News Widget in Match-Trader

We’ve added a News Widget to our platform so that traders can check the news about specific currency pairs, companies and economic events without leaving the platform. This will help them to better analyze the situation on the market before making a deal. News is available in an expanded or collapsed form and can be enabled or disabled at the request of the Broker.

Fixed Amount payment in Match2Pay

There have been some changes in our Match2Pay payment gateway as well. We’ve enabled the payment of fixed amounts in digital currency. This functionality is useful for e-commerce that wants to accept digital currency payments. The rate and the amount to be paid are constantly updated.

TRC-20 network support

We’ve added support for the TRC-20 network in our Match2Pay, Client Office and Match-Trader platform. Now our clients have access to digital currency payments and withdrawals from the TRON network, with a lower deposit fee. TRX (Tron) and USDT support on TRC 20 are also available.

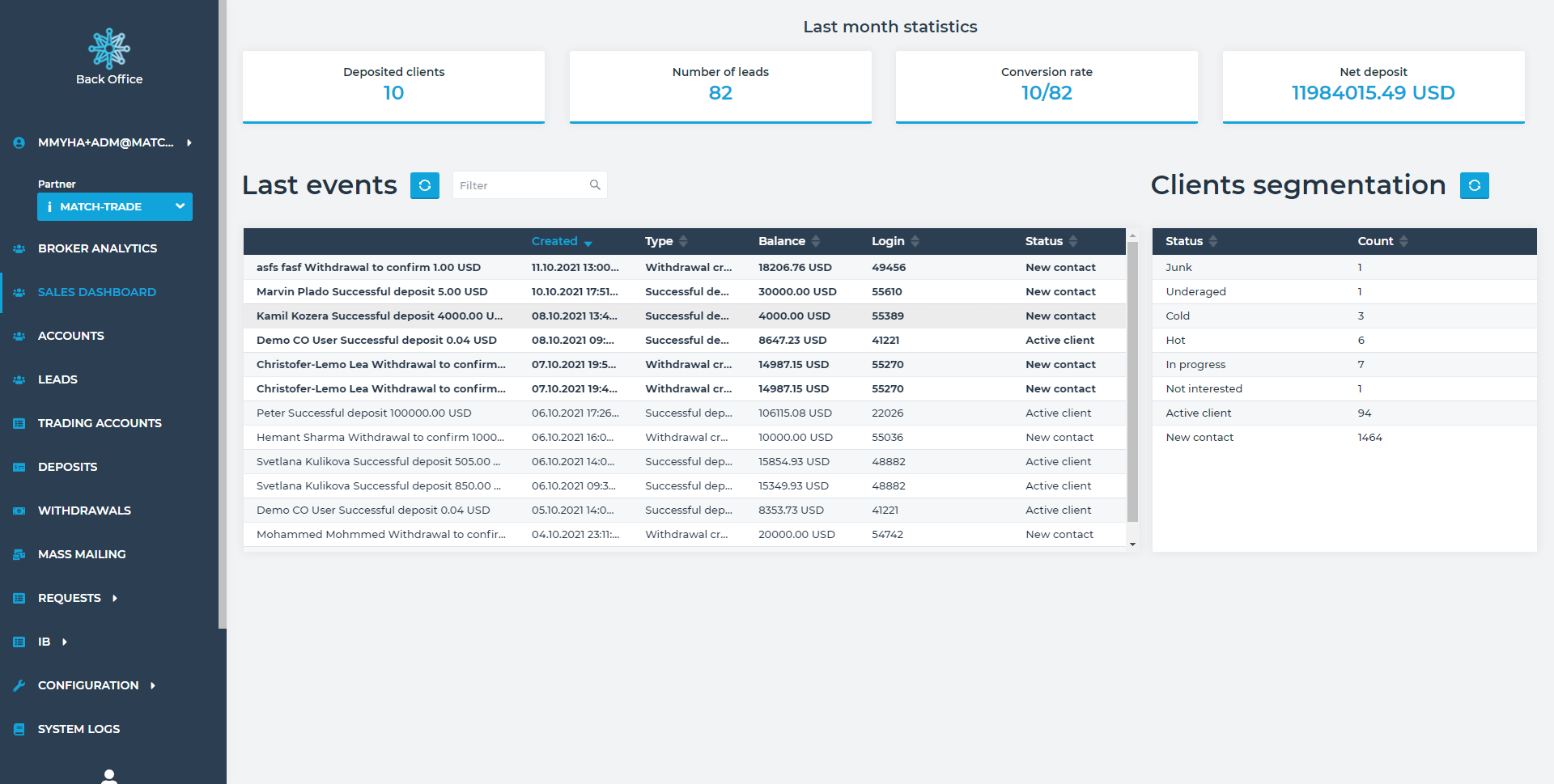

Push Notifications in Match-Trader & Back Office

We continue to work on the automation of our Match-Trader platform & Back Office Apps in order to simplify the management of our client’s brokerage business. Some new notification features have been added to our platform and BO apps. Now the trader will receive notifications in case of triggering a stop-out, margin call, take-profit / stop-loss or pending order activation. The broker receives information about the client’s activity in the Back Office – it’s visible as a list of the clients’ last actions in the Sales Dashboard or as a popup/sound notification

The Light version of Match-Trader platform

We’ve added a Light skin for our platform, which is available for both mobile and web. In addition, other customization options have appeared, such as chart colours, which the Broker can change at his own discretion.

“Become money manager” button

In our December release, we’ve added a new “Become money manager” button in our Client Office and Match-Trader platform. This small change will give your client the opportunity to become a Money Manager in Social Trading App or MAM Solution and inform a broker about such request.

Additional data in Copy Trading App

In our Client Office, in the Social Trading subscription details view, the client can check from when he is following a given Money Manager. This new feature allows traders to better control their subscription strategy over time.

Top Movers Widget

We’ve enabled access to the Top Movers through the Widget above the Market Watch in our Match-Trader platform. From now on, investors can view which of the instruments have the highest volatility of the day in a more easy way. This information will enable novice traders to find potential investment opportunities, which will increase the trading volume on your platform.

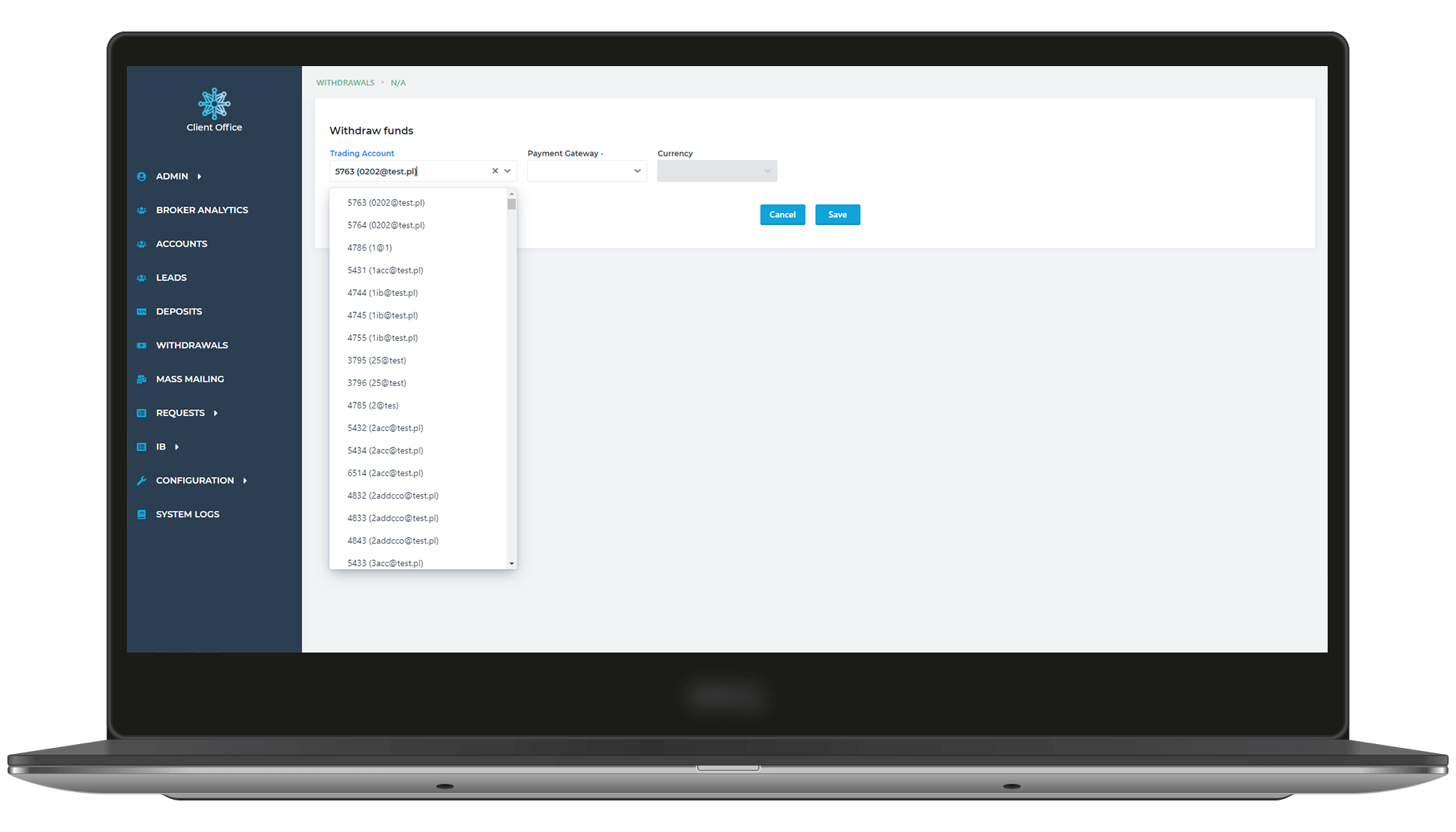

Min / Max Value for Payment Gateways

New payment settings for payment gateways were added in our Back-Office applications. Brokers can set a minimum or maximum amount for a deposit or withdrawal per chosen payment gateway.

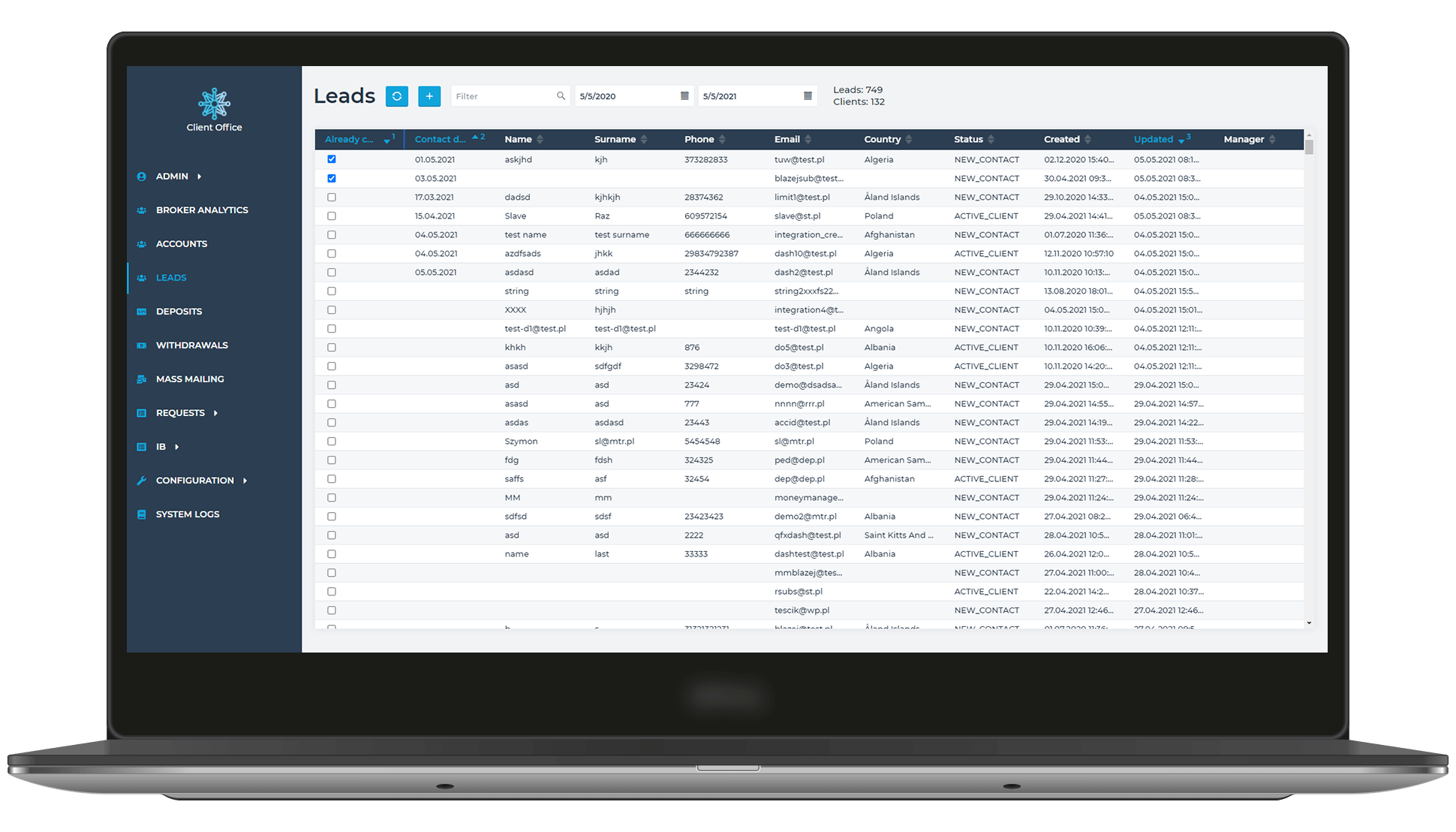

Lead import process optimization

Now we require less data to successfully import the file into Back Office. Using this function, you can immediately assign an account manager by adding email or UUID to the spreadsheet. We’ve also added the ability to download a file template for the lead import. Information about adding leads to CRM isn’t sent to them.

New look of registration forms

We’ve changed the appearance of registration forms in our Match-Trader platform so that Trader receives much better User Experience during the registration process. The registration form is completed in several stages.

TimeLine in the Accounts View

A special timeline has been added to our Back Office applications, which allows Brokers to add events and tasks. In the task, you can set a specific deadline time, change the status, assign it to a specific person and add a comment.

Account lockout feature

From now on, if the trader’s account has been blocked in Back Office, he is logged out and cannot log into the Match-Trader platform nor Client Office.

Improved balance display in the Back Office

In the lead/account profile, balance, credit, equity and free margin are displayed only from his real accounts. Statistics from real trading accounts are not mixed with data from demo accounts.