The high competition in the prop trading sector drives prop firms to constantly innovate in attracting top talent while navigating market constraints. Trading tournaments offer a novel solution, allowing aspiring traders to showcase their skills in a risk-free, simulated environment. When combined with advanced technology, this approach becomes a highly efficient way to generate leads without inflating costs, providing prop firms with a smart strategy for talent acquisition and boosting the potential for steady growth.

Trading Tournaments: Cost-effective Lead Generation

Prop trading firms traditionally rely on demo accounts to assess traders’ abilities. However, these demo environments often fail to replicate the complexities of live trading. Furthermore, the purchase of challenges is often completed through a firm’s CRM system, meaning traders rarely get a chance to familiarise themselves with the firm’s trading platform beforehand. Of course, traders can always use a demo platform offered by a technology provider. However, prop companies lose the value of acquiring leads from demo accounts (before purchasing the challenge), and the risk of traders opting for challenges from another company using the same platform increases.

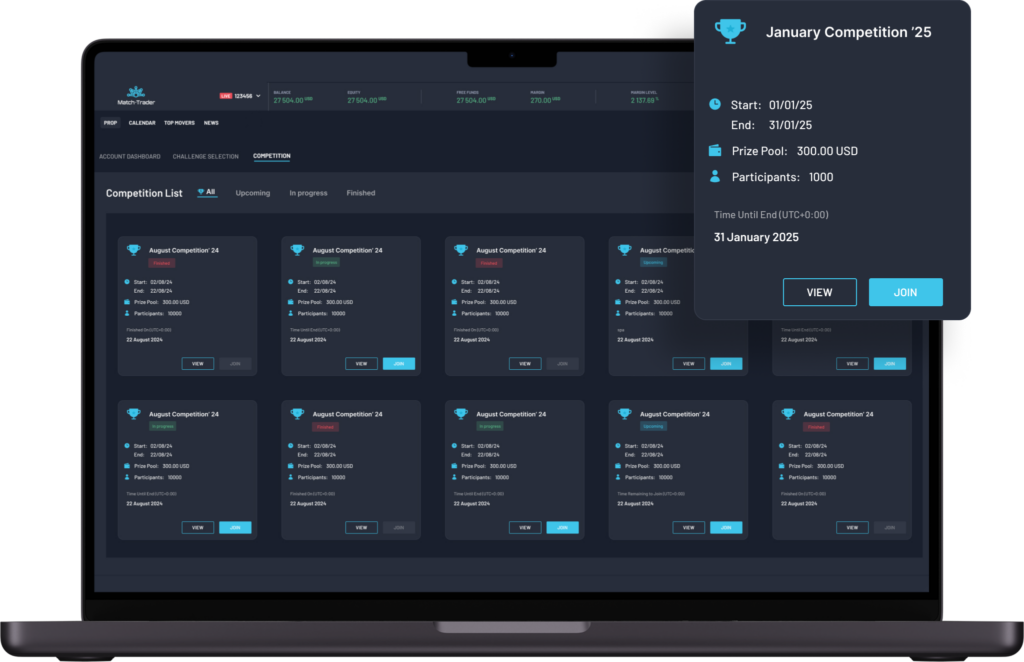

The introduction of trading tournaments offers a clever solution to this issue. Tournaments allow firms to offer free or low-cost challenges, enabling traders to experience the platform under realistic conditions. These tournaments act as lead-generation tools by providing value to both the firm and the trader. The unique pricing model for Match-Trader clients includes penny-worth tournament accounts, allowing firms to attract more participants while significantly reducing expenses. The result? Prop trading firms gain valuable leads from tournament participants, who can later convert into paying clients.

Long-Term Value of Tournaments

Another key advantage of tournaments is their alignment with regulatory frameworks. In many regions, including parts of Asia like Thailand, forex marketing and solicitation face strict limitations. By promoting tournaments, prop firms can build brand awareness without violating these rules, as tournaments simulate real trading conditions without requiring an actual financial investment from participants.

For traders, tournaments offer a unique opportunity: the chance to experience a firm’s trading platform and potentially win prizes or challenge vouchers without spending money on regular challenges. This approach allows prop firms to not only gain visibility but also gather leads from engaged, interested traders who have already tested the firm’s platform.

Demo Execution Challenges in Prop Trading

Prop trading firms face the unique challenge of providing order execution that mirrors the conditions traders would experience in live markets to ensure a reliable evaluation process. Demo trades do not affect market depth or liquidity, which can result in traders developing a false sense of their strategies’ performance.

The creators of the Match-Trader platform address this issue by providing a “Demo Execution Mode” tailored for simulated trading. This feature mirrors real market conditions more accurately by incorporating Volume-Weighted Average Price (VWAP) execution, ensuring trades are executed based on available market liquidity. By simulating real-world conditions, the demo environment becomes more reliable, allowing prop firms to better assess and prepare traders for live trading.

Scaling Challenges: Engaging and Retaining Top Traders

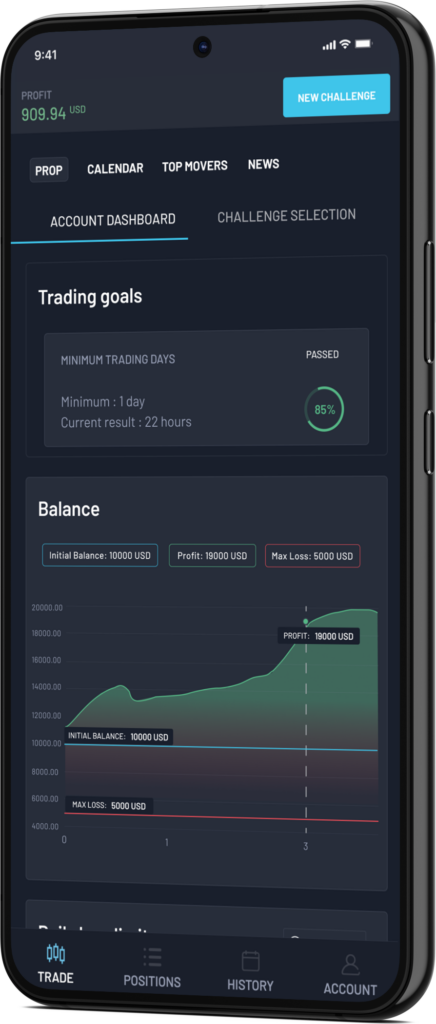

Scaling challenges in the funded phase is a new feature in Match-Trade’s CRM for prop firms (in beta testing), designed to enhance engagement and support talented traders in maximising their profits. Once a trader successfully passes the evaluation process and gains access to real funds for trading, they typically receive a predetermined profit share based on the challenge they completed.

However, the scaling option allows traders to continue trading on their funded account without withdrawing their earnings or purchasing a new challenge. For example, instead of being limited to the initial $10,000 balance, the trader’s account could be scaled up to $20,000, giving them greater opportunities to profit. Additionally, the profit share ratio can be adjusted, such as moving from an initial 60:40 split to 80:20 in the trader’s favour.

This feature not only incentivises skilled traders to stay with the firm but also allows prop firms to retain their best-performing traders, who can generate more substantial profits in a real trading environment. By offering this flexibility, firms can cultivate loyalty and share in the success of their most promising talent, fostering long-term partnerships.

Advanced Technology to Outperform the Competition

Tournaments, when paired with an advanced demo execution model like Match-Trader’s, provide prop trading firms with a powerful lead-generation tool. By offering realistic trading conditions, reducing the costs of tournament participation, and ensuring scalability through robust CRM integration, prop firms can attract, evaluate, and convert traders more effectively. Adopting these solutions can significantly streamline operations and offer long-term value in a highly competitive industry.