge-based trading with futures-specific evaluation rules,

built-in performance statistics dashboards, and integrated Prop

CRM — now including TradingView charts for every Prop firm at no

additional cost.

Prop Trading software

and turnkey solution

Prop Trading solution.

Platform & Prop CRM

In response to the growing demand for a solution tailored to

challenge-based trading and built-in performance statistics

dashboards, Match-Trader team has developed it’s own

complete Prop Trading solution, now available with TradingView

charts.

Prop Brokers can leverage Match-Trader as a standalone

platform already integrated with the most popular Prop

CRMs or connect their custom system using our APIs.

Prop Trading software

and turnkey solution

Futures Prop Trading solution. Platform & Prop CRM

As futures prop trading grows, firms need technology that

mirrors real market structure and supports scalable, challenge-

based evaluations. Match-Trader delivers a complete solution

with performance dashboards, contract-based evaluation rules,

and a seamless trading experience across web, desktop, and

mobile.

With both native and TradingView charts, firms can offer flexible

charting options. Match-Trader can run as a fully branded

standalone platform integrated with leading Prop CRMs or

connect via API for an easy, flexible futures evaluation setup.

Built-In Features and Evaluation

Contests for Prop Firms

Contract-Based

Position Limits

Set the maximum position size for

different instrument types (e.g., mini and

standard contracts), with an automated

scaling plan that can scale the maximum

position size based on the trader’s end-

of-day profit value.

Evaluation Rule

Controls

Configure trailing drawdown, minimum

trading days, profit targets, and

maximum daily loss limits — along with

other key evaluation parameters for each

challenge.

Session-Based

Auto-Liquidation

Automatically close open positions at

the end of each trading session

according to evaluation rules.

Market-Depth

Execution

Fill orders using VWAP logic based on full

market depth supplied by your data

provider.

End-of-Day Trading

Configuration

Set custom schedules for when futures

positions can be opened or held during

evaluations.

Paper-Trading

Environment

Simulate structured futures evaluations

under real-market conditions with virtual

capital.

Integrated Data-Feed

Bridges

Connect external market data feeds

instantly using Match-Trader’s wide list

of integrated bridge solutions.

Prop accounts and challenges

management for Brokers

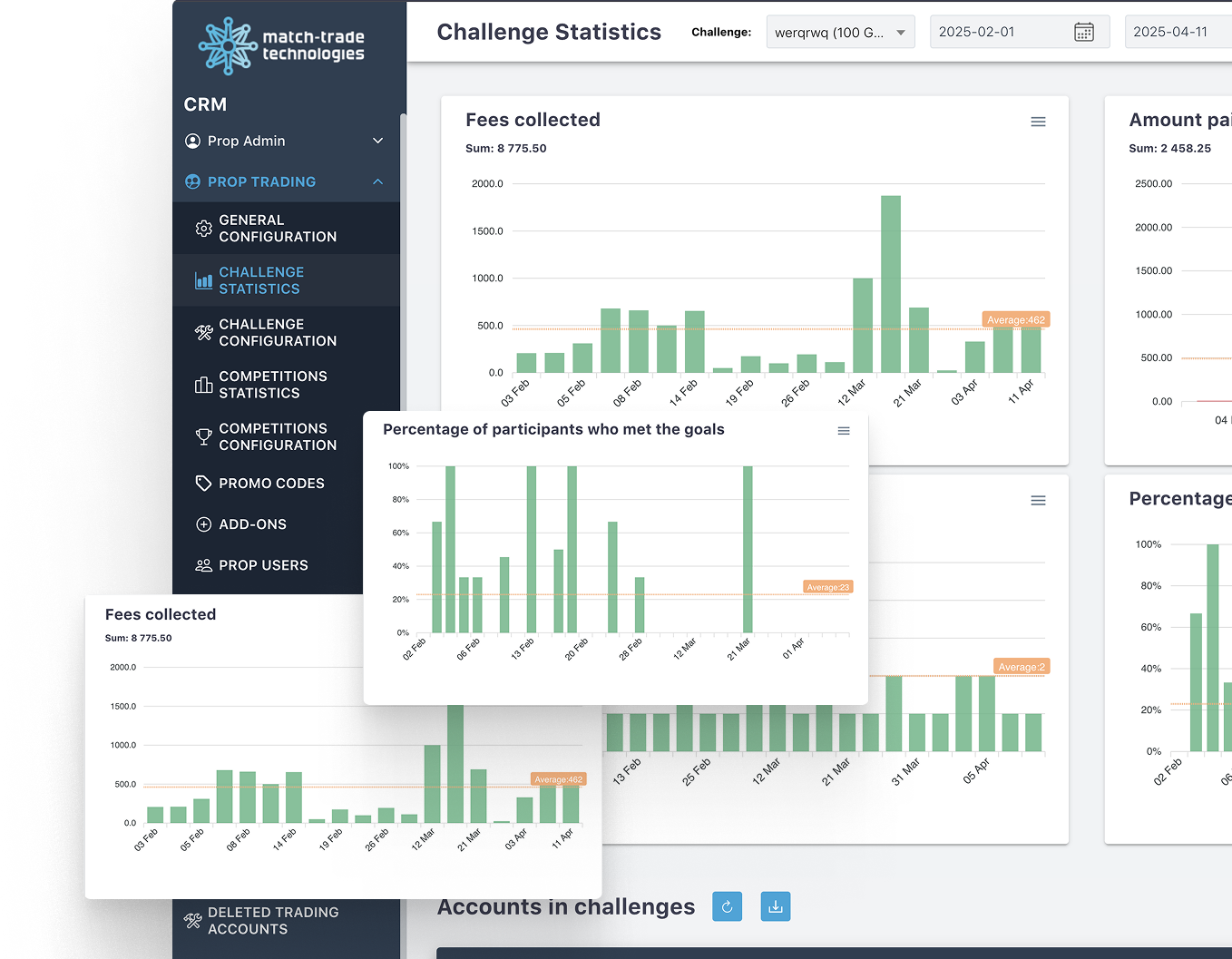

Challenge Statistics

Clear charts efficiently summarise essential metrics such as collected fees, trader payouts, new participant numbers and goal achievement percentages. They also offer detailed performance statistics for each participating account, which can be filtered by specific date ranges for convenient report creation.

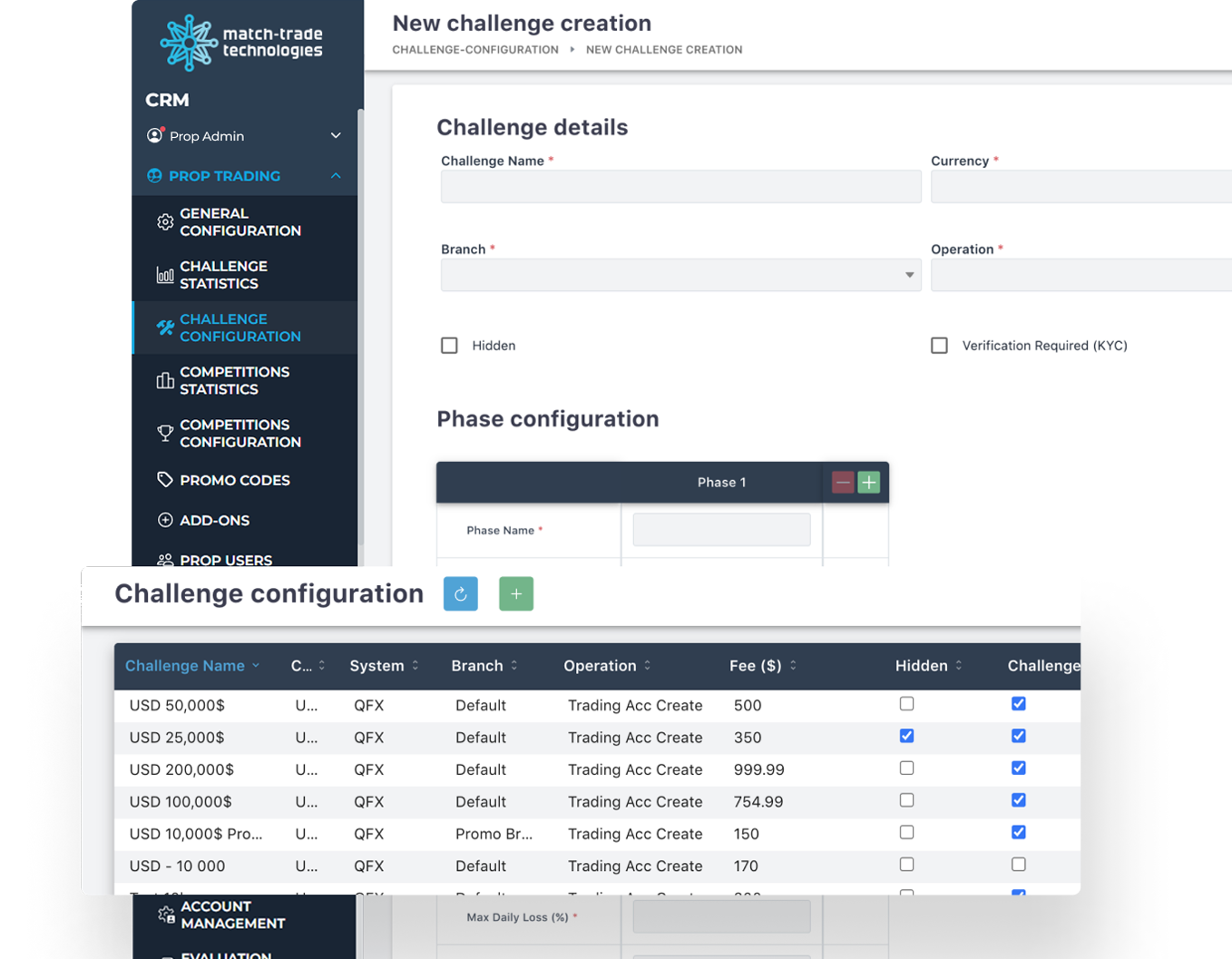

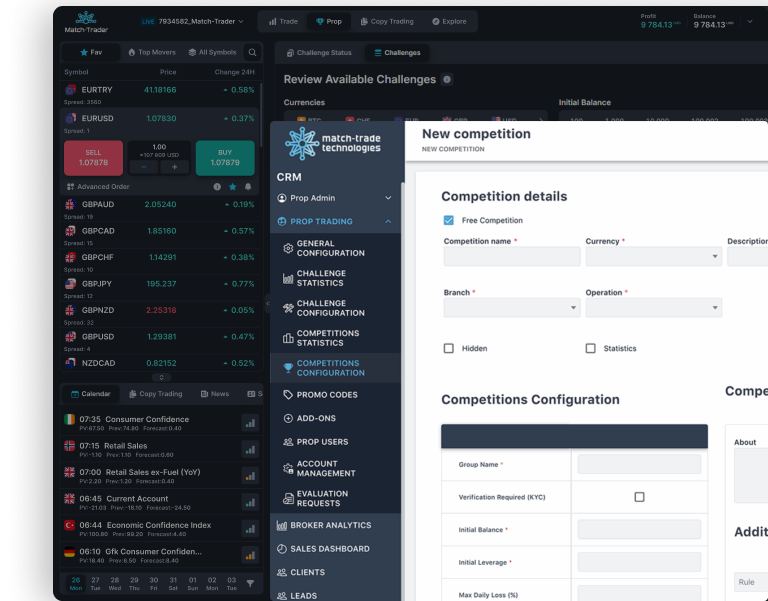

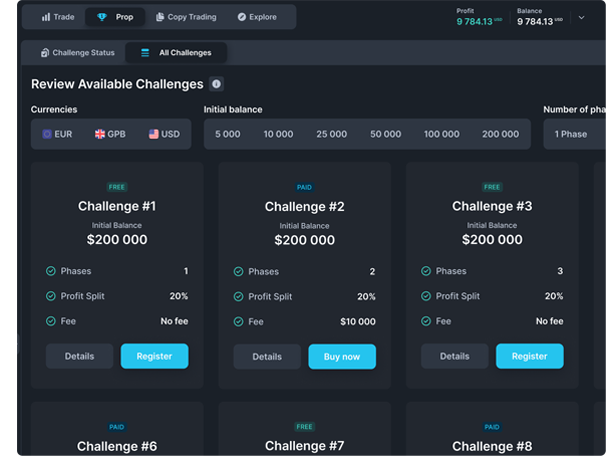

Challenge Configuration

This tab enables the creation and configuration of new challenges assigned to specific branches, with designated currency, fees and requirements for KYC verification or statistical inclusion. For each challenge, Brokers set the number of phases (indicating funded ones) and define key parameters, including initial balance, leverage, trading period with minimum trading days, loss limits, profit targets and the Broker-Client profit split arrangement.

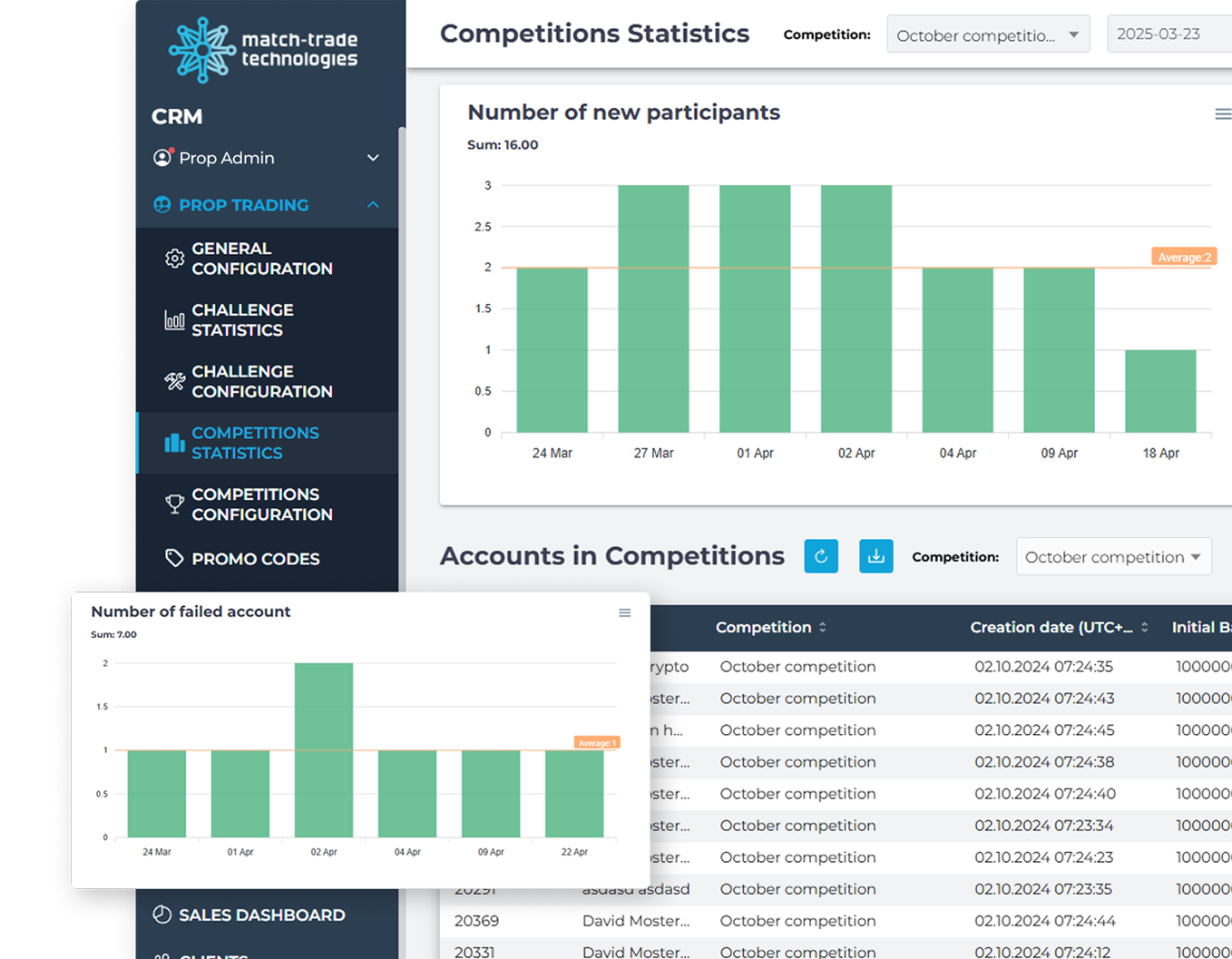

Competitions Statistics

The Statistics and Rankings system provides Brokers with a complete picture of tournament activities and participant performance. It shows important numbers like the new participant count, account failures and engagement patterns. This enables Brokers to monitor overall participation trends in real-time and use concrete data to optimise the competition experience.

Competitions Configurations

The Configuration tab enables the creation of tournament settings tailored for realistic trading environments. Brokers can define competition details such as name, currency, system and branch, with options for visibility and statistics tracking. The interface allows for detailed rule-setting, including trading conditions, competition duration, participant limits and prize pool configuration.

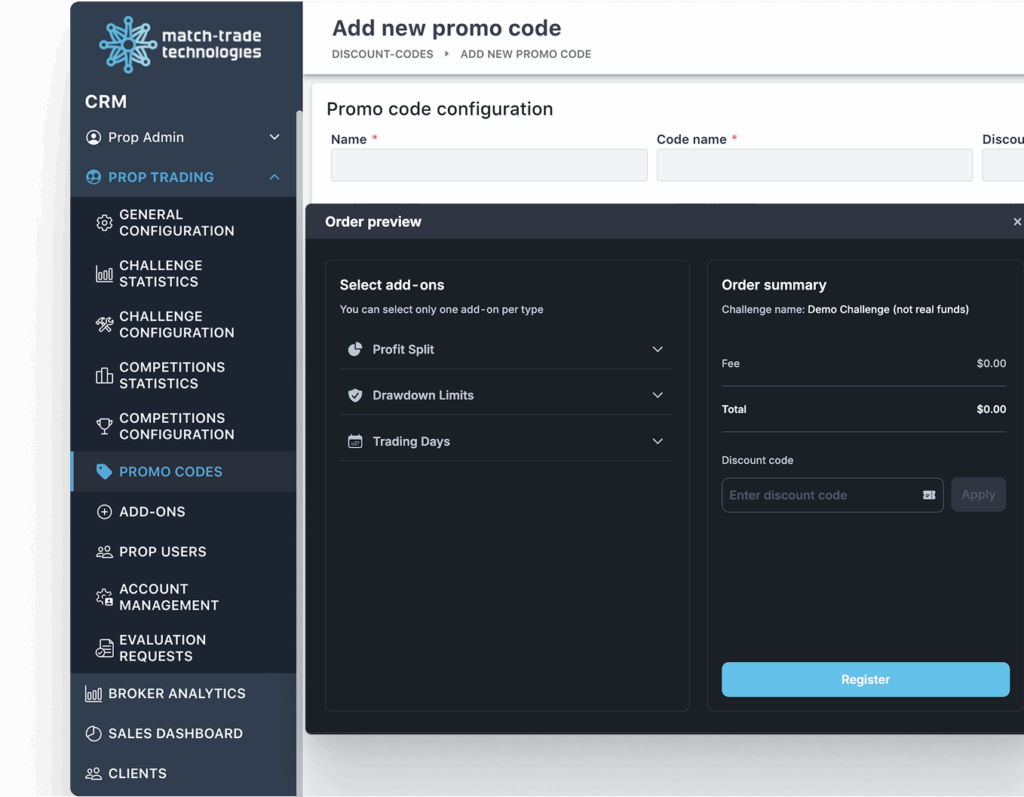

Promo Codes

The Match-Trader’s promo code feature helps Prop Trading firms enhance trader acquisition and retention through challenge fee reductions, referrer rewards and learning discounts. The CRM includes a dedicated tab for managing these codes, benefiting Brokers by increasing platform appeal, incentivising referrals, encouraging continued learning and simplifying code entry—collectively boosting Client engagement and interest in Prop Firm offerings.

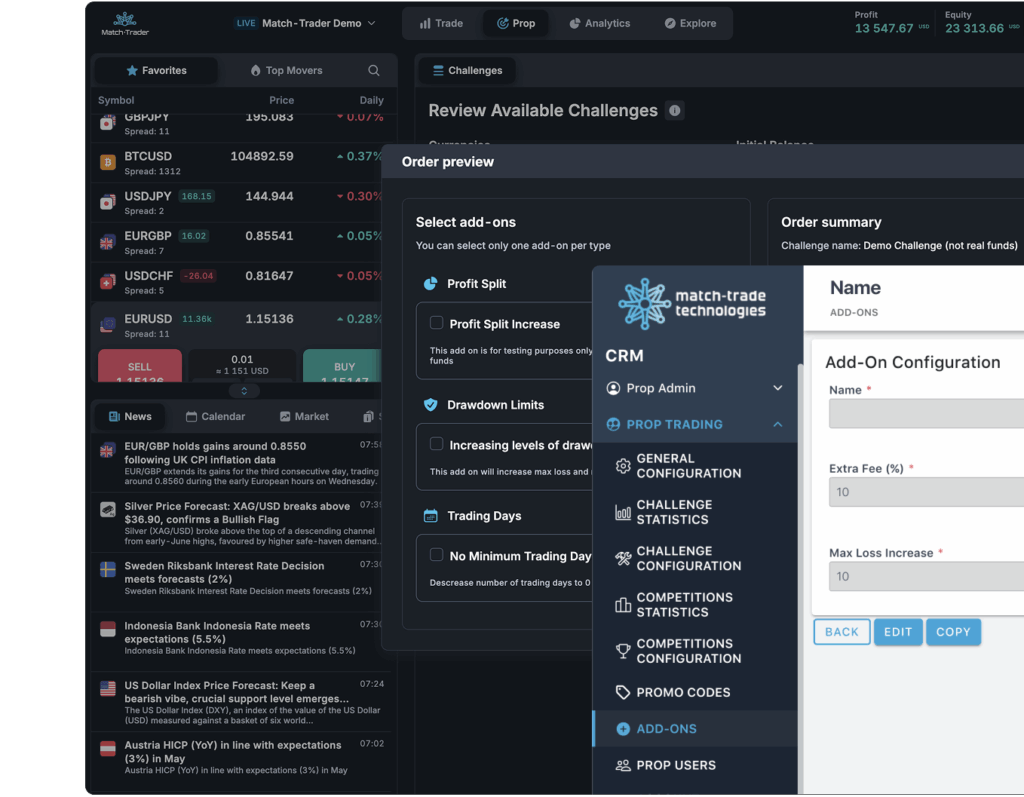

Add-Ons

This functionality enables paid modifications to challenge purchase conditions. There are three types of Add-Ons: Profit Split Increase (adjusts profit sharing in favour of the Client), Drawdown Limits Increase (raises the maximum daily and overall loss thresholds) and Minimum Trading Days Decrease (lowers the required trading days to advance phases or withdraw funds). The system offers flexibility in customising challenge parameters while creating an additional revenue stream for Brokers.

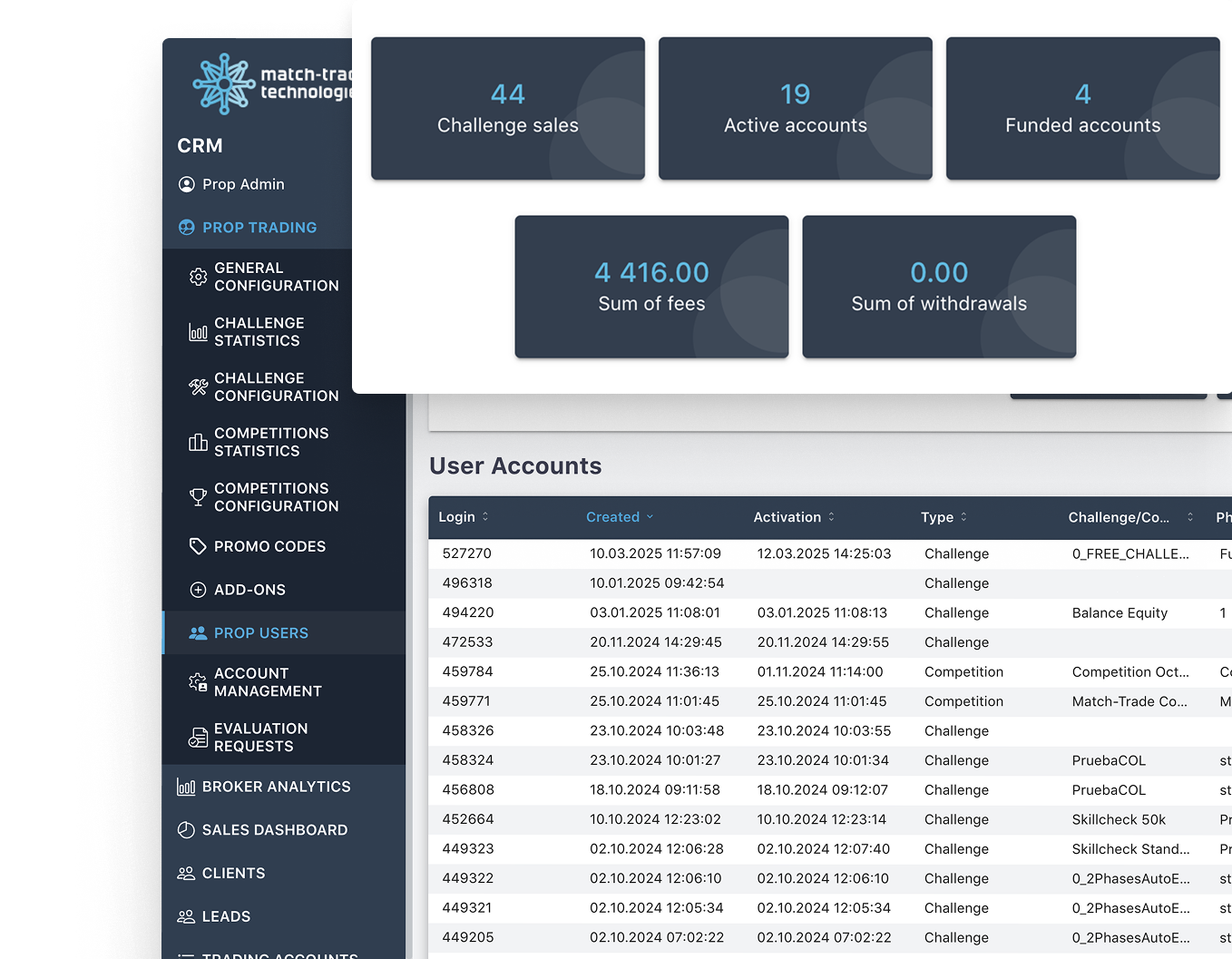

Prop Users

The Prop Users tab consolidates detailed statistics for each trader, giving Brokers a clear overview of user activity and account performance. They can easily see the total number of prop accounts acquired, how many remain active, the overall spend on accounts and total payouts from the funded phase. Detailed views also reveal promo codes used and add-ons purchased, offering valuable insights for efficient user management and informed decision-making.

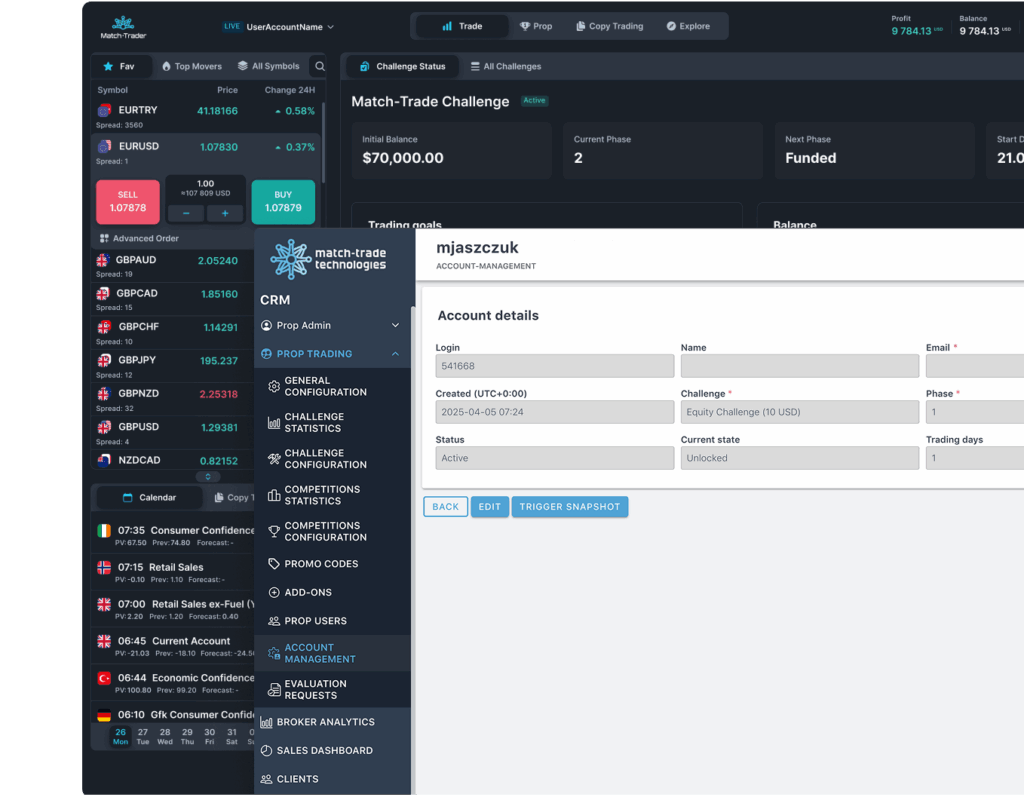

Account management

The Account Management tab offers comprehensive control over all prop trading accounts, allowing Brokers to create, unlock or modify accounts without incurring fees. Key information such as account status, challenge phase and trading days is easily accessible and editable through an intuitive interface. Whether adjusting account parameters or monitoring trader progress, Brokers can manage operations efficiently and with full transparency.

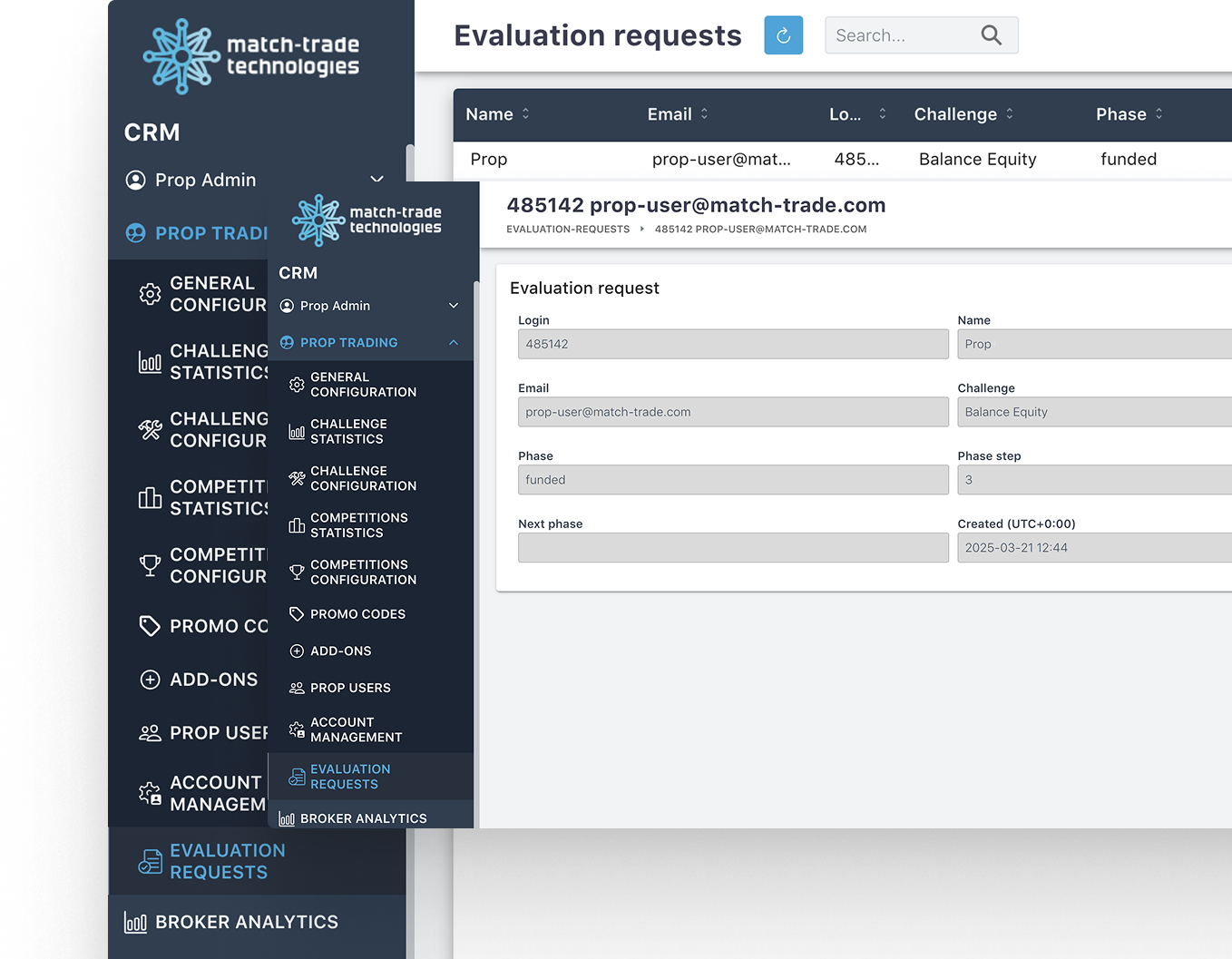

Evaluation requests

This tab in the Prop Broker CRM gives Brokers more control over the phase progression process, allowing for a more detailed review of trader performance before moving to the next challenge stage. The “Auto Evaluation” parameter lets Brokers decide which phases require manual verification and which can be processed automatically. Also, the notification system keeps traders informed on the status of their requests, improving communication, transparency and engagement.

Platform designed to offer a

seamless prop trading experience

Offer your clients the best trading experience with an industry-renowned trading

platform. Everything by the hand without the need to switch applications.

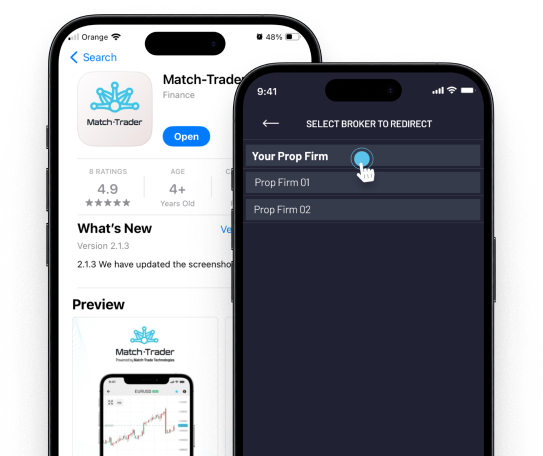

Multi-broker access for props

Match-Trader serves as a unified hub that connects Prop Traders to multiple Brokers simultaneously. Instead of switching between different trading environments, you can manage all your accounts and execute trades through a single interface. The platform ombines comprehensive market insights with multi-broker trading capabilities, helping you make well-informed decisions and optimize your trading potential.

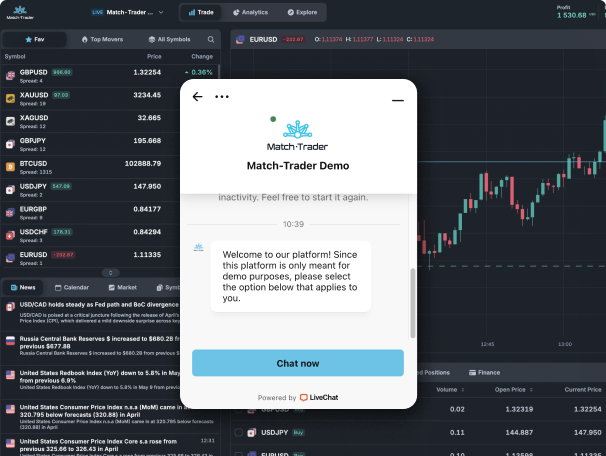

Live Chat

Designed to enhance user interaction, Live Chat enables direct, real-time communication within the trading platform, ensuring swift issue resolution and continuous monitoring. This advanced system converts chats and emails into trackable tickets, letting Brokers prioritise and manage support with ease.

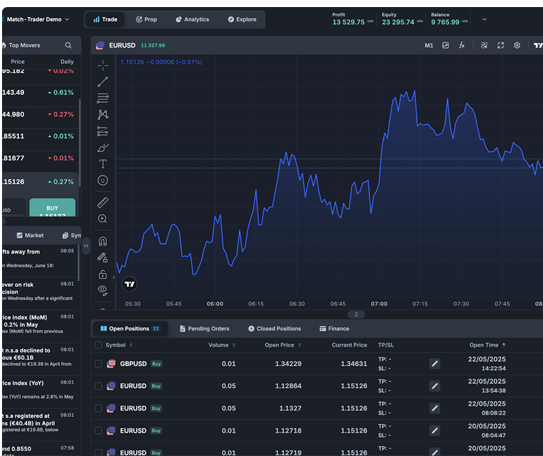

Built-in TradingView charts

Gain a competitive edge over legacy platforms by offering your clients the beloved TradingView charts. Attract more traders with the diverse market analysis tools available on the Match-Trader platform. TradingView charts are seamlessly integrated and available to every client at no additional cost.

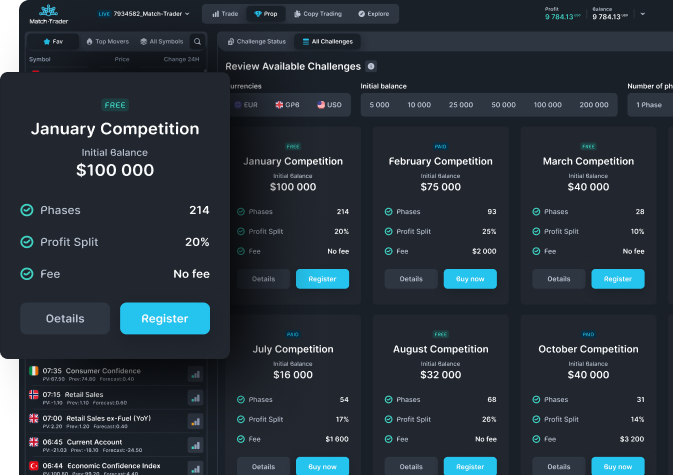

Prop trading competitions

Prop trading competitions offer aspiring traders a dynamic, realistic testing ground where they can showcase their strategic prowess in a simulated market environment. By providing a risk-free platform that mirrors actual trading conditions, these tournaments are transforming how prop trading firms identify and acquire promising talent, preparing them for live trading.

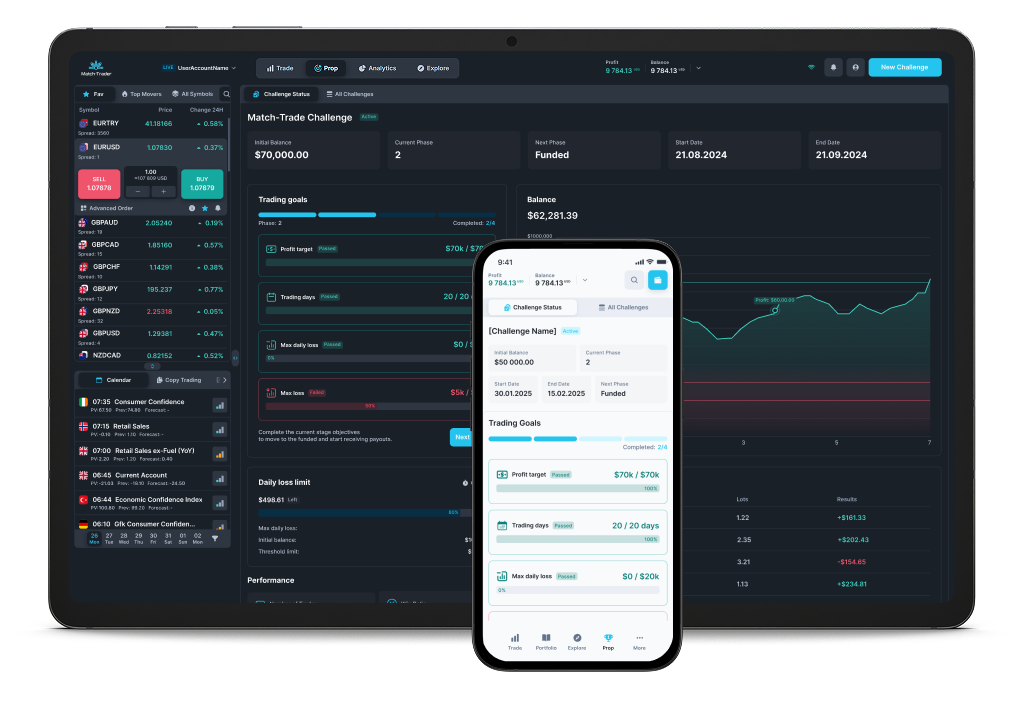

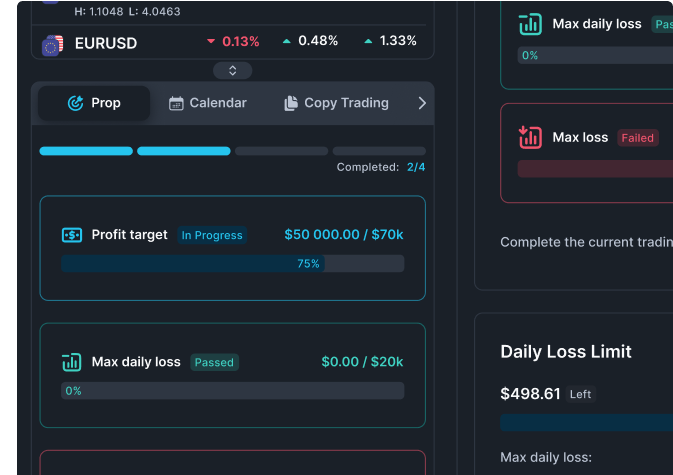

Prop widget

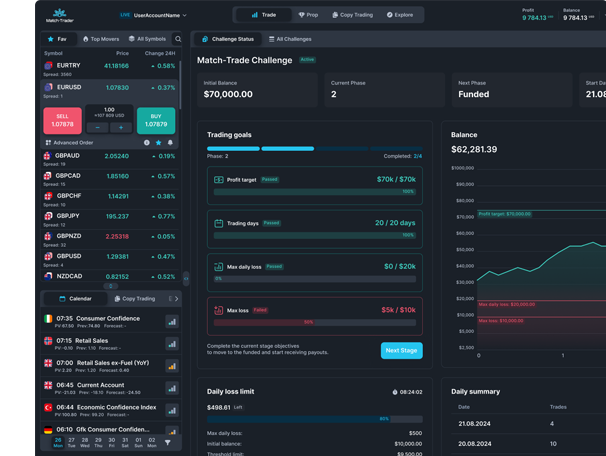

When opening a Prop Trading Account type, the default platform view shows a widget containing crucial information about performance, such as profit target, max daily loss, and max loss, as well as a Calendar of market events and Top Movers instruments.

Account Dashboard

Gathers detailed information regarding the trader’s activity to track performance in real-time and make decisions for better challenge management easier. Including : Account Details, Balance Chart, Daily Loss Limit, Trading Goals, Statistic and Daily Summary.

Challenges tab

Makes it easier to choose a challenge by pre-selecting using parameters such as the number of phases, currency, and account size. Each challenge has detailed information, including initial leverage, period, goals, and profit split. Thanks to various connected payment methods, one can pay for the selected challenge directly from the platform.

Account Performance (general)

Allows traders to calculate the value of total return and profitability measured by ROI % and presents detailed statistics of best and worst trades to ease performance analysis.

Related news

Discover the latest platform releases, market and industry

news regarding Match-Trader, our clients and partners.

-

Match-Trade February Release: Full MetaTrader 5 Integration

February’s release adds full MetaTrader 5 backend integration for Match-Trader Prop, alongside targeted improvements to onboarding, verification, challenge management, and core operational workflows. Phase-based fees and new add-ons open additional…

-

Our Prop CRM Now Integrated with MetaTrader 5

Match-Trader has expanded its proprietary trading infrastructure by extending Prop CRM functionality to support MT5, enabling full, challenge-based prop trading programs to run while using MT5 as an execution platform.…

-

Match-Trade January Release: Prop Challenge Boost Add-On

Our January release strengthens your competitive edge with upgrades across trader experience, prop infrastructure, and operational efficiency. Enhanced visual flexibility, expanded analytical capabilities, and revenue-generating features reduce friction while maintaining…

FAQ

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus augue arcu, placerat ac risus nec, blandit sollicitudin est. Nullam nec nunc dui. Aenean eleifend imperdiet quam a rhoncus. Vestibulum sollicitudin ante eu lacus egestas condimentum. Proin a consequat quam, dictum commodo lorem. Cras vitae vulputate libero. Praesent ac lacus vel augue pulvinar pellentesque. Donec aliquam nulla vitae est ultricies, nec fermentum metus malesuada. Vestibulum tincidunt maximus urna, a pellentesque lectus rhoncus non. Maecenas fermentum ullamcorper mi, nec dictum nisi. Duis cursus aliquam sapien ac convallis. Suspendisse potenti. Praesent auctor turpis id nunc porta, ut feugiat dui pharetra. Donec finibus aliquam accumsan.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus augue arcu, placerat ac risus nec, blandit sollicitudin est. Nullam nec nunc dui. Aenean eleifend imperdiet quam a rhoncus. Vestibulum sollicitudin ante eu lacus egestas condimentum. Proin a consequat quam, dictum commodo lorem. Cras vitae vulputate libero. Praesent ac lacus vel augue pulvinar pellentesque. Donec aliquam nulla vitae est ultricies, nec fermentum metus malesuada. Vestibulum tincidunt maximus urna, a pellentesque lectus rhoncus non. Maecenas fermentum ullamcorper mi, nec dictum nisi. Duis cursus aliquam sapien ac convallis. Suspendisse potenti. Praesent auctor turpis id nunc porta, ut feugiat dui pharetra. Donec finibus aliquam accumsan.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus augue arcu, placerat ac risus nec, blandit sollicitudin est. Nullam nec nunc dui. Aenean eleifend imperdiet quam a rhoncus. Vestibulum sollicitudin ante eu lacus egestas condimentum. Proin a consequat quam, dictum commodo lorem. Cras vitae vulputate libero. Praesent ac lacus vel augue pulvinar pellentesque. Donec aliquam nulla vitae est ultricies, nec fermentum metus malesuada. Vestibulum tincidunt maximus urna, a pellentesque lectus rhoncus non. Maecenas fermentum ullamcorper mi, nec dictum nisi. Duis cursus aliquam sapien ac convallis. Suspendisse potenti. Praesent auctor turpis id nunc porta, ut feugiat dui pharetra. Donec finibus aliquam accumsan.