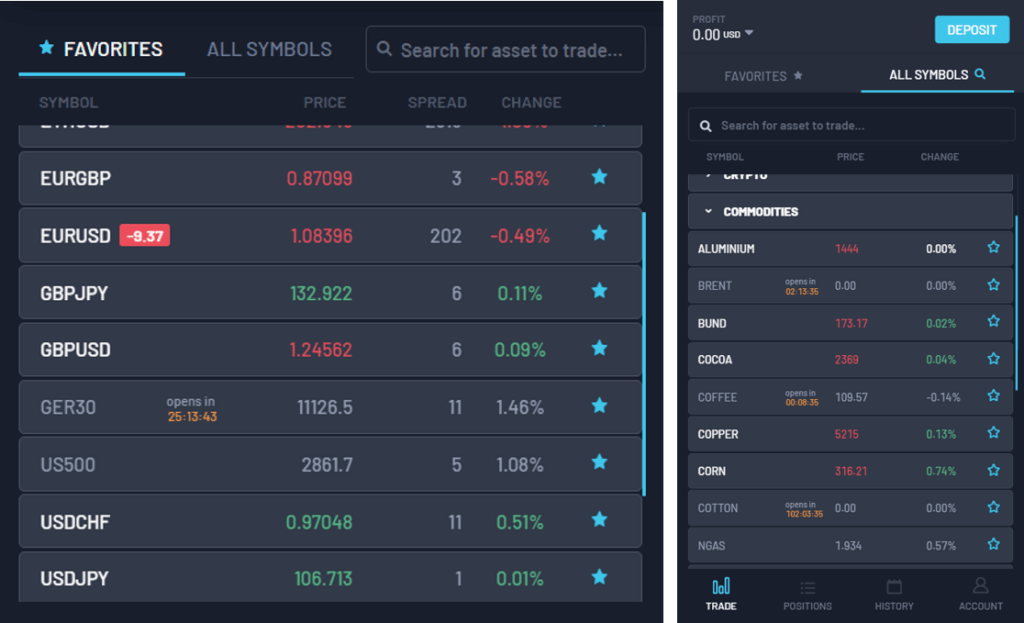

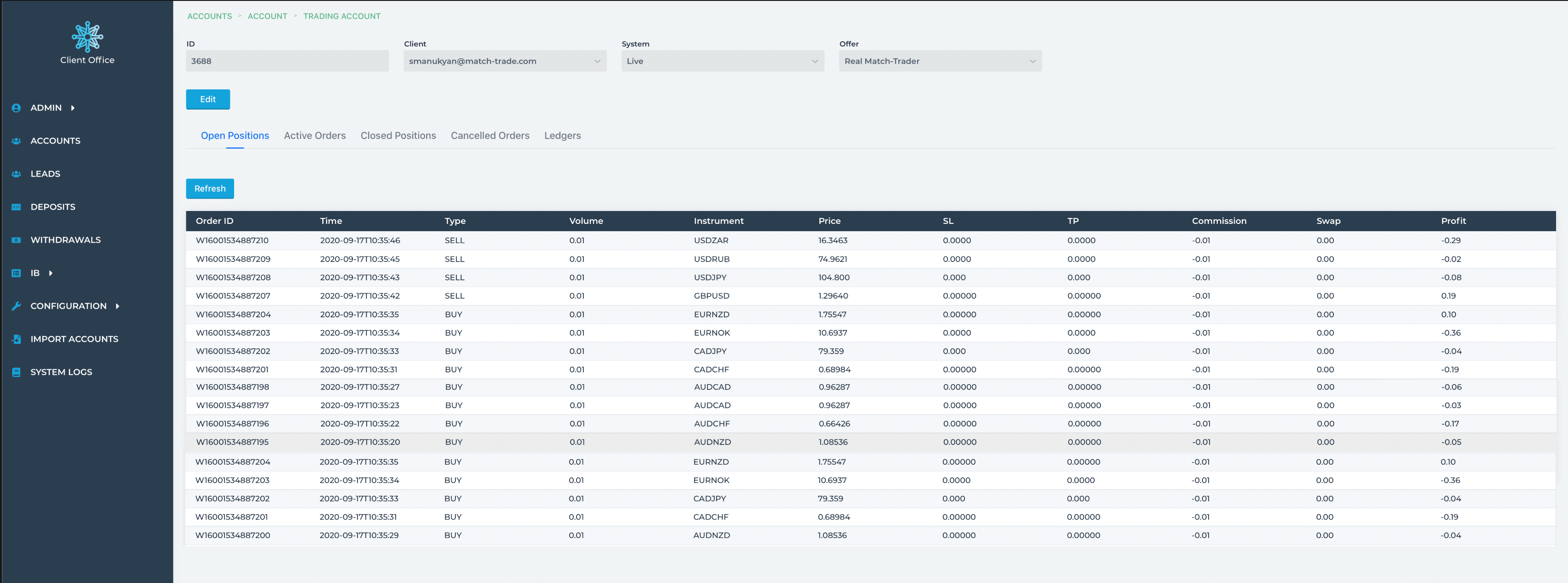

All investors’ operations now visible in the Client Office

In the September release, we have added functionality of checking trading account details from the Client Office view. Brokers can check what positions are opened by the client, pending orders waiting to be activated, cancelled orders, closed positions and also ledgers-all financial operations on the trading account like deposits, withdrawals, credits or agent commission. To check these details, you need to double click the trading account in the Client view.

Flexible API for the user’s purpose

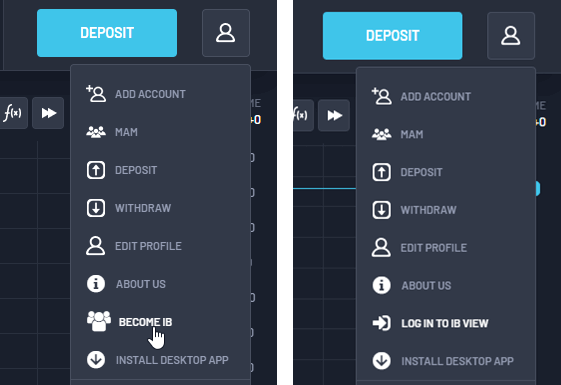

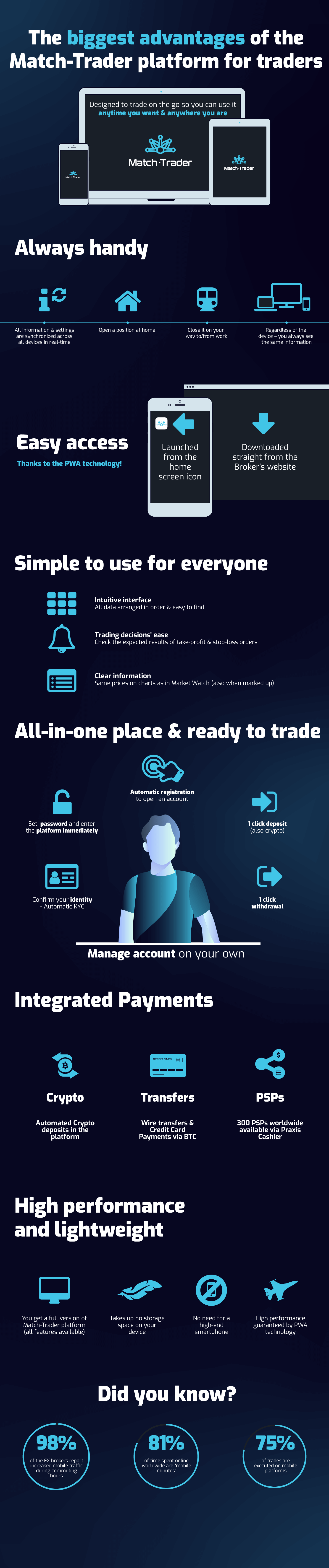

We are sharing an API interface which can be used to do all of the platform operations using Websocket API demanding minimal programming skills. Thanks to that, users can do such operations like trading (creating a trading bot is possible), modifying orders, registering an account or even making a deposit without need to log in to the platform. Ask our sales about details and check how many possibilities you have with our flexible API.

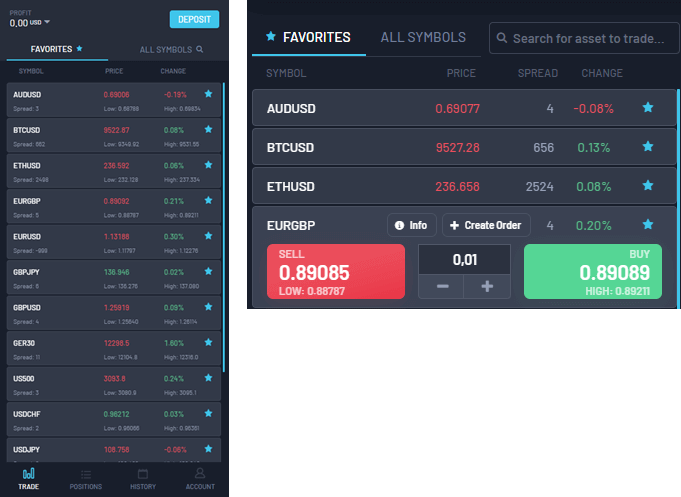

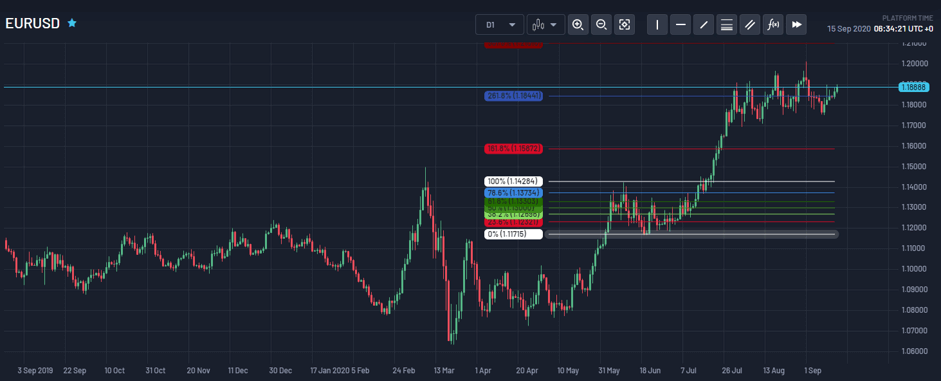

Fibonacci retracements

Decisively one of the essential tools of technical analysis – Fibonacci retracements, has been added to our platform. Levels visible on the chart are created by dividing two numbers from the Fibonacci sequence. Thus 61,8% is splitting 34/55. Many traders widely use the indicator. In the Match-Trader platform, it can be accessed in all versions – desktop, web and mobile, what is more, all chart drawings are live synchronized between them.

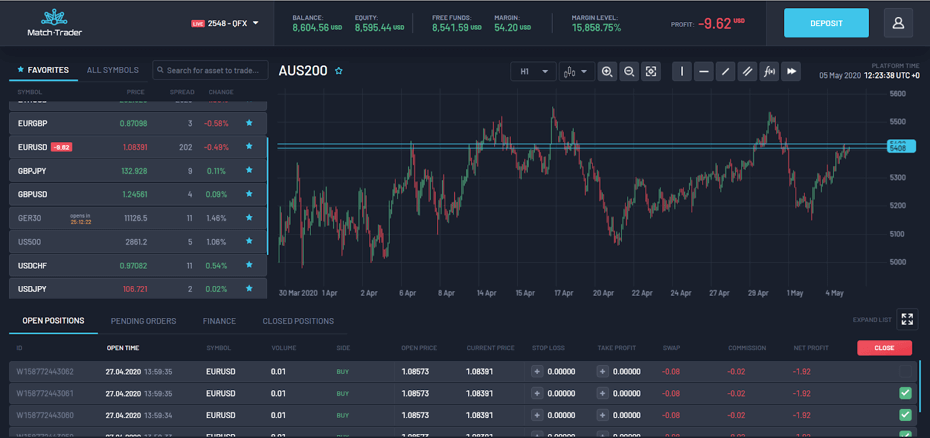

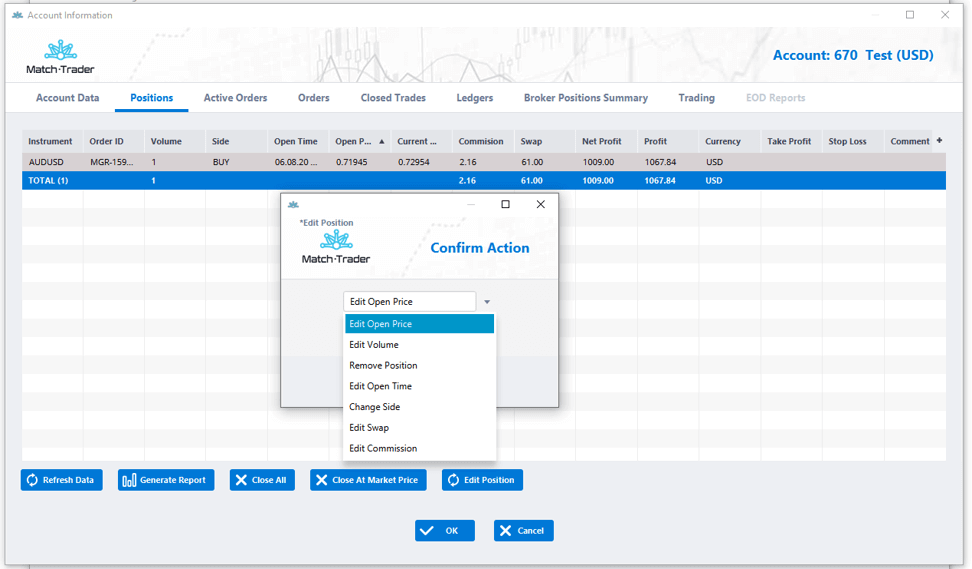

Possibility to edit positions and to remove trades

In the Manager application, we have added an option to edit open positions, which will facilitate the process of making adjustments and corrections for the brokers. Manager can edit such parameters as open price, side, open time, swap or commission. Additionally, there is also an option to delete a closed trade from the database or close open positions at the market price just in one click directly from the application.

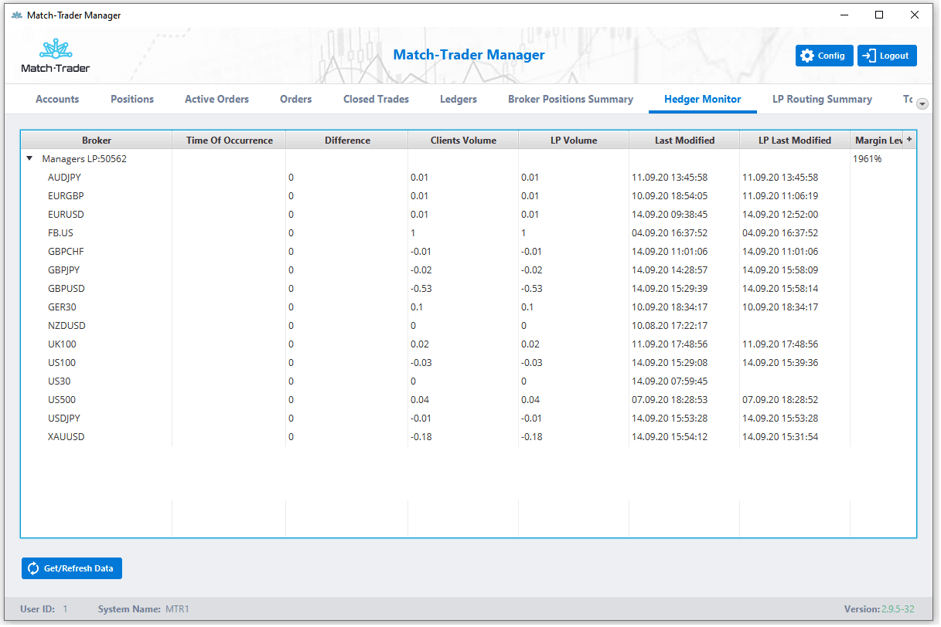

Hedge Monitor

It is crucial to monitor your hedge exposure in real-time; therefore, we’ve created a hedge monitor tab in the Manager app to have a full view of the broker’s exposure. Our system collects information about open positions from hedge accounts and all client A-Book groups to compare them at real-time. Brokers and our support can track all discrepancies which occur on hedge accounts and take necessary actions to fix them. There is also information about Margin Level displayed in this tab.

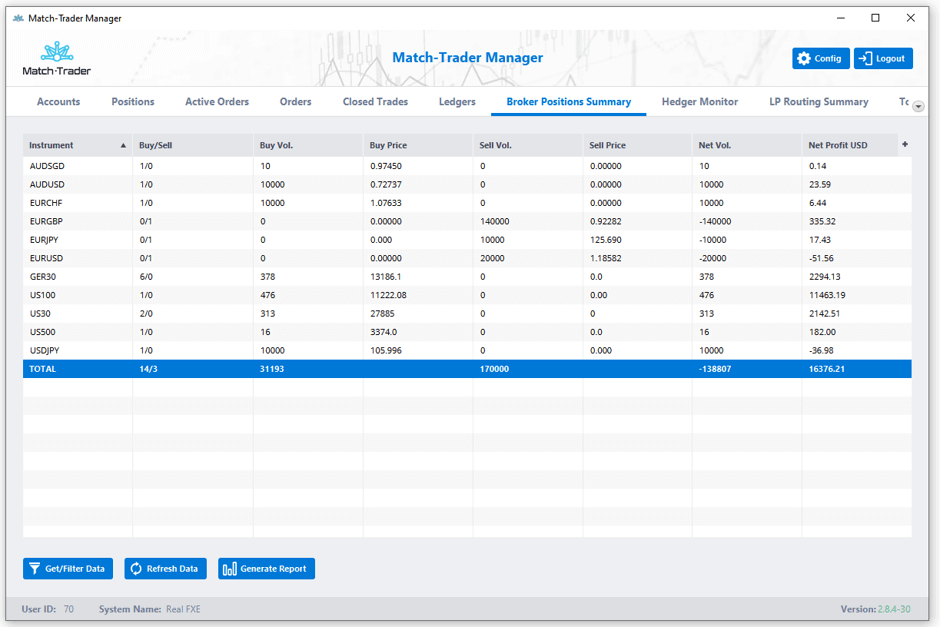

Broker/Client position summary

It is essential to see the full picture of your brokerage business at any time to assess the risk and profitability. Therefore recently we have rearranged the view for the broker and client position summary window. Now it has a more clean and user-friendly look, where brokers can check the total exposure with a current valuation of all or selected clients. Position summary table sums up all open positions on each instrument and also enables brokers to see which clients maintain the biggest and the most profitable positions. We are also working on following functionalities which will enhance reporting capabilities of the system.