If you’ve decided to become a forex broker, one of the most important decisions to make is choosing the type of trading platform.

However, to be able to take full advantage of the potential of your forex business, you need more than just a trading platform. Investors expect a certain level of service, and a management system is necessary to provide it.

What is a forex White Label?

The most popular solution among novice brokers is to choose the White Label platform. It means borrowing a trading infrastructure from a technology provider. This allows you to use recognized software and place your own branding on the platform, which has an impact on brand recognition and customer loyalty. Even though it’s very convenient, It does come with setup limitations. Most popular platforms don’t allow brokers to have their own, branded mobile app.

Yet, this is the fastest way to start your Forex brokerage business.

White Label platform vs all-in-one solution?

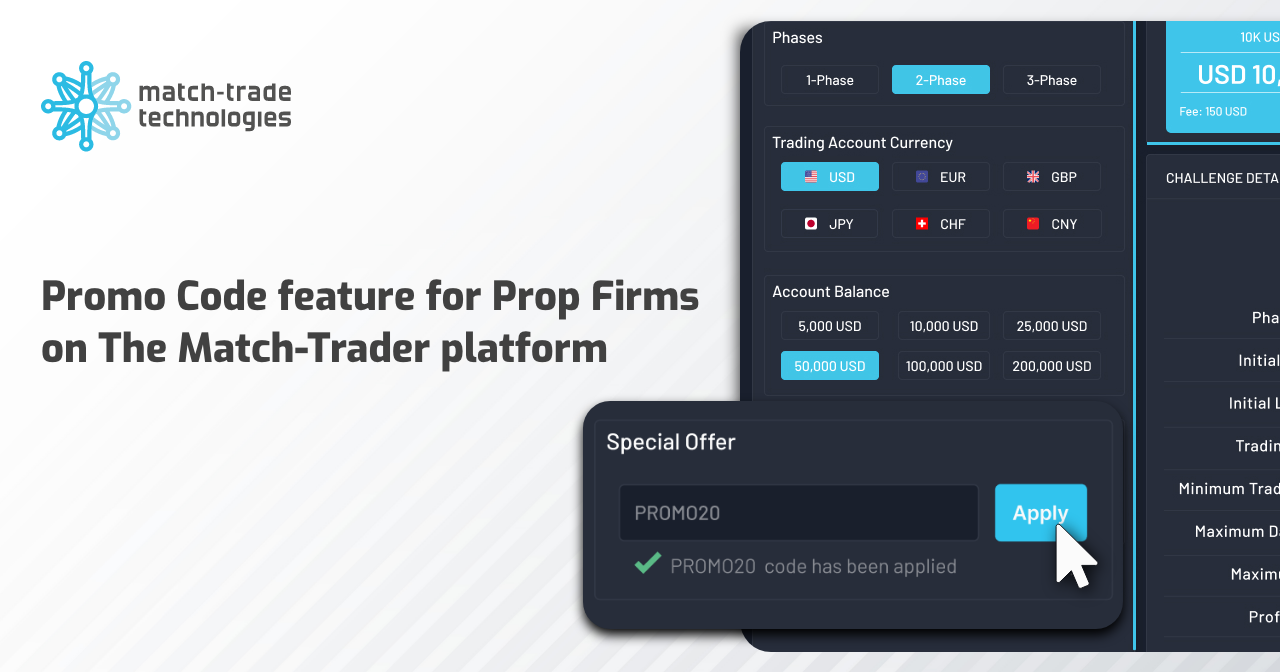

All-in-one solutions have appeared on the forex market. It is a modern model of the White Label platform equipped with tools for managing a trading account by a trader and a system for managing the entire business by a broker. Besides, the all-in-one platform also has an integrated solution that allows clients from around the world to make convenient payments directly to their trading account.

To gain an advantage in the forex market, it is no longer enough to offer good trading conditions that are comparable with many brokers. Platform functionality, as well as speed and quality of service, are becoming more and more important. Brand recognition, which will be ensured by your own branded mobile app available with Match-Trader all-in-one trading solution, is also essential.

However, this does not mean that traditional White Label platforms are falling out of use. There is a massive attachment to old, well-known platforms among traders all the time. However, younger traders are already looking for modern functionalities and advanced technology. In such a situation, a reasonable solution is to have two platforms: a traditional forex White Label and a modern all-in-one solution.

Instant Broker Solution based on Match-Trader

The concept of an all-in-one solution does not have to refer only to the trading platform. It can also mean a comprehensive service of starting your own forex broker business. The main difference from the basic White Label platform is that in the package you get all the necessary elements to get your broker up and running immediately.

In the Instant Broker Solution package you get:

- Company registration with a corporate bank account

- Match-Trader, all-in-one trading platform with Client Office forex CRM and integrated Digital Currency Payment Gateway to provide instant deposits to a trading account

- Liquidity with a free connection to Match-Trade’s liquidity pool of 20 different LPs.

Is the all-in-one trading solution more expensive than the standard White Label platform?

It doesn’t have to be that way. Remember that by choosing MT4 / MT5 one of the most popular WL platforms on the market, you will incur additional costs in the form of a margin for the technology provider as well as fees for integration with CRM or payment providers.

Choosing an all-in-one solution from the manufacturer, you don’t pay intermediaries, and you can be sure that all tools will be working seamlessly.